Rising Demand for Energy

The Oil Country Tubular Goods Market experiences a robust demand driven by the increasing need for energy. As countries strive to enhance their energy security and reduce dependence on imports, investments in oil and gas exploration and production are likely to rise. This trend is evident as the market is projected to reach 41.7 USD Billion in 2024, reflecting a growing appetite for tubular goods essential for drilling and extraction processes. The expansion of unconventional oil and gas resources, particularly in North America and the Middle East, further fuels this demand, indicating a sustained growth trajectory for the industry.

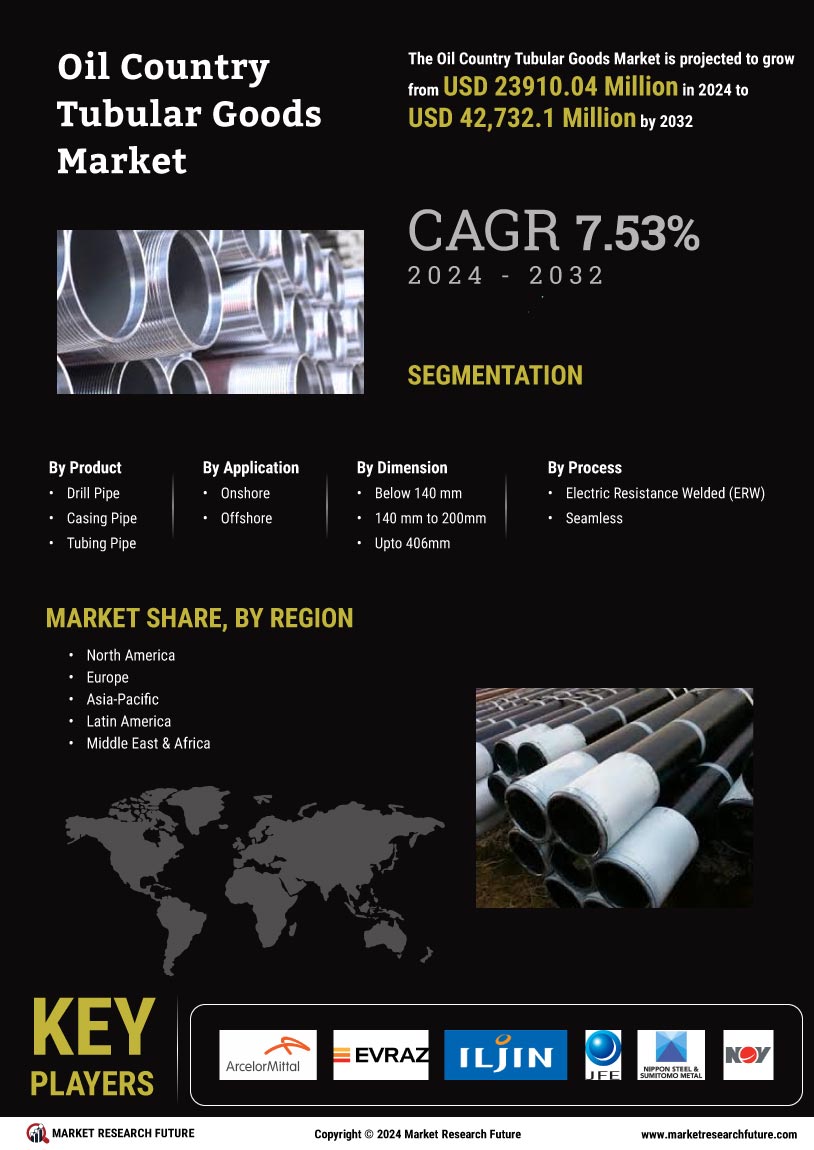

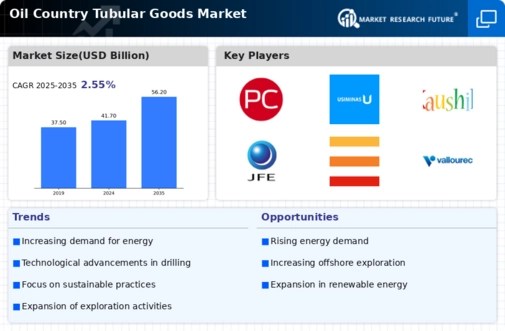

Market Trends and Projections

The Oil Country Tubular Goods Market is characterized by various trends and projections that provide insights into its future trajectory. Key indicators suggest a steady growth pattern, with the market expected to reach 41.7 USD Billion in 2024 and potentially 56.2 USD Billion by 2035. The anticipated CAGR of 2.74% from 2025 to 2035 reflects a stable demand for tubular goods driven by ongoing investments in oil and gas exploration. These trends highlight the industry's resilience and adaptability in the face of evolving market dynamics, suggesting a favorable outlook for stakeholders.

Technological Advancements in Drilling

Technological innovations in drilling techniques significantly impact the Oil Country Tubular Goods Market. Advanced methods such as horizontal drilling and hydraulic fracturing enhance the efficiency of oil and gas extraction, necessitating the use of high-quality tubular goods. These advancements not only improve production rates but also reduce operational costs, making drilling projects more economically viable. As these technologies become more prevalent, the demand for specialized tubular products is expected to rise. Consequently, the market is anticipated to grow at a CAGR of 2.74% from 2025 to 2035, underscoring the importance of innovation in driving industry growth.

Market Consolidation and Strategic Partnerships

Market consolidation and strategic partnerships among key players are reshaping the Oil Country Tubular Goods Market. As companies seek to enhance their competitive edge, mergers and acquisitions are becoming more common, allowing firms to leverage synergies and expand their product offerings. These strategic alliances enable companies to access new markets and technologies, fostering innovation and improving operational efficiencies. The resulting consolidation is likely to create a more robust supply chain, ultimately benefiting the industry as a whole. This trend may contribute to the projected market growth, with an anticipated value of 56.2 USD Billion by 2035.

Regulatory Framework and Environmental Policies

The regulatory framework and environmental policies governing the oil and gas sector significantly influence the Oil Country Tubular Goods Industry. Stricter regulations aimed at minimizing environmental impact and promoting sustainable practices compel companies to adopt advanced tubular solutions that meet compliance standards. This shift towards environmentally friendly practices may drive demand for high-performance tubular goods designed to reduce emissions and enhance safety. As the industry adapts to these regulations, the market is likely to evolve, with companies investing in innovative products that align with regulatory requirements, thereby fostering growth in the sector.

Infrastructure Development in Emerging Economies

Infrastructure development in emerging economies plays a crucial role in shaping the Oil Country Tubular Goods Market. Countries such as India, Brazil, and various African nations are investing heavily in their energy infrastructure to support economic growth. This investment leads to increased drilling activities and, subsequently, a higher demand for tubular goods. The expansion of pipelines and refineries in these regions is likely to create a favorable environment for the industry. As these economies continue to develop, the market is expected to witness significant growth, contributing to the overall expansion of the global energy sector.