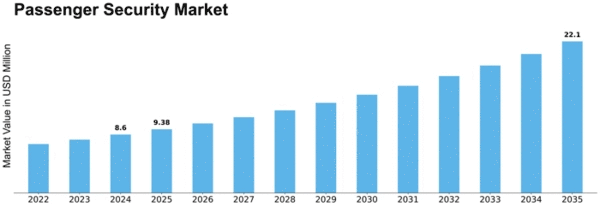

Passenger Security Size

Passenger Security Market Growth Projections and Opportunities

Various factors together shape the landscape of safety and security for passengers across different modes of transportation, within which the Passenger Security Market operates. Such an increasing global emphasis on improving passenger safety in relation to ever-changing security threats, aviation terrorism or rising number of passengers is one main market dynamic. This leads to demand for advanced passenger security solutions in airports, seaports, railway stations and other transit hubs to mitigate risks and protect travelling public.

The dynamics of the Passenger Security Market are shaped by technology advancement. Advancements in surveillance systems, biometric technologies and screening equipment have significantly contributed to the development of more efficient and effective solutions for security issues. The market dynamics are characterized by a relentless quest for cutting-edge technologies aimed at enhancing the ability of passenger screening processes, identity verification methods as well as threat detection techniques ultimately ensuring that there is no compromise made regarding passenger’s safety.

The regulatory environment has significant influence on dynamics of the Passenger Security Market. Strict aviation and transport authority provided security regulations as well as international standards necessitate compliance with specific protocols regarding security matters. Consequently, it becomes necessary to comply with regulatory requirements in order to develop industry standard driven solutions leading towards uniformity concerning a comprehensive approach to passenger’s safety.

Integrated intelligence-driven security systems are demanded by evolving forms of insecurity risks that confront the Passenger Security Markets. Concerning this, this is because complex risks keep growing whereas new insecurities come up from time to time hence need for the all-encompassing adaptive approach toward passenger protection against threats like cybercrime, terror attacks among others . It prompts the industry into developing real-time intelligence driven solution adopting data analytics and multidimensional collaboration amongst players- these indicate an urge for a proactive interconnected ecosystem.

International cooperation and standardization are crucial aspects in understanding how travel works globally which apply in case of Passenger Security Market. Airports airlines and transit authorities around the globe must therefore ensure that their securitiesolutions can interoperate with different systems and meet different regulatory requirements. Such standardization requirements are informed by the need to offer standardized security measures enhancing seamless and safe passenger movements across the borders.

Passenger security market dynamics are driven by public awareness and expectations. Acts of terror, hijackings or any other insecurity cases have raised public consciousness about the importance of strong safety measures in a flight. To this end, market participants have been designing traveler friendly technologies such as non-intrusive screening techniques and expedited security procedures that ensure both effective safety mechanisms while at the same time affording passengers some level of comfort.

The resilience of this sector is manifested by how it has responded to global challenges including pandemics and public health crises. For instance, in-flight biosecurity as part of passenger’s safety process in response to COVID-19 pandemics involves incorporating health screening features. The adaptability demonstrated through such market dynamics reflects how responsive these securitiesolutions are to emerging societal challenges thus indicating a commitment towards protection of travelers under varying circumstances.

Collaboration and partnerships between transportation and security industry accounts much for market dynamics. Integrated security solutions aimed at ensuring customers’ safety are created through cooperation between manufacturers, technology developers and transport authorities. These Market dynamics have been shaped by partnership initiatives promoting innovation, knowledge sharing as well as comprehensive security strategies for all modes of transport that exist today."

Leave a Comment