Increasing Cybersecurity Awareness

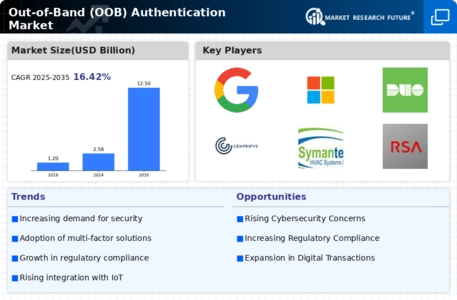

The Out-of-Band (OOB) Authentication Market is experiencing a surge in demand due to heightened awareness of cybersecurity threats. Organizations are increasingly recognizing the importance of safeguarding sensitive information against unauthorized access. This awareness is driven by the proliferation of data breaches and cyberattacks, which have prompted businesses to adopt more robust security measures. As a result, the OOB authentication solutions are being integrated into security protocols to provide an additional layer of protection. According to recent data, the market for OOB authentication is projected to grow at a compound annual growth rate of over 20% in the coming years, reflecting the urgent need for enhanced security measures. This trend indicates that organizations are prioritizing investments in OOB authentication to mitigate risks associated with cyber threats.

Regulatory Compliance Requirements

The Out-of-Band (OOB) Authentication Market is significantly influenced by the increasing regulatory compliance requirements across various sectors. Governments and regulatory bodies are imposing stringent guidelines to protect consumer data and ensure secure transactions. For instance, regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) mandate the implementation of strong authentication methods. As organizations strive to comply with these regulations, the demand for OOB authentication solutions is expected to rise. The market is projected to witness substantial growth, with estimates suggesting a valuation exceeding $5 billion by 2026. This compliance-driven demand underscores the critical role of OOB authentication in helping organizations meet legal obligations while enhancing their overall security posture.

Adoption of Multi-Factor Authentication

The Out-of-Band (OOB) Authentication Market is benefiting from the widespread adoption of multi-factor authentication (MFA) strategies. Organizations are increasingly implementing MFA to bolster their security frameworks, recognizing that relying solely on passwords is insufficient. OOB authentication serves as a vital component of MFA, providing an additional verification step that enhances security. This trend is particularly evident in sectors such as finance and healthcare, where the protection of sensitive data is paramount. Market analysis indicates that the OOB authentication segment is expected to capture a significant share of the MFA market, which is projected to reach $20 billion by 2025. The integration of OOB authentication into MFA solutions is likely to drive further growth in the OOB authentication market, as organizations seek to adopt comprehensive security measures.

Growing E-Commerce and Digital Transactions

The Out-of-Band (OOB) Authentication Market is experiencing growth driven by the increasing volume of e-commerce and digital transactions. As more consumers engage in online shopping and digital banking, the need for secure authentication methods becomes paramount. OOB authentication provides an effective solution to mitigate risks associated with online fraud and identity theft. The rise in digital transactions has led to a corresponding increase in the demand for robust security measures, with the OOB authentication market projected to grow significantly. Recent estimates suggest that the e-commerce sector alone could reach $6 trillion by 2024, further emphasizing the necessity for secure authentication solutions. This trend indicates that as digital transactions continue to proliferate, the OOB authentication market will likely expand to meet the growing security demands.

Technological Advancements in Authentication Solutions

The Out-of-Band (OOB) Authentication Market is poised for growth due to rapid technological advancements in authentication solutions. Innovations such as biometric authentication, mobile device verification, and artificial intelligence are transforming the landscape of security. These advancements enable organizations to implement more sophisticated OOB authentication methods that enhance user experience while maintaining high security standards. The integration of AI-driven analytics into OOB solutions allows for real-time threat detection and response, further solidifying their importance in modern security frameworks. As organizations increasingly seek to leverage these technologies, the OOB authentication market is expected to expand, with projections indicating a market size of over $4 billion by 2025. This technological evolution suggests a promising future for OOB authentication as a critical component of comprehensive security strategies.