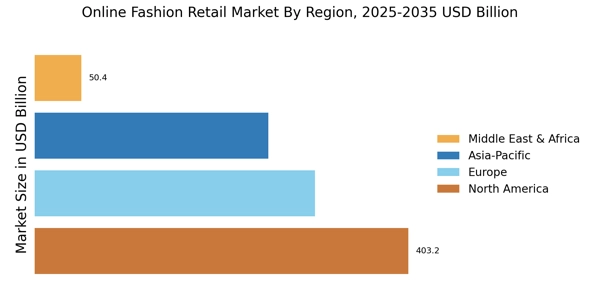

North America : E-commerce Leader

North America is the largest market for online fashion retail, holding approximately 40% of the global market share. Key growth drivers include high internet penetration, a strong consumer base, and increasing mobile shopping trends. Regulatory support for e-commerce and digital payments further catalyzes growth, making it a robust environment for online fashion retailers. The U.S. is the largest market, followed by Canada, which contributes around 10% to the overall market share.

The competitive landscape is dominated by major players such as Amazon, Nordstrom, and Lulus, which leverage advanced logistics and customer service to enhance user experience. The presence of established brands and innovative startups fosters a dynamic market. Additionally, the rise of sustainable fashion is influencing consumer preferences, prompting retailers to adapt their offerings accordingly.

Europe : Diverse Fashion Hub

Europe is a significant player in the online fashion retail market, accounting for approximately 30% of the global share. The region benefits from a diverse consumer base and a strong inclination towards online shopping, driven by convenience and a wide range of choices. Regulatory frameworks supporting e-commerce, such as the Digital Single Market strategy, enhance cross-border trade and consumer protection, further stimulating growth. Germany and the UK are the largest markets, contributing around 12% and 10% respectively to the overall market share.

Leading countries like Germany, the UK, and France host key players such as Zalando, ASOS, and H&M. The competitive landscape is characterized by a mix of established brands and emerging online retailers. The focus on sustainability and ethical fashion is reshaping consumer preferences, prompting retailers to innovate and adapt their strategies to meet evolving demands.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is an emerging powerhouse in the online fashion retail market, holding approximately 25% of the global market share. The region's growth is fueled by rising disposable incomes, urbanization, and a young, tech-savvy population. Countries like China and India are leading this growth, with China alone accounting for nearly 15% of the global market. Regulatory improvements in e-commerce and logistics are also enhancing market accessibility and consumer trust.

China is home to major players like Shein and Myntra, while India is witnessing a surge in local brands. The competitive landscape is vibrant, with both international and domestic players vying for market share. The increasing trend of online shopping, coupled with social media influence, is driving fashion retail growth, making the region a focal point for innovation and investment.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa represent an untapped frontier in the online fashion retail market, holding approximately 5% of the global share. The region is witnessing rapid growth driven by increasing internet penetration, mobile usage, and a young population eager for fashion choices. Regulatory initiatives aimed at enhancing e-commerce infrastructure are also contributing to market expansion. Countries like South Africa and the UAE are leading the charge, with the UAE accounting for about 3% of the market share.

The competitive landscape is evolving, with local and international players entering the market. Key players include Jumia and Namshi, which cater to diverse consumer preferences. The region's unique cultural dynamics and growing interest in online shopping present significant opportunities for retailers to innovate and capture market share, making it a promising area for future growth.