Rising Demand for Biofuels

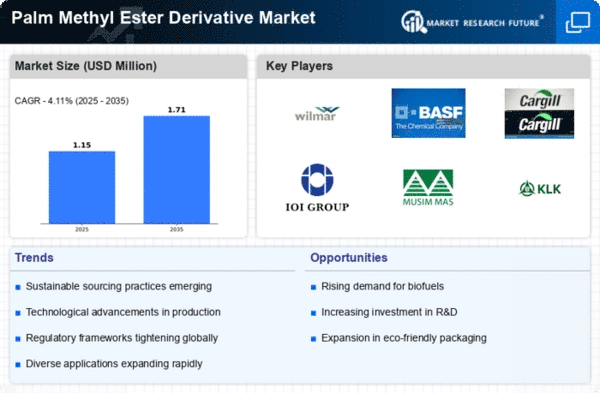

The Global Palm Methyl Ester Derivative Market Industry is experiencing a surge in demand for biofuels, driven by increasing environmental concerns and the need for sustainable energy sources. Governments worldwide are implementing policies to promote renewable energy, which has led to a significant rise in the use of palm methyl esters as biofuels. For instance, the market is projected to reach 1.63 USD Billion in 2024, reflecting a growing acceptance of biofuels in various sectors, including transportation and industrial applications. This trend indicates a shift towards greener alternatives, positioning palm methyl esters as a viable solution in the global energy landscape.

Increasing Awareness of Health Benefits

The Global Palm Methyl Ester Derivative Market Industry is benefiting from a growing awareness of the health benefits associated with palm methyl esters. These derivatives are recognized for their potential to improve skin health and provide moisturizing properties, which are increasingly valued by consumers. As the trend towards health-conscious products continues to rise, manufacturers are incorporating palm methyl esters into formulations for dietary supplements and functional foods. This shift is likely to enhance market growth, as consumers seek products that align with their health and wellness goals. The increasing focus on health benefits positions palm methyl esters favorably in the global market.

Regulatory Support for Sustainable Practices

The Global Palm Methyl Ester Derivative Market Industry benefits from robust regulatory frameworks that encourage sustainable practices in various industries. Governments are increasingly mandating the use of renewable resources, which bolsters the demand for palm methyl esters as eco-friendly alternatives. For example, initiatives aimed at reducing carbon emissions and promoting sustainable agriculture are likely to enhance the market's growth trajectory. The anticipated compound annual growth rate (CAGR) of 6.32% from 2025 to 2035 reflects the positive impact of these regulations on the palm methyl ester derivatives market, positioning it favorably within the global sustainability agenda.

Growing Applications in Personal Care Products

The Global Palm Methyl Ester Derivative Market Industry is witnessing an expansion in the personal care sector, where palm methyl esters are increasingly utilized as emollients and surfactants. These derivatives offer excellent skin-conditioning properties, making them desirable in formulations for cosmetics and skincare products. As consumer preferences shift towards natural and sustainable ingredients, manufacturers are incorporating palm methyl esters to meet these demands. This trend is expected to contribute to the market's growth, with projections indicating a potential increase to 3.2 USD Billion by 2035. The versatility of palm methyl esters in personal care applications underscores their significance in the global market.

Technological Advancements in Production Processes

The Global Palm Methyl Ester Derivative Market Industry is poised for growth due to ongoing technological advancements in production processes. Innovations in extraction and refining techniques are enhancing the efficiency and yield of palm methyl esters, making them more cost-effective and accessible. These advancements not only improve product quality but also reduce environmental impact, aligning with global sustainability goals. As production becomes more streamlined, the market is likely to attract new players and investment, further driving growth. The combination of technology and sustainability is expected to play a crucial role in shaping the future of the palm methyl ester derivatives market.