Economic Factors

Economic factors are also a significant driver of the online clothing rental Market. In times of economic uncertainty, consumers often seek cost-effective alternatives to traditional retail shopping. Renting clothing allows individuals to access high-quality apparel at a fraction of the purchase price, making it an attractive option during financial downturns. Recent studies indicate that the rental market has seen a surge in demand during periods of economic instability, as consumers prioritize budget-friendly solutions. Additionally, the rise of the gig economy and flexible work arrangements has led to an increase in disposable income for some segments, further fueling interest in rental services. As economic conditions fluctuate, the Online Clothing Rental Market is likely to adapt, offering diverse pricing models and rental options to meet the needs of cost-conscious consumers.

Social Media Influence

The influence of social media on consumer behavior is a notable driver in the Online Clothing Rental Market. Platforms such as Instagram and TikTok have transformed the way individuals discover and engage with fashion. Influencers and celebrities showcasing rental outfits create a buzz around the concept of renting clothing, making it more appealing to a wider audience. Data suggests that approximately 40% of consumers are inspired to try rental services after seeing them featured on social media. This trend indicates that effective marketing strategies leveraging social media can significantly impact consumer decisions. As the Online Clothing Rental Market continues to evolve, businesses are likely to invest in social media campaigns to enhance brand visibility and attract new customers. The power of social media in shaping fashion trends cannot be underestimated, as it plays a crucial role in driving the growth of the rental market.

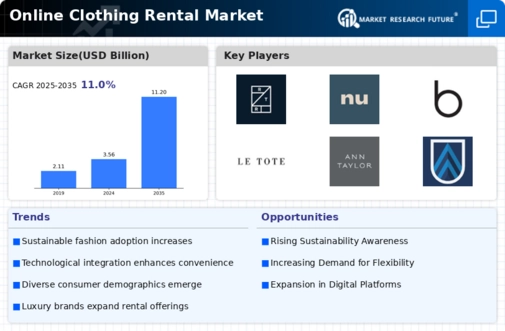

Sustainability Awareness

The increasing awareness of environmental issues among consumers appears to be a driving force in the Online Clothing Rental Market. As individuals become more conscious of their carbon footprint, they are likely to seek sustainable alternatives to fast fashion. This shift in consumer behavior suggests that the demand for rental services, which promote reuse and reduce waste, is on the rise. According to recent data, the online clothing rental market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth may be attributed to the rising preference for eco-friendly practices, as consumers opt for rental services that align with their values. Consequently, businesses in the Online Clothing Rental Market are increasingly focusing on sustainable practices to attract environmentally conscious customers.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Online Clothing Rental Market. The integration of artificial intelligence and machine learning into rental platforms enhances user experience by providing personalized recommendations based on individual preferences. Furthermore, advancements in logistics and inventory management systems streamline operations, allowing companies to efficiently manage their rental offerings. Data indicates that the use of technology in the rental sector has led to a reduction in operational costs by up to 20%, thereby increasing profitability. As technology continues to evolve, it is likely that the Online Clothing Rental Market will witness further innovations, making it more accessible and appealing to a broader audience. This technological integration not only improves customer satisfaction but also fosters loyalty, as users are more inclined to return to platforms that offer seamless experiences.

Changing Consumer Preferences

Changing consumer preferences are significantly influencing the Online Clothing Rental Market. The modern consumer, particularly millennials and Gen Z, appears to prioritize experiences over ownership, leading to a growing inclination towards renting rather than buying clothing. This trend is reflected in market data, which shows that approximately 30% of consumers aged 18-34 have engaged in clothing rental services in the past year. The desire for variety and the ability to access high-quality fashion without the commitment of purchase are compelling factors driving this shift. As these demographics continue to dominate the market, businesses in the Online Clothing Rental Market are adapting their offerings to cater to this evolving mindset. This adaptability may prove crucial for companies aiming to capture and retain a loyal customer base in an increasingly competitive landscape.