Research Methodology on Optocoupler IC Market

Introduction

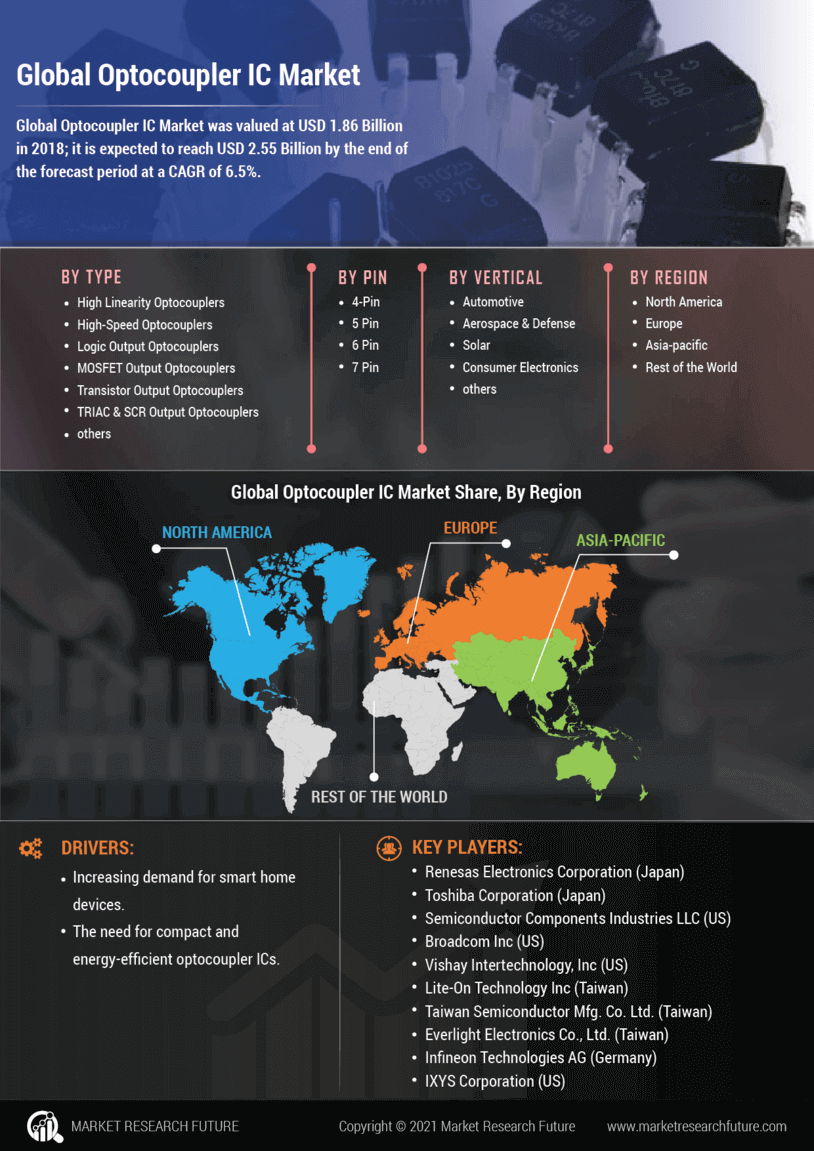

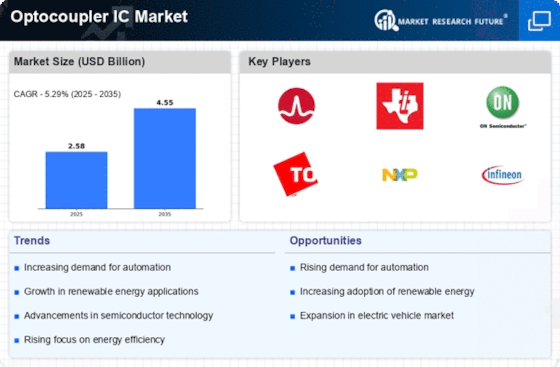

This research report aims to provide insight into the optocouplers and an analysis of the Optocoupler IC market. Optocoupler ICs are used for transferring electrical signals between two circuits that are electrically isolated from one another. Market Research Future’s (MRFR) report contains an in-depth analysis of the Optocoupler IC market and provides insights into the future growth prospects. The scope of the research is broad and covers all the major segments of the Optocoupler IC market.

The research report is the result of a comprehensive research methodology built to understand all the nuances of the optocoupler IC market. This document elucidates the process of data collection and analysis for the research.

Research Objective

The primary objective of the research is as follows

• To study the global market for Optocoupler ICs

• To analyze the dynamics associated with the market for Optocoupler ICs in the near future.

• To study drivers, restraints, opportunities, and trends of the Optocoupler IC market.

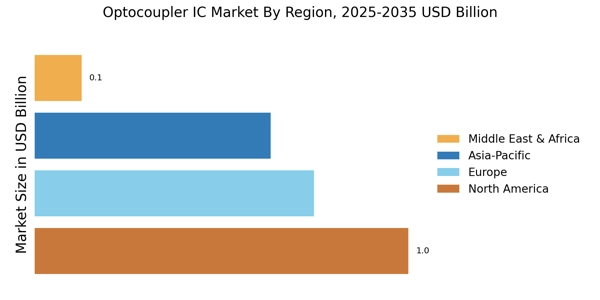

• To analyze the global market by region

• To provide a comprehensive competitive landscape

Research Methodology

Research Approach

MRFR's market analysis follows a mix of top-down and bottom-up approaches. It starts with the macro analysis of the industry environment and key drivers, and then proceeds to the market analysis, covering a detailed segmentation of the market.

Data Collection

The research encompasses extensive primary and secondary research to provide insights into the optocoupler IC market. The information managed to be collected from several reliable sources and mavens such as news portals, websites, interviews of professionals, magazines, and press releases. The primary research is conducted in the form of interviews and surveys. This data is then analyzed and validated with the help of secondary research. The secondary research involves industry reports, company profiles, and various associations and government bodies.

- Secondary Research: We enhanced our insights into the market using investment reports, company filings, presentations, investor presentations, company press releases, and other sources.

- Primary Research: We conducted primary interviews with industry experts, and data was validated through such activities.

Factor Analysis

Different drivers are analyzed to carry a detailed inductive analyses while generating the exact estimates of the global Optocouplers IC market. Factors such as increasing applications of optocouplers in various industries, the trend of miniaturization of ICs, innovations in integrated circuit technology, etc are analyzed to gain insights into the growth opportunities of the market.

Time-series Analysis

The data collected is further analysed using the time-series analysis to calculate the growth trajectory of the optocoupler IC market over the forecast period. This helps in understanding the market dynamics and provides a more accurate forecast.

Demand-Side

The existing and potential consumer preferences of the optocouplers IC market in different regions are studied to understand the growth opportunities. The ongoing market trends, emerging applications, and technological advancements are also taken into account to provide demand-side projections.

Supply-Side

The report further covers the supply-side analysis of the optocouplers IC market. It covers the major manufacturers and their market position in the different regions. The production capacities, capacities utilization, pricing, production, and other aspects are taken into account.

Conclusion

Market Research Future’s (MRFR’s) report provides a detailed and comprehensive analysis of the optocouplers IC market. The research relies on a robust methodology to capture insights about the market. The primary and secondary research techniques, together with emerging trends, factor analysis, and time-series analysis, help provide accurate projections about the growth trajectory of the market. It provides insights into the demand-side and supply-side dynamics to provide the stakeholders with actionable intelligence about the market.