Technological Innovations

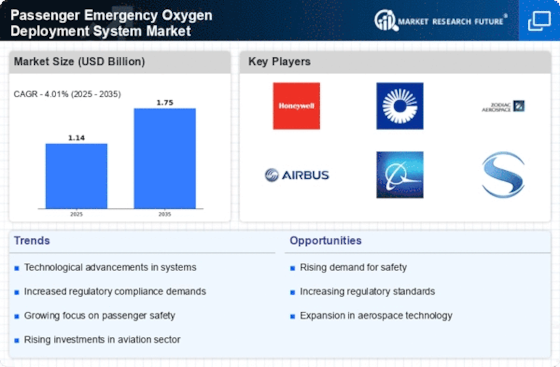

Technological innovations play a crucial role in shaping the Passenger Emergency Oxygen Deployment System Market. The development of lightweight, efficient, and reliable oxygen systems has become a focal point for manufacturers. Innovations such as automatic deployment mechanisms and improved oxygen delivery systems enhance the overall effectiveness of emergency protocols. Furthermore, advancements in materials and design contribute to the reduction of system weight, which is essential for modern aircraft. As airlines seek to improve operational efficiency and passenger safety, the integration of these technologies into emergency oxygen systems is expected to drive market expansion.

Regulatory Safety Standards

Stringent regulatory safety standards imposed by aviation authorities significantly influence the Passenger Emergency Oxygen Deployment System Market. Regulatory bodies, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), mandate that commercial aircraft be equipped with reliable emergency oxygen systems. These regulations are designed to protect passengers in the event of cabin depressurization or other emergencies. Compliance with these standards is not only a legal requirement but also a competitive advantage for airlines. As regulations evolve and become more rigorous, the demand for advanced oxygen deployment systems is likely to increase, thereby propelling market growth.

Increasing Air Travel Demand

The rising demand for air travel is a primary driver for the Passenger Emergency Oxygen Deployment System Market. As more individuals opt for air transportation, the need for enhanced safety measures becomes paramount. According to recent data, air passenger numbers are projected to reach 8.2 billion by 2037, indicating a substantial increase in the number of flights and passengers. This surge necessitates the implementation of advanced safety systems, including emergency oxygen deployment systems, to ensure passenger safety during unforeseen circumstances. Airlines are increasingly investing in these systems to comply with safety regulations and to enhance passenger confidence, thereby driving the market forward.

Growing Awareness of Passenger Safety

The increasing awareness of passenger safety among travelers is a significant driver for the Passenger Emergency Oxygen Deployment System Market. Passengers are becoming more informed about safety protocols and the importance of emergency systems in aviation. This heightened awareness leads to greater expectations for airlines to provide comprehensive safety measures, including effective emergency oxygen systems. Airlines that prioritize passenger safety and invest in advanced oxygen deployment systems are likely to enhance their brand reputation and customer loyalty. Consequently, this trend is expected to stimulate demand for innovative emergency oxygen solutions in the aviation sector.

Investment in Aviation Infrastructure

Investment in aviation infrastructure is a vital driver for the Passenger Emergency Oxygen Deployment System Market. As countries expand and modernize their airports and fleets, there is a corresponding need for enhanced safety systems, including emergency oxygen deployment systems. Governments and private investors are channeling funds into upgrading existing aircraft and acquiring new ones, which often necessitates the installation of state-of-the-art safety equipment. This trend is particularly evident in emerging markets, where the growth of air travel is prompting airlines to adopt advanced safety measures. As infrastructure investments continue, the demand for effective emergency oxygen systems is likely to rise.