Rising Demand for Energy Resources

The Oil and Gas Magnetic Ranging Market is significantly influenced by the rising demand for energy resources. As global energy consumption continues to escalate, driven by population growth and industrialization, the need for efficient exploration and extraction methods becomes paramount. Magnetic ranging technologies facilitate the precise identification of subsurface resources, thereby enhancing the efficiency of drilling operations. This demand is further underscored by the International Energy Agency's projections, which indicate that oil and gas will remain a critical component of the energy mix for the foreseeable future. Consequently, the market for magnetic ranging solutions is expected to expand as companies strive to meet the increasing energy demands while minimizing environmental impacts.

Growing Focus on Operational Efficiency

The Oil and Gas Magnetic Ranging Market is increasingly characterized by a growing focus on operational efficiency. Companies are under pressure to reduce costs while maximizing output, prompting the adoption of technologies that streamline operations. Magnetic ranging solutions contribute to this objective by enabling precise subsurface mapping, which minimizes drilling errors and enhances resource recovery. The market is projected to benefit from this trend, as organizations seek to leverage advanced technologies to improve their operational performance. As the industry evolves, the emphasis on efficiency is likely to drive further innovation in magnetic ranging technologies, positioning them as a vital component of modern oil and gas operations.

Regulatory Compliance and Safety Standards

The Oil and Gas Magnetic Ranging Market is also shaped by stringent regulatory compliance and safety standards. Governments and regulatory bodies are imposing more rigorous requirements on oil and gas operations to ensure environmental protection and worker safety. Magnetic ranging technologies play a crucial role in meeting these standards by providing accurate data that aids in risk assessment and management. Companies that adopt advanced magnetic ranging solutions are better positioned to comply with regulations, thereby avoiding potential fines and operational disruptions. This trend is likely to drive the adoption of magnetic ranging technologies, as firms prioritize safety and compliance in their operational strategies.

Increased Investment in Exploration Activities

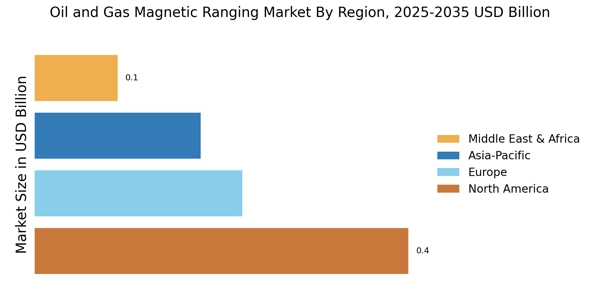

The Oil and Gas Magnetic Ranging Market is witnessing increased investment in exploration activities, particularly in untapped regions. As traditional oil and gas reserves become depleted, companies are turning their attention to new frontiers, necessitating advanced technologies for effective exploration. Magnetic ranging solutions are essential for navigating complex geological formations and ensuring successful drilling operations. According to industry reports, exploration budgets are expected to rise by approximately 10% in the coming years, reflecting the industry's commitment to discovering new resources. This influx of investment is likely to bolster the demand for magnetic ranging technologies, as firms seek to enhance their exploration capabilities.

Technological Advancements in Magnetic Ranging

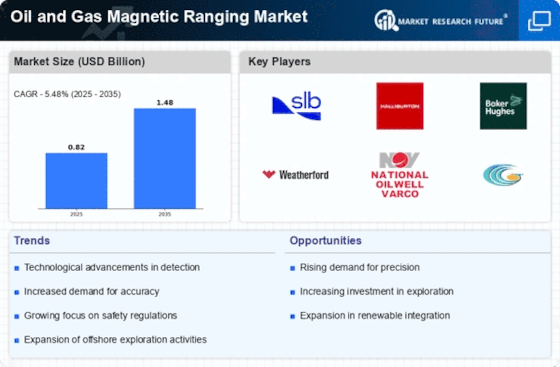

The Oil and Gas Magnetic Ranging Market is experiencing a notable transformation due to rapid technological advancements. Innovations in magnetic ranging technologies, such as enhanced sensor capabilities and improved data processing algorithms, are driving efficiency and accuracy in subsurface mapping. These advancements enable operators to better locate and assess the position of pipelines and wells, thereby reducing operational risks. The market is projected to grow at a compound annual growth rate of approximately 6% over the next five years, reflecting the increasing reliance on advanced technologies. As companies seek to optimize their exploration and production processes, the integration of cutting-edge magnetic ranging solutions becomes essential, positioning the industry for sustained growth.