North America : Energy Dominance and Innovation

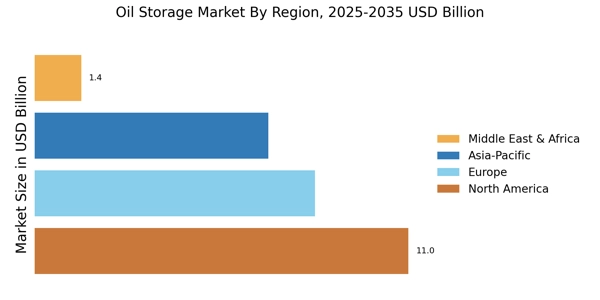

North America is the largest market for oil storage, accounting for approximately 40% of the global share. The region's growth is driven by increasing oil production, particularly in the U.S. shale sector, and rising demand for strategic reserves, which significantly boosts the storage of crude oil across North America. Regulatory support, including favorable policies for energy infrastructure, further catalyzes market expansion. The U.S. and Canada are the primary contributors, with significant investments in storage facilities and technology.

The competitive landscape is characterized by major players such as ExxonMobil, Chevron, and Valero Energy, which dominate the market. These companies are investing in advanced storage technologies and expanding their facilities to meet growing demand. The presence of established infrastructure and a robust supply chain enhances the region's competitive edge, ensuring efficient oil storage and distribution capabilities.

Europe : Regulatory Framework and Sustainability

Europe is the second-largest market for oil storage, holding around 30% of the global share. The region's growth is propelled by stringent regulations aimed at enhancing energy security and sustainability. The European Union's policies encourage the development of strategic oil reserves and the transition to cleaner energy sources, which are reshaping the oil storage landscape. Countries like Germany and the Netherlands are at the forefront of these initiatives, driving demand for modern storage solutions. Leading countries in Europe include Germany, the Netherlands, and the UK, where key players like TotalEnergies and BP are actively expanding their storage capacities. The competitive environment is marked by a focus on innovation and sustainability, with companies investing in eco-friendly technologies. The presence of Oiltanking GmbH further strengthens the market, providing specialized storage services and enhancing operational efficiency.

Asia-Pacific : Emerging Markets and Growth Potential

Asia-Pacific is witnessing rapid growth in the oil storage market, accounting for approximately 25% of the global share. The region's expansion is driven by increasing oil consumption, particularly in countries like China and India, alongside rising imports. Government initiatives to enhance energy security and infrastructure development are key catalysts for market growth, with storing crude oil becoming increasingly important to manage rising import dependency. The demand for strategic reserves is also on the rise, reflecting the region's growing energy needs.

China and India are the leading countries in this region, with significant investments in storage facilities to accommodate rising demand. The competitive landscape features both local and international players, including major oil companies and independent storage operators. The presence of established firms like Eni and Marathon Petroleum enhances the market's competitiveness, as they adapt to the evolving energy landscape and invest in advanced storage technologies.

Middle East and Africa : Resource-Rich and Strategic Hub

The Middle East and Africa region is a crucial player in the oil storage market, holding about 5% of the global share. The region's growth is driven by its vast oil reserves and strategic location, facilitating trade and storage. Countries like Saudi Arabia and the UAE are investing heavily in storage infrastructure to support their oil export capabilities. Regulatory frameworks are evolving to enhance energy security and attract foreign investments, further boosting market potential. Saudi Arabia and the UAE are the leading countries in this region, with key players such as BP and Eni establishing a strong presence. The competitive landscape is characterized by a mix of state-owned and private enterprises, focusing on expanding storage capacities and improving operational efficiencies. The region's strategic importance in global oil trade positions it as a vital hub for oil storage and distribution.