Increasing Regulatory Pressures

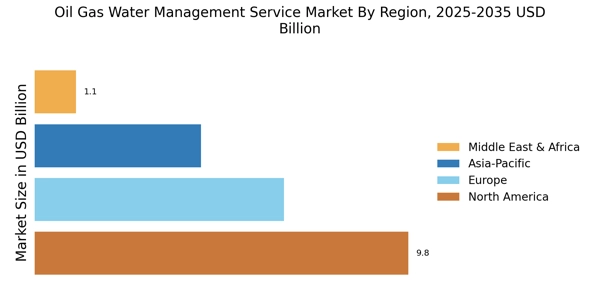

Regulatory compliance is a critical driver in the Oil Gas Water Management Service Market. Governments and regulatory bodies are imposing stricter regulations on water usage and discharge, compelling companies to adopt more sustainable practices. This trend is particularly evident in regions where water scarcity is a pressing issue. Companies are required to implement effective water management strategies to meet these regulations, which often include the treatment and recycling of produced water. As a result, the market for water management services is expected to expand, as firms seek to comply with these regulations while maintaining operational efficiency.

Rising Demand for Water Recycling

The growing emphasis on sustainability is propelling the demand for water recycling within the Oil Gas Water Management Service Market. As water scarcity becomes an increasingly critical issue, companies are recognizing the importance of recycling produced water for reuse in various operations. This shift not only conserves freshwater resources but also reduces the environmental impact associated with water disposal. According to recent estimates, the water recycling market in the oil and gas sector is projected to grow significantly, indicating a robust opportunity for service providers. This trend is likely to drive investments in water management technologies and services.

Focus on Environmental Sustainability

Environmental sustainability is becoming a paramount concern within the Oil Gas Water Management Service Market. Companies are increasingly aware of their environmental footprint and are seeking ways to mitigate negative impacts associated with water usage. This focus on sustainability is leading to the adoption of best practices in water management, including the implementation of efficient treatment processes and the reduction of water waste. As stakeholders demand greater accountability and transparency, firms that prioritize sustainable water management practices are likely to gain a competitive edge, thereby driving growth in the market.

Economic Growth and Industrial Expansion

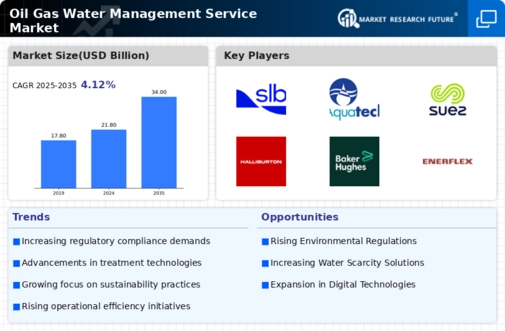

Economic growth and industrial expansion are significant drivers of the Oil Gas Water Management Service Market. As economies develop, the demand for energy and resources increases, leading to heightened activity in the oil and gas sector. This expansion often results in increased water usage and the need for effective management solutions. Companies are investing in water management services to ensure that they can meet operational demands while adhering to environmental regulations. The correlation between industrial growth and water management needs suggests that as economies continue to expand, the Oil Gas Water Management Service Market will likely experience substantial growth.

Technological Innovations in Water Management

The Oil Gas Water Management Service Market is experiencing a surge in technological innovations that enhance water treatment processes. Advanced technologies such as membrane filtration, reverse osmosis, and advanced oxidation processes are being integrated into water management systems. These innovations not only improve the efficiency of water treatment but also reduce operational costs. For instance, the adoption of smart water management systems allows for real-time monitoring and data analytics, which can lead to more informed decision-making. As companies strive to optimize their water usage and minimize waste, the demand for these advanced technologies is likely to grow, driving the Oil Gas Water Management Service Market forward.