Market Trends

Key Emerging Trends in the Packaging Printing Market

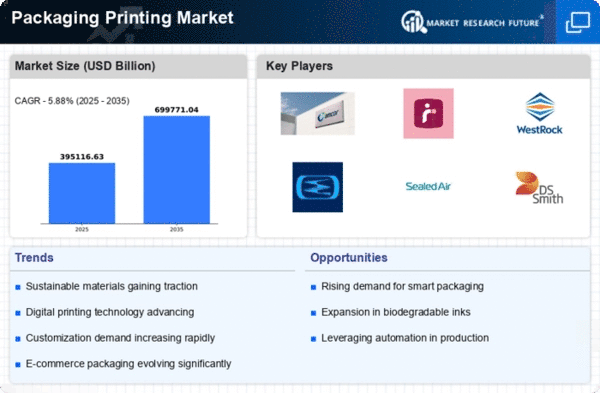

The packaging printing market has experienced significant trends in recent years, reflecting shifts in consumer preferences, advancements in printing technology, and evolving industry regulations. Packaging printing plays a crucial role in enhancing brand visibility, product appeal, and consumer engagement across various sectors such as food and beverage, pharmaceuticals, cosmetics, and consumer goods.

Some regulations followed by the packaging printing industries with the right intention of counterfeit prevention, child resistance, tamper resistance might end up the packaging non-functional. Consumers might find it difficult to open the packaging. Such factors might change the attitude of the consumer and might decrease the value of the product.

One notable trend in the packaging printing market is the increasing demand for sustainable and eco-friendly printing solutions. With growing awareness of environmental issues and regulatory pressures to reduce carbon footprint, there is a rising preference for printing technologies and materials that are environmentally friendly. Manufacturers are responding to this trend by adopting eco-friendly printing processes such as water-based inks, UV-curable inks, and digital printing techniques that minimize volatile organic compound (VOC) emissions and reduce energy consumption. Additionally, there is a growing emphasis on using recycled and biodegradable substrates in packaging printing to promote sustainability and minimize environmental impact.

Moreover, technological advancements have been driving innovation in the packaging printing market, leading to the development of advanced printing technologies and solutions that offer improved print quality, efficiency, and customization. Digital printing technologies, such as inkjet and electrophotography, have gained traction in the packaging industry due to their flexibility, cost-effectiveness, and ability to produce high-quality, variable data prints. These technologies enable manufacturers to create personalized and targeted packaging designs, enhancing brand differentiation and consumer engagement. Furthermore, advancements in color management, image reproduction, and finishing techniques have enabled packaging printers to achieve superior print quality and visual impact, meeting the evolving demands of brand owners and consumers.

Additionally, the global packaging printing market is influenced by shifting consumer preferences and buying behavior, particularly in the food and beverage sector. With consumers seeking convenience, transparency, and sustainability in packaged products, there is a growing demand for packaging designs that reflect these values. Packaging printers are responding to this trend by offering innovative printing solutions that incorporate interactive elements such as QR codes, augmented reality (AR) technology, and variable data printing to provide consumers with product information, recipes, and brand stories. This trend is driving increased adoption of smart and interactive packaging designs that enhance the consumer experience and foster brand loyalty.

Furthermore, market trends in the global packaging printing market are shaped by evolving industry regulations and standards governing packaging and labeling practices. Regulatory bodies such as the Food and Drug Administration (FDA) in the United States and the European Food Safety Authority (EFSA) in Europe establish guidelines and requirements for packaging materials, safety, and labeling in industries such as food, pharmaceuticals, and healthcare. Compliance with these regulations drives the adoption of packaging printing solutions that meet specific criteria for product safety, traceability, and information transparency, ensuring consumer protection and regulatory compliance.

Leave a Comment