Market Analysis

In-depth Analysis of Pain Relief Medication Market Industry Landscape

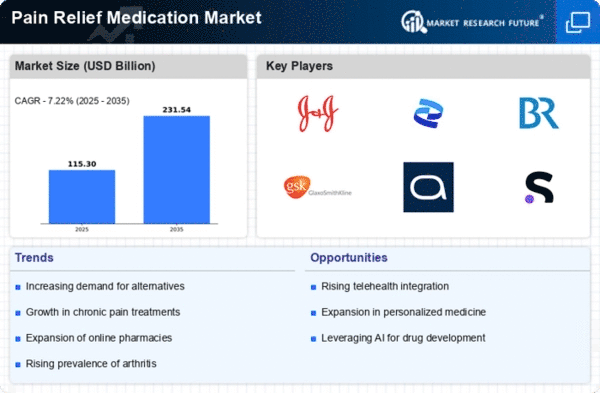

The pain relief medication market encompasses pharmaceutical products designed to alleviate pain symptoms, ranging from over-the-counter analgesics to prescription opioids. Market dynamics in this sector are shaped by factors such as the prevalence of pain conditions, regulatory oversight, consumer preferences, and pharmaceutical innovation. The global pain relief medication market has witnessed steady growth in recent years, driven by factors such as an aging population, increasing prevalence of chronic pain conditions, and rising demand for pain management solutions. Projections indicate continued growth as the burden of pain-related disorders continues to increase globally. The market dynamics of pain relief medication are influenced by various types of medications, including nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, opioids, muscle relaxants, and topical analgesics. Each type of medication has its indications, efficacy profile, and safety considerations, impacting market segmentation and prescribing patterns. Chronic pain conditions, such as arthritis, back pain, neuropathic pain, and migraines, drive demand for pain relief medications. The prevalence of these conditions is a primary driver of market dynamics, influencing the choice of medications, treatment strategies, and healthcare expenditure related to pain management.

Demographic trends, such as aging populations and lifestyle factors, contribute to the growth of the pain relief medication market. Aging populations are more susceptible to chronic pain conditions, leading to an increased demand for pain relief medications and driving market growth globally. Regulatory oversight plays a crucial role in shaping market dynamics by governing drug approvals, labeling requirements, marketing practices, and post-market surveillance of pain relief medications. Compliance with regulations such as FDA approval in the United States and EMA approval in Europe is essential for pharmaceutical companies to commercialize their products and ensure patient safety. The opioid crisis has significantly impacted the pain relief medication market, leading to increased scrutiny of opioid prescribing practices, regulatory restrictions, and public awareness campaigns about the risks of opioid misuse and addiction. Efforts to address the opioid epidemic shape market dynamics by influencing prescribing patterns, treatment guidelines, and patient preferences for non-opioid alternatives.

Non-pharmacological approaches to pain management, such as physical therapy, acupuncture, cognitive-behavioral therapy, and alternative medicine modalities, influence market dynamics by providing complementary or alternative treatment options for individuals with chronic pain. Integrative pain management strategies emphasize a holistic approach to pain relief, impacting market demand for pharmaceuticals.

Consumer preferences for pain relief medications are influenced by factors such as efficacy, safety, convenience, and cost. Over-the-counter analgesics are preferred for mild to moderate pain relief due to their accessibility and affordability, while prescription opioids are reserved for severe pain or specific medical conditions, shaping market dynamics and product demand. Pharmaceutical innovation drives market dynamics in the pain relief medication market, with companies investing in research and development to discover novel analgesic compounds, develop new drug formulations, and improve drug delivery systems. Innovations such as abuse-deterrent formulations, extended-release formulations, and combination therapies address unmet needs in pain management and drive market growth. Healthcare expenditure and reimbursement policies influence market dynamics by affecting patient access to pain relief medications and treatment options. Adequate insurance coverage and reimbursement rates contribute to market growth by reducing financial barriers to pain management and promoting timely access to effective treatments. Public health initiatives aimed at promoting safe and effective pain management practices, preventing opioid misuse, and reducing the burden of pain-related disorders impact market dynamics by shaping healthcare policies, provider practices, and patient behaviors. Collaborative efforts between government agencies, healthcare organizations, and community stakeholders drive awareness, education, and intervention strategies to address pain-related challenges and improve patient outcomes.

Leave a Comment