Rising Demand for Efficient Production

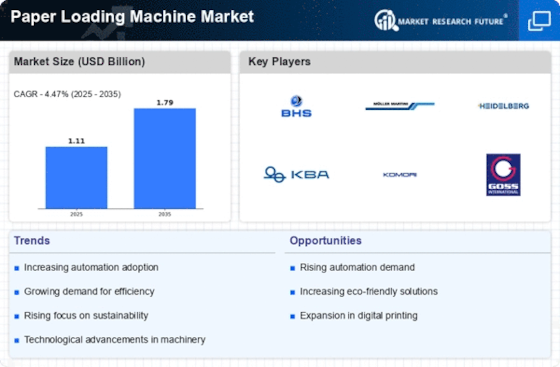

The Paper Loading Machine Market experiences a notable surge in demand for efficient production processes. As manufacturers strive to enhance productivity, the integration of advanced paper loading machines becomes essential. These machines facilitate faster loading times and reduce manual labor, thereby optimizing operational efficiency. According to recent data, the market for paper loading machines is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is driven by the increasing need for automation in manufacturing processes, which allows companies to meet rising consumer demands while minimizing costs. Consequently, the Paper Loading Machine Market is likely to witness significant investments in innovative technologies that enhance production capabilities.

Technological Advancements in Machinery

Technological advancements play a pivotal role in shaping the Paper Loading Machine Market. Innovations such as artificial intelligence and machine learning are being integrated into paper loading machines, enhancing their functionality and efficiency. These advancements enable machines to adapt to various paper types and sizes, thereby increasing versatility in production lines. Furthermore, the introduction of IoT-enabled devices allows for real-time monitoring and predictive maintenance, reducing downtime and operational costs. As a result, manufacturers are increasingly adopting these advanced machines to stay competitive in the market. The Paper Loading Machine Market is expected to benefit from these technological trends, as they not only improve performance but also contribute to sustainability efforts by minimizing waste and energy consumption.

Growth of E-commerce and Packaging Industry

The Paper Loading Machine Market is significantly influenced by the growth of the e-commerce and packaging sectors. As online shopping continues to expand, the demand for efficient packaging solutions rises correspondingly. Paper loading machines are integral to the packaging process, ensuring that products are loaded swiftly and accurately. Recent statistics indicate that the e-commerce sector is projected to grow by over 20% annually, which directly impacts the need for advanced paper loading solutions. This trend suggests that manufacturers in the Paper Loading Machine Market must adapt to the evolving requirements of packaging, thereby driving innovation and investment in more sophisticated machinery. The interplay between e-commerce growth and packaging demands presents a lucrative opportunity for stakeholders in the market.

Customization and Adaptability in Manufacturing

Customization is becoming increasingly vital in the Paper Loading Machine Market. As businesses seek to differentiate their products, the need for adaptable machinery that can handle various specifications is paramount. Paper loading machines that offer customization options allow manufacturers to tailor their production processes to meet specific client requirements. This flexibility not only enhances operational efficiency but also fosters customer satisfaction. Recent trends indicate that companies are investing in machines that can easily switch between different paper types and sizes, thereby reducing setup times and increasing throughput. The Paper Loading Machine Market is likely to continue evolving in response to these demands, with manufacturers focusing on developing machines that provide greater adaptability and customization capabilities.

Focus on Sustainability and Eco-friendly Practices

Sustainability has emerged as a critical driver in the Paper Loading Machine Market. With increasing awareness of environmental issues, manufacturers are prioritizing eco-friendly practices in their operations. This shift includes the adoption of paper loading machines that utilize sustainable materials and energy-efficient technologies. Companies are now seeking machines that not only enhance productivity but also align with their sustainability goals. The market is witnessing a rise in demand for machines that minimize waste and reduce carbon footprints. As a result, the Paper Loading Machine Market is likely to see a growing emphasis on sustainable innovations, which could lead to the development of new products that cater to environmentally conscious consumers and businesses.