Rising Demand in Electronics

The Optically Clear Adhesives Market is witnessing a notable increase in demand from the electronics sector. With the proliferation of smartphones, tablets, and other electronic devices, the need for high-performance adhesives that provide optical clarity is paramount. These adhesives are essential for applications such as bonding touchscreens and displays, where visual quality is critical. Market data suggests that the electronics segment accounts for a substantial share of the overall optically clear adhesives market, driven by the continuous innovation in display technologies. As manufacturers strive to enhance device aesthetics and functionality, the reliance on optically clear adhesives is expected to grow, further propelling market expansion.

Growth in Automotive Applications

The Optically Clear Adhesives Market is benefiting from the increasing adoption of these adhesives in automotive applications. As vehicles become more technologically advanced, the demand for adhesives that can bond various materials while maintaining optical clarity is rising. These adhesives are utilized in applications such as bonding windshields and other transparent components, where clarity and durability are essential. The automotive sector's shift towards electric vehicles and advanced driver-assistance systems (ADAS) is also contributing to this trend, as manufacturers seek lightweight and efficient bonding solutions. Market analysis indicates that the automotive segment is projected to grow significantly, potentially reaching a valuation of several billion dollars in the next few years.

Expanding Applications in Construction

The Optically Clear Adhesives Market is experiencing growth due to the expanding applications in the construction sector. These adhesives are increasingly used in architectural glass bonding, where optical clarity is crucial for aesthetic and functional purposes. The trend towards modern architectural designs that incorporate large glass facades and structures is driving the demand for high-performance adhesives that can withstand environmental stresses while maintaining clarity. Industry expert's suggest that the construction segment is set to grow, fueled by urbanization and infrastructure development projects. As builders and architects seek innovative solutions for their designs, the reliance on optically clear adhesives is likely to increase, further enhancing market prospects.

Technological Advancements in Manufacturing

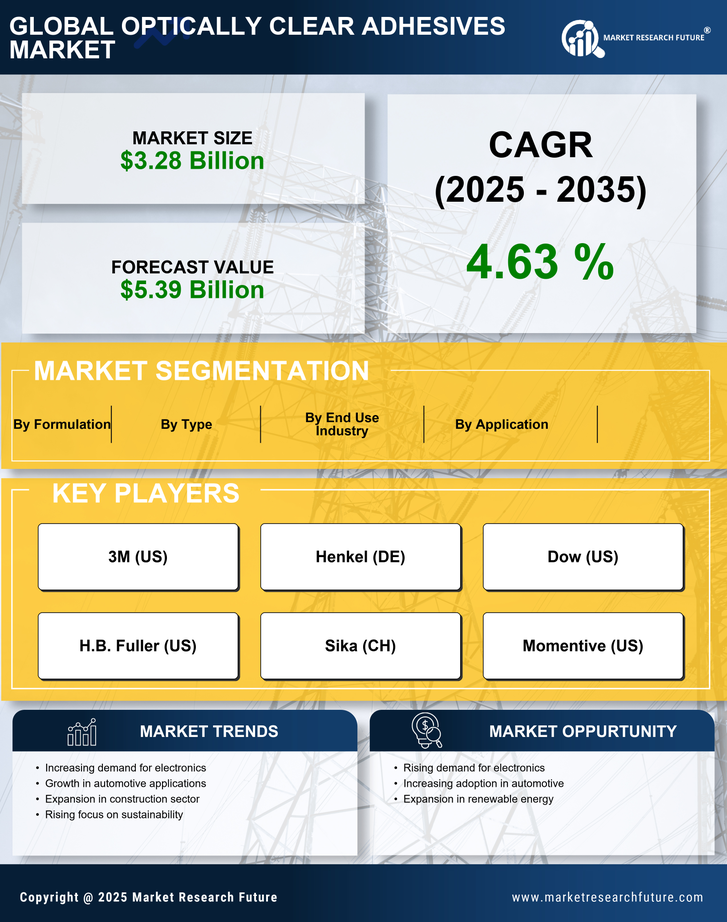

The Optically Clear Adhesives Market is experiencing a surge in demand due to rapid technological advancements in manufacturing processes. Innovations such as improved polymer formulations and enhanced curing techniques are enabling the production of adhesives that offer superior optical clarity and adhesion properties. These advancements not only enhance product performance but also reduce production costs, making optically clear adhesives more accessible to various sectors. For instance, the integration of automation in manufacturing lines has streamlined operations, resulting in higher output and consistency in adhesive quality. As industries increasingly adopt these technologies, the market is poised for significant growth, with projections indicating a compound annual growth rate (CAGR) of over 5% in the coming years.

Sustainability Trends in Adhesive Production

The Optically Clear Adhesives Market is increasingly influenced by sustainability trends, as manufacturers seek to develop eco-friendly adhesive solutions. The growing awareness of environmental issues has prompted companies to invest in the formulation of adhesives that are not only high-performing but also biodegradable or made from renewable resources. This shift towards sustainable practices is likely to attract environmentally conscious consumers and businesses, thereby expanding the market. Furthermore, regulatory pressures are encouraging manufacturers to adopt greener production methods, which may lead to innovations in adhesive formulations. As sustainability becomes a key focus, the optically clear adhesives market is expected to evolve, aligning with global efforts to reduce environmental impact.