Over The Wire Micro Guide Catheter Size

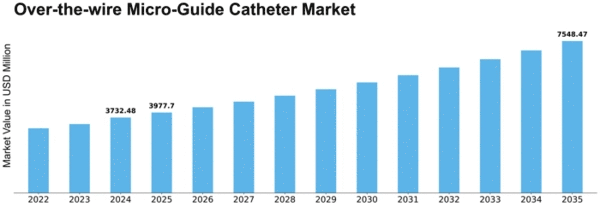

Over-the-wire Micro-Guide Catheter Market Growth Projections and Opportunities

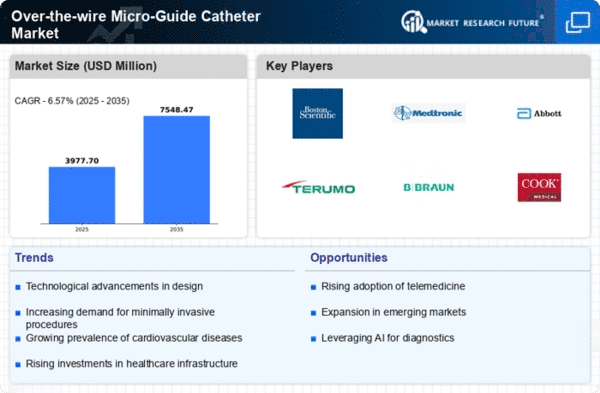

Growing Prevalence of Cardiovascular Diseases : The increasing incidence of cardiovascular diseases worldwide, including coronary artery diseases and stroke, is driving the demand for over-the-wire micro-guide catheters, which are commonly used in interventional cardiology procedures.

Technological Advancements : Ongoing technological advancements in micro-guide catheter design and materials, such as improved flexibility, trackability, and torque control, are enhancing procedural outcomes and expanding the applicability of these devices in complex interventions.

Rising Geriatric Population : The aging population demographic, particularly in developed regions, is contributing to the growth of the over-the-wire micro-guide catheter market, as elderly individuals are more susceptible to cardiovascular ailments necessitating interventional procedures.

Increasing Adoption of Minimally Invasive Procedures : The shift towards minimally invasive techniques in healthcare, driven by factors like reduced hospital stays, quicker recovery times, and lower complication rates, is fueling the demand for over-the-wire micro-guide catheters, which play a crucial role in minimally invasive interventions.

Expanding Applications Beyond Cardiology : Over-the-wire micro-guide catheters are finding applications beyond traditional cardiology procedures, such as neurovascular interventions and peripheral vascular interventions, further broadening their market potential.

Rising Healthcare Expenditure : The increasing healthcare expenditure globally, coupled with improving healthcare infrastructure in emerging economies, is facilitating greater access to advanced medical devices like over-the-wire micro-guide catheters, thereby stimulating market growth.

Regulatory Environment and Reimbursement Policies : Stringent regulatory requirements and evolving reimbursement policies influence market dynamics, impacting product approval timelines, market entry barriers, and pricing strategies for over-the-wire micro-guide catheters.

Competitive Landscape : Intense competition among key market players, characterized by product innovation, strategic collaborations, mergers and acquisitions, and geographical expansions, drives continuous advancements in over-the-wire micro-guide catheter technology and contributes to market growth and consolidation.

Patient Safety and Quality Standards : Emphasis on patient safety, quality standards, and regulatory compliance drives manufacturers to invest in research and development activities aimed at enhancing the performance, reliability, and safety profile of over-the-wire micro-guide catheters, fostering market expansion.

Market Access Challenges in Developing Regions : Limited healthcare infrastructure, inadequate access to advanced medical technologies, and economic constraints pose challenges to market penetration and adoption of over-the-wire micro-guide catheters in certain developing regions, necessitating targeted strategies to address these barriers.

Leave a Comment