Organic Soaps Size

Organic Soaps Market Growth Projections and Opportunities

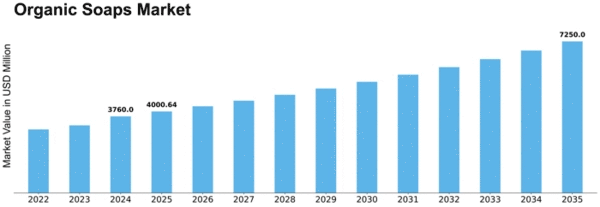

The organic soaps market is experiencing a notable surge in popularity, driven by a convergence of market factors that reflect changing consumer preferences and a growing awareness of the benefits of natural and sustainable products. An important reason that organic soap market gains popularity is the upsurge in demand for products that do not contain chemicals and are friendly to the environment. With the consumers having begun to take note of what goes into their skincare regimens, there has emerged a rise in demand for organic soaps that are packed with all-natural formulations which exclude harsh chemicals. The projected trajectory of the global organic soaps market indicates a size reaching around USD 432 million by 2027, demonstrating a Compound Annual Growth Rate (CAGR) of 8.2% from 2020 to 2027. The importance of health and well-being is another key market intrusion factors that support the growth of the organic soaps segment. Nowadays, customers are searching for products that support their overall well-being, and soap products, made predominately out of natural ingredients like plant or essential oils are considered as a healthier option for skin care. Response from the market to this demand is the supply of organic soaps containing various ingredients that fit different skin types and problems. Moreover, this encourages the market growth. The consideration of the environmental sustainability is a fundamental factor in the market segment of the organic soaps. In line with the rising trend of eco-friendly and cruelty-free options, consumers are becoming more attracted to organic soaps that highlight sustainable sourcing, minimal packaging, and ethical production, ensuring a system that is nature-friendly. Brands that adhere and promulgate these values are experiencing an upward trend signifying a bigger shift towards conscious consumerism. By the way of market segmentation the organic soap market encompasses different customer groups with varied tastes. Sensitivity factor is high as products vary from fragrance-free versions for sensitive skins to soaps with special functions having therapeutic properties. Nowadays, consumers are offered a variety of cleansing products ranging from basic soaps to others with anti-aging properties or moisturizing elements and those crafted for special skin conditions. Geographical factors are known as the determinants of organic soaps market. This type of area where the focus is sustainability, organic farming and ecological consciousness has more popularity of organic personal care products such as organic soaps. In these areas, consumers are more likely to prioritize products that align with their values, contributing to the overall growth of the market.

Leave a Comment