Osteoarthritis Size

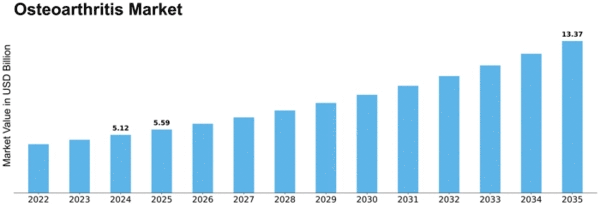

Osteoarthritis Market Growth Projections and Opportunities

With advances in technology, patients get better outcomes, which in turn impacts the market's growth. Examples include joint-preserving treatments, regenerative medicine, and minimally invasive surgery. Increasing obesity around the world puts stress on knees and is a major cause of osteoarthritis. When people put on weight, the joints that support their weight are put under more stress. This makes more people want treatments that will ease their symptoms and slow the disease's progress, which ultimately affects market trends. Growing use of biologics and disease-modifying osteoarthritis drugs (DMOADs) is another important market driver. Innovative drug methods try to change how a disease works at its core, giving people more options for managing pain and influencing the development of new therapies. Legal requirements and healthcare rules play a big role in shaping the osteoarthritis market. Therapies for osteoarthritis are safe and successful as long as they follow the rules set by officials. During the COVID-19 outbreak, market growth slowed down for a short time. Fewer new cases of osteoarthritis and stopped or pushed back treatment plans caused this. In June 2022, PubMed Central released a report that showed treatment for hip and fracture patients in the Czech Republic dropped a lot during the COVID-19 outbreak. It also brought up problems with the health care system, like the difference between care given outside of hospitals and care given in A&E. COVID-19 also slowed down the research and development work of pharmaceutical companies. It also slowed down the clinical testing of many new medicines around the world, including treatments for arthritis. This is why the COVID-19 spread quickly changed the market in a big way. More and more older people around the world are expected to have a big effect on the market that is being studied, since older people are more likely to get osteoarthritis. The UN says that by 2050, 16% of people will be 65 or older, up from 10% in 2022. A study from September 2022 on PubMed Central says that osteoarthritis is also a major cause of disability. More than 10% of people over 60 around the world have extraordinary arthritis. People who have osteoarthritis should think about how physical therapy and other types of rehabilitation can help them. As part of full-spectrum care, people with osteoarthritis can get non-drug treatments like physical therapy and exercise plans. These treatments change how the market makes choices. The market for medicines that help gout is also likely to grow. This is because better solutions are becoming available, more people are ready to go to therapy, and more people know about the disease. The Osteoarthritis Action Alliance says that May is Arthritis Awareness Month. It also said that osteoarthritis (OA) is the most common type of arthritis. Researchers also looked at a variety of tactics that people have used in the market. These include releasing new products, creating new products, joining with or buying other companies, making partnerships, and improving and adding to their product lines. The market that is being studied is likely to grow during the study term. There are many reasons for this, including more people becoming aware of osteoarthritis and new goods. The osteoarthritis treatment market might not grow as quickly as expected over the next few years, though, since hyaluronic acid products and other treatments are pricey and some of them have negative effects.

Leave a Comment