Top Industry Leaders in the Organic Energy Bar Market

The organic energy bar market has experienced rapid growth in recent years, driven by increasing consumer awareness of the health benefits of organic products and a growing demand for convenient, on-the-go snacks. The competitive landscape of this market is characterized by the presence of several key players, each employing various strategies to gain a competitive edge.

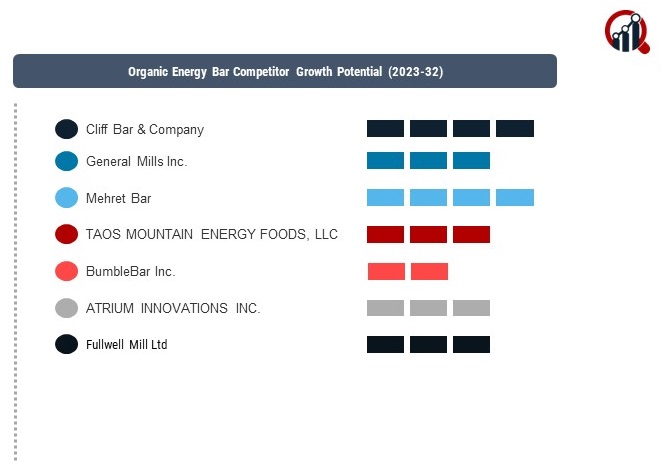

Key Players:

Clif Bar & Company (US)

General Mills Inc. (US)

Mehret Bar (US)

TAOS MOUNTAIN ENERGY FOODS, LLC (Mexico)

BumbleBar Inc. (US)

ATRIUM INNOVATIONS INC. (Canada)

Fullwell Mill Ltd (UK)

CHIMPANZEE NATURAL NUTRITION (South Africa)

Haco Holding AG (Switzerland)

Atkins Nutritionals, Inc. (US)

Quest Nutrition, LLC(US)

McKee Foods Corporation (US)

Kellogg Company (US)

Quaker Oats Company (US)

PowerBar, Inc. (US)

Abbott Nutrition Manufacturing Inc. (US).

Strategies Adopted:

Strategies adopted by these key players include product innovation, strategic partnerships, and marketing campaigns aimed at promoting the health benefits and sustainability of their products. Clif Bar, for example, has introduced new flavors and formulations to cater to changing consumer preferences, while also partnering with retailers to expand its distribution network.

Market Share Analysis:

The organic energy bar market include brand recognition, product quality, pricing strategy, and distribution network. Companies with strong brand loyalty, such as Clif Bar and KIND LLC, are able to command a larger share of the market compared to smaller, less established players.

News & Emerging Companies:

The organic energy bar market has seen a rise in startups offering unique and innovative products. These companies often focus on using organic, non-GMO ingredients and sustainable packaging to differentiate themselves from traditional players in the market.

Industry Trends:

The organic energy bar market in 2023 included several notable developments. Clif Bar announced plans to expand its product line with the introduction of new flavors and packaging options. KIND LLC also introduced new products aimed at tapping into the growing demand for healthier snack options.

In terms of investment trends, companies in the organic energy bar market have been investing in research and development to create new and innovative products. There has also been a focus on expanding distribution networks to reach a wider audience of health-conscious consumers.

Competitive Scenario:

The organic energy bar market is expected to remain intense, with key players vying for market share through product innovation and strategic partnerships. With consumer demand for organic, healthy snacks on the rise, companies that can adapt to changing preferences are likely to succeed in this competitive landscape.

Recent Development:

Clif Bar & Company: In October 2023, Clif Bar announced the launch of its new CLIF® BUILD™ High Protein Bars, which are made with organic ingredients and contain 20 grams of protein per bar. The company is also expanding its line of plant-based energy bars with the introduction of two new flavors of its CLIF® Plant Based Builder's Bars.

General Mills, Inc.: In August 2023, General Mills announced the acquisition of Lärabar, a maker of organic fruit and nut bars. The acquisition will help General Mills to expand its presence in the healthy snack market.