North America : Established Agricultural Market

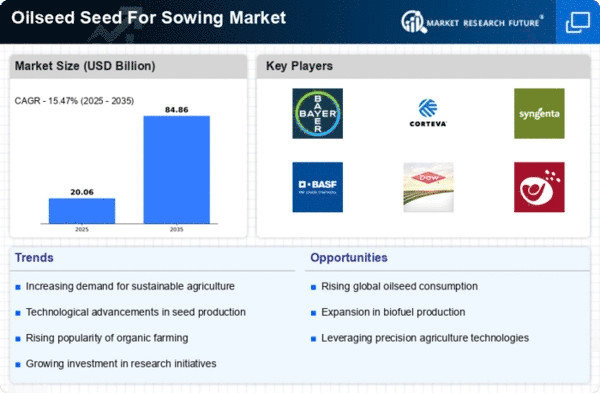

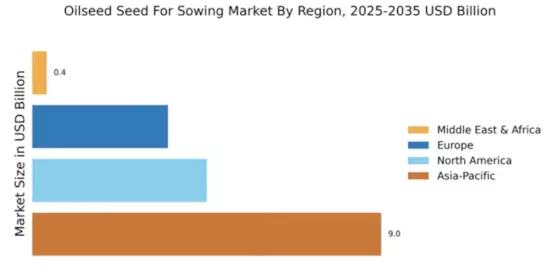

North America is witnessing robust growth in the oilseed seed for sowing market, driven by increasing demand for biofuels and sustainable agricultural practices. The market size is projected at $4.5 billion, reflecting a significant share in the global landscape. Regulatory support for biofuel production and advancements in seed technology are key catalysts for this growth, enhancing productivity and sustainability in farming practices.

The United States and Canada are the leading countries in this region, with major players like Corteva Agriscience and Bayer Crop Science dominating the market. The competitive landscape is characterized by innovation in seed varieties and biotechnology, aimed at improving yield and resistance to pests. The presence of established companies ensures a dynamic market environment, fostering continuous advancements in oilseed cultivation.

Europe : Innovative Agricultural Practices

Europe's oilseed seed for sowing market is evolving, with a market size of $3.5 billion. The region is focusing on sustainable agricultural practices and regulatory frameworks that promote environmentally friendly farming. The European Green Deal and CAP (Common Agricultural Policy) are pivotal in driving demand for oilseed crops, emphasizing sustainability and biodiversity in agriculture, which is crucial for meeting EU climate goals.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with key players like BASF and Limagrain actively contributing to innovation. The competitive landscape is marked by a strong emphasis on research and development, with companies investing in genetically modified seeds to enhance yield and resilience. This focus on innovation positions Europe as a leader in sustainable oilseed production.

Asia-Pacific : Emerging Market Dynamics

Asia-Pacific is the largest market for oilseed seeds for sowing, with a market size of $9.0 billion. The region's growth is driven by increasing population, rising income levels, and a shift towards more sustainable agricultural practices. Countries are implementing policies to enhance agricultural productivity, which is crucial for food security. The demand for oilseed crops is expected to rise significantly, supported by government initiatives promoting modern farming techniques.

India and China are the leading countries in this region, with companies like Mahyco and Nuziveedu Seeds playing a vital role in the market. The competitive landscape is characterized by a mix of local and international players, focusing on innovation and adaptation to local farming conditions. The presence of major global companies ensures a competitive environment, fostering advancements in oilseed seed technology.

Middle East and Africa : Developing Agricultural Sector

The Middle East and Africa region is gradually developing its oilseed seed for sowing market, with a market size of $0.37 billion. The growth is driven by increasing agricultural investments and a focus on food security. Governments are implementing policies to enhance local production of oilseeds, which is crucial for reducing dependency on imports. The region's agricultural sector is evolving, with a growing emphasis on sustainable practices and modern farming techniques.

Countries like South Africa and Egypt are leading the way in oilseed production, with local companies beginning to emerge in the market. The competitive landscape is still in its nascent stages, but there is potential for growth as more players enter the market. The presence of international companies can also stimulate innovation and improve the overall quality of oilseed seeds available in the region.