Market Analysis

In-depth Analysis of On the Go Breakfast Products Market Industry Landscape

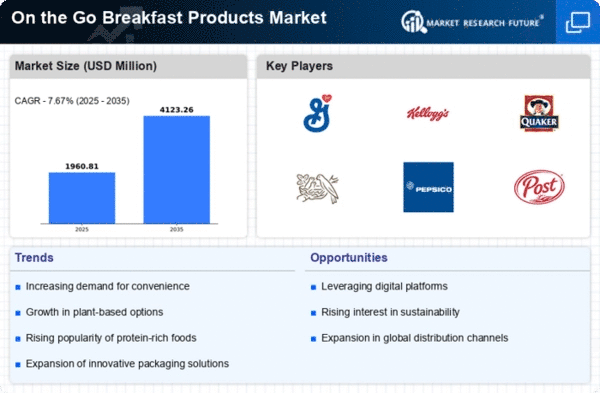

The on-the-go breakfast products market has experienced significant transformations in recent years, driven by the changing lifestyles and hectic routines of consumers seeking convenient and portable breakfast options. With an increasing number of people leading busy lives, there has been a growing demand for quick, nutritious, and easily consumable breakfast solutions. The market dynamics are shaped by factors such as shifting consumer preferences, the emphasis on health and wellness, and innovations in packaging and product formats.

One of the primary drivers of the on-the-go breakfast products market is the shift in consumer preferences towards convenient and time-saving options. As individuals face time constraints in the mornings, the traditional sit-down breakfast is becoming less feasible, leading to a rise in demand for breakfast items that can be consumed on the move. This trend is particularly prevalent among urban populations and busy professionals who prioritize efficiency and functionality in their daily routines.

The emphasis on health and wellness is another key factor influencing the dynamics of the on-the-go breakfast products market. Consumers are increasingly seeking breakfast options that not only offer convenience but also align with their health goals. This has led to the development of on-the-go products that emphasize nutritional value, incorporating ingredients like whole grains, fruits, and protein sources. Health-conscious consumers are driving the market towards healthier alternatives, prompting manufacturers to focus on clean labels and transparent ingredient sourcing.

Innovations in packaging and product formats play a crucial role in shaping the market dynamics of on-the-go breakfast products. Single-serving packs, resealable pouches, and portable containers have become popular choices, offering convenience and portion control. The market has seen the emergence of diverse product formats, including breakfast bars, yogurt cups, smoothie pouches, and pre-packaged breakfast sandwiches, providing consumers with a wide range of choices to fit their preferences and dietary requirements.

The on-the-go breakfast products market is also influenced by the increasing prevalence of snacking behavior throughout the day. As consumers move away from traditional three-meal structures, there is a growing acceptance of breakfast items as snacks or mini-meals consumed at different times. This shift in eating patterns has expanded the market beyond traditional breakfast hours, creating opportunities for product innovation and marketing strategies that position on-the-go breakfast items as versatile snacks suitable for any time of day.

Challenges in the market include addressing concerns related to the nutritional content and sugar levels in some on-the-go breakfast products. As consumers become more discerning about their food choices, manufacturers are responding by reformulating products to reduce added sugars and enhance nutritional profiles. Additionally, competition among brands to stand out in a crowded market poses a challenge, driving companies to invest in marketing strategies, unique product offerings, and collaborations to maintain a competitive edge.

Leave a Comment