Top Industry Leaders in the Oil Shale Market

Oil shale, a sedimentary rock impregnated with kerogen, a precursor to oil, holds a paradoxical position in the energy landscape. Touted as a potential game-changer for energy security and independence, it also faces concerns about environmental impact and economic feasibility. Navigating the competitive landscape of this nascent market requires understanding the strategies at play, the factors determining market share, and the recent developments shaping its future.

Oil shale, a sedimentary rock impregnated with kerogen, a precursor to oil, holds a paradoxical position in the energy landscape. Touted as a potential game-changer for energy security and independence, it also faces concerns about environmental impact and economic feasibility. Navigating the competitive landscape of this nascent market requires understanding the strategies at play, the factors determining market share, and the recent developments shaping its future.

Strategic Maneuvers in the Hydrocarbons Wild West:

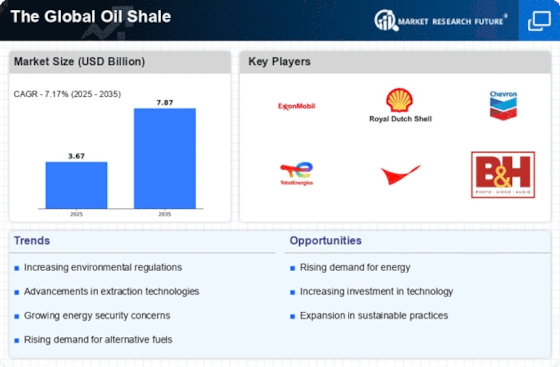

Leading players like ExxonMobil, Royal Dutch Shell, and Chevron Corporation employ a range of strategies to gain a foothold in the oil shale market:

-

Exploration and resource acquisition: Securing licenses to promising oil shale deposits, particularly in countries with supportive regulatory frameworks like the United States and Australia. -

Technological innovation: Investing in R&D for efficient and environmentally friendly extraction and processing technologies, focusing on in-situ retorting methods with reduced surface impact. -

Partnerships and joint ventures: Collaborating with government agencies, universities, and technology startups to share resources, expertise, and mitigate risks. -

Public relations and advocacy: Engaging in community outreach and policy discussions to address environmental concerns and gain public acceptance for oil shale development. -

Diversification: Balancing oil shale ventures with other energy sources like renewables and natural gas to manage financial risks and position themselves for a transition to a low-carbon future.

Factors dictating market share:

Success in this evolving market hinges on several key factors:

-

Resource quality and accessibility: Securing oil shale deposits with high kerogen content and favorable geological conditions for efficient extraction and processing. -

Technology performance and cost: Developing cost-competitive and environmentally friendly extraction and processing technologies with high oil yields and minimal emissions. -

Regulatory environment: Navigating complex and often-fluid regulations regarding environmental impact assessments, land use permits, and waste disposal. -

Public perception and social license to operate: Gaining public trust by addressing environmental concerns, mitigating risks, and ensuring transparency in operations. -

Global energy landscape and oil prices: Aligning oil shale production with future energy demand forecasts and ensuring it remains economically viable compared to other hydrocarbon sources.

Key Companies in the oil shale market include

American Shale Oil (USA),Aura Source Inc. (USA),Blue Ensign Technologies Ltd (Australia),Chevron Corporation (USA),Electro-Petroleum Inc. (USA),Exxon Mobil Corporation (USA),Occidental Petroleum Corporation (USA),Chesapeake (USA),MARATHON OIL COMPANY (USA),CotCabot Oil & Gas Corporation (USA),Halliburton Energy Services. (USA),

Recent Developments:

-

October 2023: Major technology advancements lead to the development of cleaner and more efficient retorting processes using supercritical fluids and microwave heating. -

November 2023: Growing concerns about energy security in Europe due to the Russia-Ukraine war spur renewed interest in domestic oil shale resources. -

December 2023: Financial institutions launch specialized investment funds focused on sustainable oil shale development, signaling growing confidence in the sector's potential.