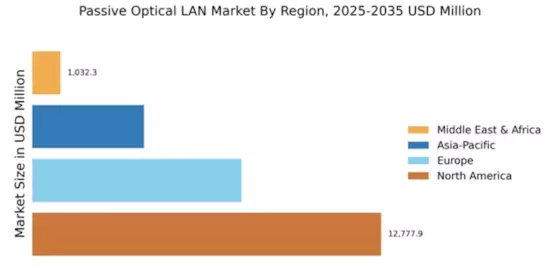

North America : Market Leader in Technology

North America is poised to maintain its leadership in the Passive Optical LAN market, with a market size of $12,777.94 million in 2025. The region's growth is driven by increasing demand for high-speed internet and the expansion of smart city initiatives. Regulatory support for broadband expansion and investments in fiber-optic infrastructure further catalyze market growth. The region's focus on innovation and technology adoption positions it as a key player in the global market. The competitive landscape in North America is robust, featuring major players like Cisco Systems, Adtran, and CommScope. These companies are leveraging advanced technologies to enhance service delivery and customer experience. The U.S. leads the market, supported by significant investments in telecommunications infrastructure. As organizations seek to upgrade their networks, the demand for Passive Optical LAN solutions is expected to rise, solidifying North America's market share.

Europe : Emerging Market with Potential

Europe is witnessing a significant transformation in the Passive Optical LAN market, with a market size of €7,654.73 million projected for 2025. The region's growth is fueled by increasing digitalization and the need for efficient network solutions. Regulatory frameworks promoting broadband access and sustainability initiatives are key drivers. The European Union's commitment to enhancing digital infrastructure supports the adoption of Passive Optical LAN technologies across various sectors. Leading countries in Europe include Germany, the UK, and France, where major players like Nokia and Huawei are actively expanding their presence. The competitive landscape is characterized by strategic partnerships and technological advancements aimed at improving network efficiency. As organizations prioritize high-speed connectivity, the demand for Passive Optical LAN solutions is expected to grow, positioning Europe as a significant player in the global market.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a rapidly growing market for Passive Optical LAN, with a projected market size of $4,090.88 million by 2025. The region's growth is driven by increasing urbanization, rising internet penetration, and government initiatives to enhance digital infrastructure. Countries like China and India are investing heavily in fiber-optic networks, which are crucial for supporting the growing demand for high-speed internet and smart technologies. China leads the market, with key players like Huawei and ZTE Corporation dominating the landscape. The competitive environment is marked by innovation and aggressive pricing strategies. As businesses and governments prioritize digital transformation, the demand for Passive Optical LAN solutions is expected to surge, making Asia-Pacific a vital region for market expansion.

Middle East and Africa : Emerging Opportunities Ahead

The Middle East and Africa region is gradually emerging in the Passive Optical LAN market, with a market size of $1,032.34 million anticipated by 2025. The growth is driven by increasing investments in telecommunications infrastructure and the rising demand for high-speed internet services. Government initiatives aimed at enhancing connectivity and digital transformation are pivotal in shaping the market landscape. The region's focus on smart city projects further propels the adoption of Passive Optical LAN technologies. Leading countries in this region include South Africa and the UAE, where companies are beginning to recognize the benefits of optical networking solutions. The competitive landscape is evolving, with both local and international players entering the market. As the region continues to develop its digital infrastructure, the demand for Passive Optical LAN solutions is expected to grow significantly, presenting new opportunities for market players.