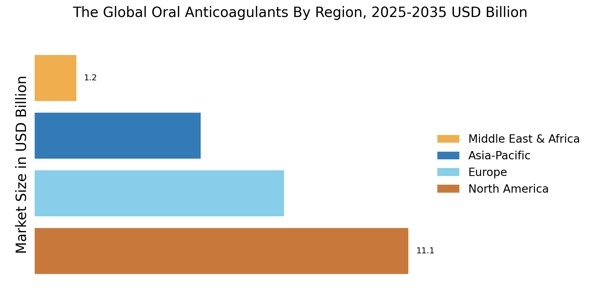

By Region, the study provides market insights into Europe, North America, Asia-Pacific, and the Rest of the World. The North America Oral Anticoagulants Market accounted for USD 9.57 billion in 2022 and is anticipated to exhibit a significant CAGR growth over the study period. The high prevalence of cardiovascular diseases requiring anticoagulant treatment, combined with new product launches throughout the region, will drive the growth of the oral anticoagulants market. According to American Heart Association research in October 2021, roughly 2,300 Americans die each day from cardiovascular diseases, an average of one death every 38 seconds.

Additionally, the Centers for Disease Control & Prevention estimates that in February 2022, heart disease will be the leading cause of mortality in the United States, with about 659,000 deaths annually. This accounts for nearly 25% of all deaths in the United States. As a result of the rise in cardiovascular diseases, the demand for oral anticoagulants in the region is increasing, boosting the market.

Along with these factors, the market in North America is anticipated to grow during the forecast period due to rising research and development efforts, increased awareness, and the prevalence of risk factors like obesity and diabetes among the general populace.

Further, the major countries studied in the market report are the U.S., Germany, Canada, France, the UK, Italy, Japan, India, Australia, Spain, China, South Korea, and Brazil.

Source Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

The European oral anticoagulants market has the second-largest market share due to the rising incidence of cardiovascular disease, increasing the use of blood-thinning medications. For instance, the European Cardiovascular Disease Statistics show that more than 45% of all deaths in Europe are attributable to cardiovascular disease. Moreover, the existence of top pharma and biotech companies involved in therapeutic development and well-established healthcare infrastructure is fueling the overall regional market's growth to a large extent. Further, the German oral anticoagulants market held the largest market share, and the UK oral anticoagulants market was the fastest-growing market in the European region.

The Asia-Pacific Oral Anticoagulants Market will likely grow at the fastest CAGR from 2024 - 2032. This region's increased awareness of cardiovascular diseases and rising disposable income drive market growth. There are many options for advanced anticoagulant drugs (also known as blood thinners) to help patients feel better due to the prevalence of cardiovascular diseases. Moreover, China’s oral anticoagulants market held the largest market share, and the Indian oral anticoagulants market was the fastest-growing market in the Asia-Pacific region.