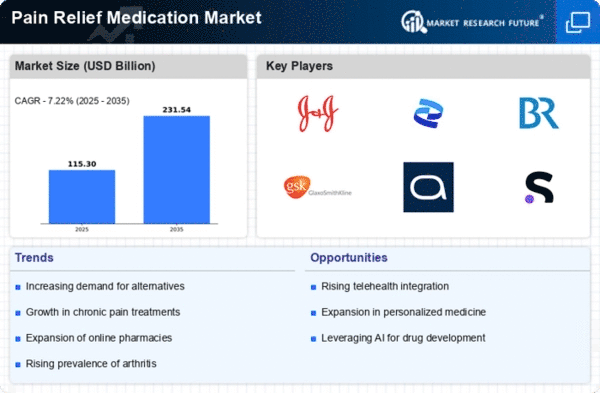

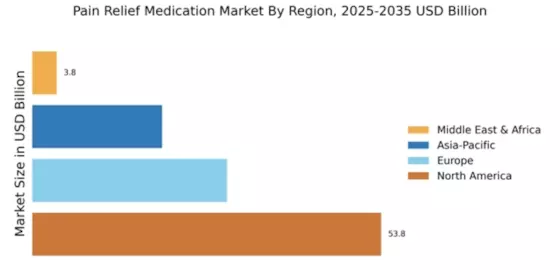

Market Growth Projections

The Global Pain Relief Medication Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 56.8 USD Billion in 2024, it is anticipated to reach 88 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.07% from 2025 to 2035. Factors contributing to this expansion include the rising prevalence of chronic pain, advancements in pain management technologies, and increased awareness of pain management options. As the market evolves, it is likely to witness the introduction of innovative therapies and a broader range of pain relief medications.

Growing Geriatric Population

The aging population significantly influences the Global Pain Relief Medication Market Industry. As individuals age, they are more susceptible to chronic pain conditions, leading to an increased demand for pain relief medications. The World Health Organization projects that by 2030, the number of people aged 60 years and older will reach 1.4 billion globally. This demographic shift necessitates the development and availability of effective pain management solutions tailored to the needs of older adults. Consequently, the market is poised for growth as pharmaceutical companies focus on creating medications that address the unique challenges faced by this population.

Increased Awareness and Education

The Global Pain Relief Medication Market Industry benefits from heightened awareness and education regarding pain management options. Campaigns aimed at educating patients and healthcare professionals about chronic pain and its treatment options have led to a more informed public. This increased awareness encourages individuals to seek appropriate pain relief solutions, thereby driving demand for medications. Furthermore, healthcare providers are more likely to prescribe effective pain management therapies as they become better informed about available options. This trend is expected to support the market's growth trajectory, particularly as more individuals recognize the importance of addressing chronic pain.

Rising Prevalence of Chronic Pain

The Global Pain Relief Medication Market Industry experiences a notable surge due to the increasing prevalence of chronic pain conditions, such as arthritis and fibromyalgia. As populations age, the incidence of these conditions rises, leading to a greater demand for effective pain management solutions. In 2024, the market is projected to reach 56.8 USD Billion, reflecting the urgent need for innovative pain relief medications. This trend is likely to continue as healthcare systems prioritize pain management, potentially driving the market to an estimated 88 USD Billion by 2035, with a compound annual growth rate of 4.07% from 2025 to 2035.

Regulatory Support for Pain Management

Regulatory bodies play a pivotal role in shaping the Global Pain Relief Medication Market Industry by providing support for the development and approval of new pain management therapies. Initiatives aimed at streamlining the approval process for innovative pain relief medications can facilitate quicker access to effective treatments for patients. Additionally, guidelines promoting the use of multimodal pain management strategies encourage healthcare providers to adopt comprehensive approaches to pain relief. This regulatory support not only enhances patient care but also fosters a favorable environment for market growth, as pharmaceutical companies are incentivized to invest in research and development.

Advancements in Pain Management Technologies

Technological advancements play a crucial role in shaping the Global Pain Relief Medication Market Industry. Innovations in drug formulation, delivery systems, and personalized medicine are enhancing the efficacy and safety of pain relief medications. For instance, the development of transdermal patches and sustained-release formulations allows for more effective pain management with fewer side effects. These advancements not only improve patient outcomes but also drive market growth as healthcare providers adopt new technologies. As a result, the industry is likely to witness a shift towards more sophisticated pain management solutions, further contributing to the projected market growth.