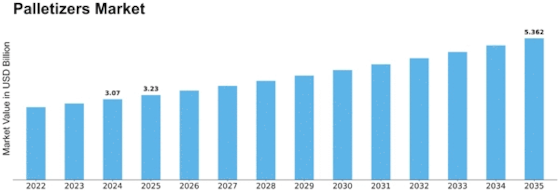

Palletizers Size

Palletizers Market Growth Projections and Opportunities

The palletizers market is shaped by various market factors that play a pivotal role in its growth and evolution. Understanding these factors is essential for businesses and investors seeking to thrive in this dynamic industry. Here are key market factors influencing the palletizers market, presented in a concise pointer format: Automation Trends: The increasing adoption of automation in industries is a significant driver for the palletizers market. As businesses aim to enhance efficiency and reduce labor costs, automated palletizing systems become a preferred choice. This trend is particularly prominent in sectors such as manufacturing, logistics, and food and beverage. E-commerce Boom: The surge in e-commerce activities globally has propelled the demand for palletizing solutions. Efficient palletizing systems play a crucial role in streamlining warehouse operations, meeting the high demand for quick and accurate order fulfillment in the e-commerce sector. Customization and Flexibility: Businesses are seeking palletizing solutions that offer customization and flexibility to adapt to diverse product sizes and packaging formats. Palletizers that can handle a variety of products and packaging configurations provide a competitive edge in meeting the evolving needs of different industries. Labor Shortages: The shortage of skilled labor in certain regions has led industries to invest in palletizing systems to mitigate the impact of workforce limitations. Automated palletizers not only address labor shortages but also contribute to improved workplace safety and efficiency. Integration with Industry 4.0: Palletizers are increasingly being integrated into the broader framework of Industry 4.0, leveraging technologies such as the Internet of Things (IoT) and data analytics. Smart palletizing systems offer real-time monitoring, predictive maintenance, and data-driven insights, enhancing overall operational efficiency. Environmental Sustainability: The growing emphasis on environmental sustainability is influencing the palletizers market. Companies are seeking eco-friendly palletizing solutions that reduce energy consumption, minimize waste, and contribute to their sustainability goals. Palletizers with energy-efficient features are gaining traction in this context. Global Supply Chain Challenges: Disruptions in global supply chains, whether due to natural disasters, geopolitical factors, or pandemics, have underscored the importance of resilient and adaptable palletizing systems. Businesses are prioritizing palletizers that can withstand and quickly recover from supply chain disruptions. Regulatory Compliance: Adherence to safety and regulatory standards is a critical factor in the palletizers market. Manufacturers and users of palletizing systems need to comply with industry-specific regulations to ensure workplace safety, product quality, and overall operational integrity. Cost-Effectiveness: While the initial investment in palletizing systems may seem significant, businesses focus on the long-term cost-effectiveness of these solutions. Palletizers that offer a balance between upfront costs, maintenance expenses, and operational efficiency are well-positioned in the market. Emerging Markets: The palletizers market is witnessing growth in emerging markets, driven by industrialization, infrastructure development, and increased manufacturing activities. Companies are expanding their presence in these regions, capitalizing on the rising demand for advanced palletizing solutions.

Leave a Comment