Adoption of IoT and Smart Technologies

The proliferation of Internet of Things (IoT) devices and smart technologies is significantly influencing the Oil And Gas Data Monetization Market. These technologies facilitate the collection and analysis of vast amounts of data from various sources, including drilling operations and equipment performance. The implementation of IoT solutions is expected to enhance operational efficiency and reduce costs, with the market for IoT in oil and gas projected to grow at a compound annual growth rate of 25% through 2025. This trend underscores the importance of data monetization strategies, as companies leverage IoT data to drive innovation and improve service delivery within the Oil And Gas Data Monetization Market.

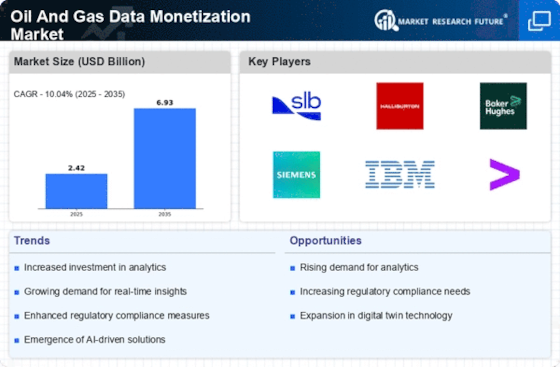

Rising Demand for Data-Driven Insights

The Oil And Gas Data Monetization Market is experiencing a notable surge in demand for data-driven insights. Companies are increasingly recognizing the value of data analytics in optimizing operations, enhancing decision-making, and improving overall efficiency. According to recent estimates, the market for data analytics in the oil and gas sector is projected to reach USD 20 billion by 2026. This growth is driven by the need for real-time data analysis to mitigate risks and enhance productivity. As organizations strive to remain competitive, the integration of advanced analytics tools becomes essential, thereby propelling the Oil And Gas Data Monetization Market forward.

Growing Focus on Operational Efficiency

Operational efficiency remains a paramount concern within the Oil And Gas Data Monetization Market. Companies are increasingly seeking ways to streamline processes and reduce operational costs. The integration of data monetization strategies allows organizations to identify inefficiencies and optimize resource allocation. Recent studies suggest that companies implementing data-driven strategies can achieve cost reductions of up to 20%. This focus on operational efficiency not only enhances profitability but also positions companies favorably in a competitive market, thereby driving the growth of the Oil And Gas Data Monetization Market.

Regulatory Compliance and Risk Management

In the Oil And Gas Data Monetization Market, regulatory compliance and risk management are becoming increasingly critical. Companies are required to adhere to stringent regulations regarding environmental protection and safety standards. The need for comprehensive data management systems to ensure compliance is driving investments in data monetization solutions. It is estimated that the compliance market within the oil and gas sector will exceed USD 15 billion by 2025. This focus on compliance not only mitigates risks but also enhances the reputation of companies, making data monetization a strategic priority in the Oil And Gas Data Monetization Market.

Increased Investment in Digital Transformation

The Oil And Gas Data Monetization Market is witnessing a significant increase in investment aimed at digital transformation initiatives. Companies are allocating substantial resources to upgrade their technological infrastructure, enabling them to harness the power of data analytics and artificial intelligence. This shift is expected to drive the market for data monetization solutions, with projections indicating a growth rate of 30% annually through 2025. As organizations seek to modernize their operations and improve efficiency, the emphasis on digital transformation is likely to reshape the competitive landscape of the Oil And Gas Data Monetization Market.