Organic Catalyst Size

Organic Catalyst Market Growth Projections and Opportunities

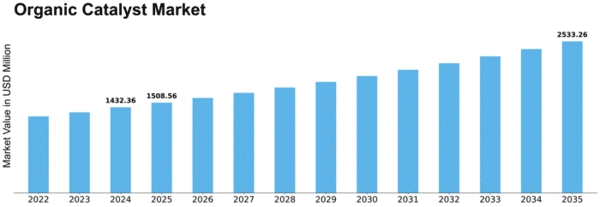

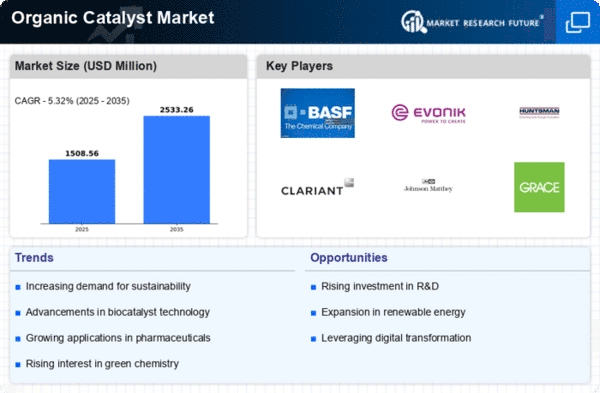

The global organic catalyst market value was 550 million US dollars in 2018. It is expected to grow by more than 4.8% annually in the next years. Most of this growth is due to more people embracing green scientific concepts, which shows a trend toward greener methods. A catalyst speeds a chemical reaction without being consumed. Organic catalysts are chemicals made of carbon, hydrogen, oxygen, nitrogen, sulfur, and phosphorus. Another term for organic catalysts is organocatalyst. These catalysts are crucial for chemical acceleration. To accelerate a chemical reaction, organocatalysis uses organic catalysts. Organic catalysts are non-toxic, affordable, easy to find, and do not react with air or water. Due to their advantages, organic catalysts are favored in medicine and agriculture over transition metal catalysts. Organic catalysts work with many functional groups and don't require dry conditions. They can cut reaction steps and synthesis costs this way. Organic chemical catalysts for biological catalysis are becoming increasingly popular. Metal-organic catalysts are different because they are metals connected to organic catalysts. This trend is due to concerns about the health risks of therapeutic metal usage. Manufacturers are using organic chemical catalysts increasingly to practice green chemistry. Environmentally friendly and sustainable chemical processes are promoted by "green chemistry" principles. Organic catalysts are employed to support these ideas, expanding the global organic catalyst market. Organic catalysts will become more important in horticulture and health as the need for eco-friendly alternatives rises. Organic catalysts are essential to green chemistry in the chemical industry. This is because they are cheap, versatile, and compatible with other compounds. Asia-Pacific may dominate the worldwide industry in subsequent years. China dominates the chemical, polymer, petroleum, and car industries, which explains this. China has several polymer and chemical companies. China began producing chemical and petroleum products due to rising local demand and lower production costs than the US and EU. Increasing foreign direct investment (FDI) and strong economic prospects in rising countries like India and Vietnam are also driving Asia-Pacific market growth. North America is the second-largest market due to changing low sulfur and car laws. This area values environmental catalysts because to these rules. As more Americans buy fuel, catalysts that convert heavy crude oil into lighter components like kerosene, diesel, and gasoline will be needed. The growth of Mexico's chemical, oil, and fuel industries also boosts North America's market. The oil and gas industries in Saudi Arabia, Oman, Kuwait, and Qatar are very robust so the Middle East and Africa should be ideal locations to make petroleum processing catalysts. Chemical companies in the Middle East are likely to make more plastics and petrochemicals because the building, car, packing, and drug businesses need them more.

Leave a Comment