E-commerce Expansion

The rapid expansion of e-commerce is significantly influencing the Paperboard Container Market. With online shopping becoming increasingly prevalent, the need for efficient and protective packaging solutions has surged. In 2025, e-commerce sales are expected to account for over 20% of total retail sales, necessitating robust packaging options that ensure product safety during transit. Paperboard containers, known for their lightweight and durable characteristics, are well-suited for this purpose. This trend not only drives demand for paperboard packaging but also encourages innovation in design and functionality, thereby enhancing the overall market landscape.

Technological Innovations

Technological advancements are reshaping the Paperboard Container Market, introducing new manufacturing processes and materials that enhance product quality and efficiency. Innovations such as digital printing and automated production lines are streamlining operations, reducing costs, and improving customization options. For instance, the integration of smart packaging technologies allows for better tracking and inventory management, which is increasingly important in a fast-paced market. As these technologies continue to evolve, they are likely to attract investments and foster competition, ultimately benefiting the Paperboard Container Market by providing more versatile and appealing products.

Sustainability Initiatives

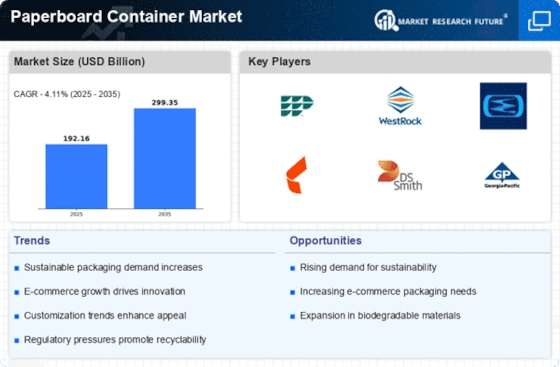

The increasing emphasis on sustainability is a pivotal driver for the Paperboard Container Market. As consumers become more environmentally conscious, companies are compelled to adopt eco-friendly packaging solutions. Paperboard containers, being recyclable and biodegradable, align with these sustainability goals. In fact, the demand for sustainable packaging is projected to grow at a rate of approximately 7% annually. This shift not only enhances brand image but also meets regulatory requirements aimed at reducing plastic waste. Consequently, businesses that prioritize sustainable practices are likely to gain a competitive edge in the Paperboard Container Market, appealing to a broader customer base that values environmental responsibility.

Consumer Preferences for Convenience

Shifting consumer preferences towards convenience are driving the Paperboard Container Market. As lifestyles become busier, there is a growing demand for packaging that offers ease of use and portability. Paperboard containers, which are lightweight and easy to handle, cater to this need effectively. Moreover, the trend towards ready-to-eat meals and on-the-go snacks has further propelled the demand for convenient packaging solutions. In 2025, it is anticipated that the convenience food sector will continue to expand, thereby increasing the need for innovative paperboard packaging that meets these consumer demands.

Regulatory Support for Sustainable Packaging

Regulatory frameworks promoting sustainable packaging are emerging as a crucial driver for the Paperboard Container Market. Governments worldwide are implementing policies aimed at reducing plastic usage and encouraging the adoption of recyclable materials. These regulations not only create a favorable environment for paperboard containers but also incentivize companies to transition towards more sustainable practices. As a result, businesses that align with these regulations are likely to experience growth in the Paperboard Container Market, as they can meet both consumer expectations and legal requirements, thereby enhancing their market position.