Innovation in Product Formulation

Innovation in product formulation is a critical driver in the Organic Cosmetic Ingredient Market. As brands strive to differentiate themselves, they are increasingly investing in research and development to create unique formulations that incorporate organic ingredients. This focus on innovation not only enhances product efficacy but also caters to diverse consumer needs. Market data indicates that the introduction of innovative organic products is likely to attract a broader customer base, thereby expanding the market. As a result, the Organic Cosmetic Ingredient Market is poised for growth, driven by continuous advancements in formulation techniques.

Consumer Demand for Natural Products

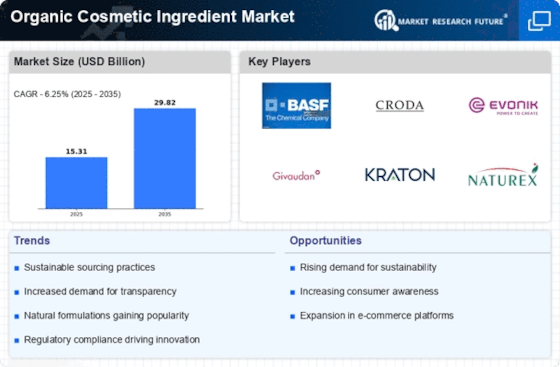

The increasing consumer preference for natural and organic products is a pivotal driver in the Organic Cosmetic Ingredient Market. As awareness of the potential harmful effects of synthetic chemicals grows, consumers are gravitating towards products that are perceived as safer and more environmentally friendly. This shift is reflected in market data, which indicates that the organic cosmetics segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend suggests that brands focusing on organic ingredients are likely to capture a larger market share, thereby influencing the overall dynamics of the Organic Cosmetic Ingredient Market.

Regulatory Support for Organic Standards

Regulatory frameworks supporting organic standards are increasingly shaping the Organic Cosmetic Ingredient Market. Governments and regulatory bodies are establishing stringent guidelines to ensure the authenticity and safety of organic products. This regulatory support not only enhances consumer trust but also encourages manufacturers to adopt organic practices. For instance, the establishment of certification programs for organic ingredients has led to a rise in the number of certified products in the market. As a result, the Organic Cosmetic Ingredient Market is likely to experience growth driven by compliance with these regulations, which may further solidify the market's foundation.

Sustainability and Environmental Concerns

Sustainability and environmental concerns are increasingly influencing consumer choices in the Organic Cosmetic Ingredient Market. As consumers become more environmentally conscious, they are seeking products that align with their values. This has led to a surge in demand for sustainably sourced organic ingredients, which are perceived as less harmful to the planet. Market analysis shows that brands emphasizing sustainability in their sourcing and production processes are likely to gain a competitive edge. Consequently, the Organic Cosmetic Ingredient Market is evolving to meet these expectations, potentially leading to a more sustainable future.

Influence of Social Media and Digital Marketing

The role of social media and digital marketing in promoting organic cosmetics cannot be overstated. Influencers and brands leverage platforms to educate consumers about the benefits of organic ingredients, thereby driving interest and sales in the Organic Cosmetic Ingredient Market. Data suggests that brands utilizing social media effectively can see a significant increase in consumer engagement and brand loyalty. This trend indicates that the Organic Cosmetic Ingredient Market is not only expanding due to product demand but also through innovative marketing strategies that resonate with a tech-savvy audience.