Growing Awareness of Eye Health

There is a growing awareness of eye health among the global population, which positively influences the Global Ophthalmology Device Market Industry. Public health campaigns and educational initiatives are informing individuals about the importance of regular eye examinations and early detection of eye diseases. This heightened awareness is leading to increased patient engagement and a willingness to seek treatment, thereby boosting the demand for ophthalmic devices. As more individuals prioritize eye health, the market is likely to see a corresponding rise in device utilization, contributing to its overall growth trajectory.

Increasing Healthcare Expenditure

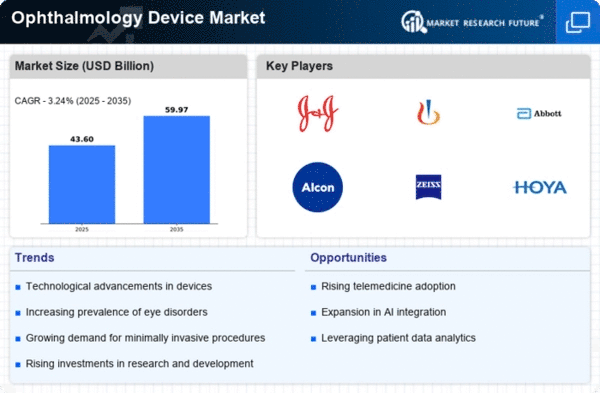

The Global Ophthalmology Device Market Industry benefits from rising healthcare expenditure across various regions. Governments and private sectors are investing significantly in healthcare infrastructure, which includes ophthalmic services. This investment is particularly evident in developing countries, where access to eye care is improving. Enhanced funding allows for the procurement of advanced ophthalmic devices, thereby increasing the overall market size. The expected compound annual growth rate of 3.25% from 2025 to 2035 indicates a sustained commitment to improving eye health, further driving the demand for innovative ophthalmology devices.

Rising Prevalence of Eye Disorders

The Global Ophthalmology Device Market Industry experiences a notable surge due to the increasing prevalence of eye disorders, such as cataracts and glaucoma. As populations age, the incidence of these conditions rises, necessitating advanced diagnostic and surgical devices. For instance, the World Health Organization indicates that by 2024, the market is projected to reach 42.2 USD Billion, reflecting the urgent need for effective treatment options. This trend is likely to continue, as the aging demographic is expected to drive demand for innovative ophthalmic solutions, thereby propelling market growth.

Expansion of Telemedicine in Ophthalmology

The expansion of telemedicine in ophthalmology is reshaping the Global Ophthalmology Device Market Industry. Remote consultations and digital monitoring tools are becoming increasingly prevalent, allowing patients to access eye care services from the comfort of their homes. This trend is particularly beneficial for individuals in remote or underserved areas, where traditional access to ophthalmic care may be limited. The integration of telehealth solutions with ophthalmic devices enhances patient outcomes and satisfaction. As telemedicine continues to evolve, it is expected to drive further growth in the market, aligning with the increasing demand for accessible eye care.

Technological Advancements in Ophthalmic Devices

Technological innovations play a crucial role in shaping the Global Ophthalmology Device Market Industry. The introduction of minimally invasive surgical techniques and advanced imaging technologies enhances the accuracy and efficiency of eye care. Devices such as optical coherence tomography and femtosecond lasers are revolutionizing treatment protocols. As these technologies become more accessible, they are likely to attract a broader patient base, contributing to market expansion. The anticipated growth from 2024 to 2035, with a projected market value of 60 USD Billion, underscores the importance of continuous innovation in ophthalmic devices.