Top Industry Leaders in the Offshore Supply Vessels Market

*Disclaimer: List of key companies in no particular order

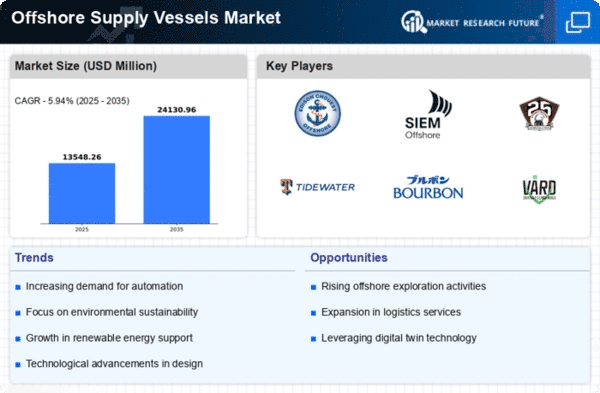

The global offshore support vessels (OSVs) market resembles a constantly evolving ocean, driven by dynamic fuel prices, shifts in energy landscapes, and ongoing technological advancements. Successful navigation of this market requires a keen understanding of the competitive landscape, where established players strive for dominance, while agile newcomers seek out niche opportunities.

Market Share Analysis: Key Differentiators

The market is dominated by key players including:

- Maersk (Denmark)

- Siem Offshore AS (Norway)

- SEACOR Marine (U.S.)

- Tidewater (U.S.)

- GulfMark Offshore Inc. (U.S.)

- Havila Shipping (Norway)

- Vroon B.V. (Netherlands)

- Swire Pacific Offshore Operations (Pte) Ltd (Singapore)

- Edison Chouest Offshore (U.S.)

- Abdon Callais Offshore LLC (U.S.)

- Solstad Farstad (Norway)

- Bourbon Offshore (France), and others.

Analyzing market share in the OSV market transcends mere vessel numbers. Understanding the factors that tip the scales is crucial.

-

Vessel Type Specialization: Companies like Maersk Supply Service and Tidewater Marine Ltd. boast diverse fleets catering to a broad spectrum of needs, from anchor handling tugs to platform supply vessels. Others, like Bourbon Offshore Norway, focus on specific segments like subsea construction vessels, carving out dedicated niches.

-

Geographical Presence: Dominating regional markets provides operational efficiencies and fosters strong client relationships. Seacor Marine's stronghold in the Americas contrasts with Swire Pacific Offshore's extensive reach in Asia, reflecting this strategic difference.

-

Technological Prowess: Integrating cutting-edge technology like remote-operated vehicles (ROVs), hybrid propulsion systems, and digital solutions for crew safety and operational efficiency sets apart leaders like DOF ASA and Boskalis.

-

Sustainability Focus: The rising tide of environmental concerns is pushing companies to adopt greener practices. Ulstein Group's emphasis on innovative vessel designs with reduced emissions and increased fuel efficiency resonates with forward-thinking clients.

Player Strategies: Adapting to the Currents

The competitive landscape is not static. Key players are adopting diverse strategies to stay afloat in the turbulent market.

-

Mergers and Acquisitions: Consolidation through M&As is a prominent trend, with players like Tidewater Marine acquiring Gulf Offshore to expand geographical reach and diversify fleet offerings.

-

Strategic Partnerships: Collaborative ventures like the alliance between Solstad Offshore and Rem Offshore leverage complementary strengths to access new markets and share resources.

-

Cost Optimization: Streamlining operations, optimizing fleet utilization, and embracing digital solutions to enhance efficiency are critical for cost-containment, exemplified by Swire Pacific Offshore's focus on lean management practices.

-

Diversification: Recognizing the cyclical nature of the OSV market, companies like DOF ASA are venturing into renewable energy sectors like offshore wind farm installation to mitigate dependence on oil & gas.

Emerging Trends: Shaping the Future

The OSV market is constantly evolving, with new trends shaping the competitive landscape.

-

Focus on Automation and Autonomy: Increased adoption of autonomous underwater vehicles (AUVs) and remotely operated vessels (ROVs) for subsea operations are reducing dependency on manned vessels and enhancing safety.

-

Alternative Fuels and Propulsion Systems: The quest for sustainability is driving innovation in areas like LNG-powered vessels and hybrid propulsion systems, with players like Ulstein Group actively developing and deploying these technologies.

-

Digitalization and Data Analytics: Leveraging data from sensors and onboard systems for predictive maintenance, optimized route planning, and improved logistics is becoming increasingly important for maximizing operational efficiency and competitiveness.

-

Renewables and Offshore Wind: The burgeoning offshore wind industry presents significant growth opportunities for specialized OSVs, attracting established players like Seaway7 and new entrants like Jan De Nul Group.

Overall Competitive Scenario: A Fluid and Fragmented Market

The OSV market remains fragmented, with no single player holding a dominant global position. Competition is fierce, with established players facing challenges from smaller, nimble companies entering niche segments. Regional variations in demand and resource availability further add complexity.

Success in this dynamic market requires adaptability, strategic partnerships, and a commitment to technological innovation. Companies that embrace sustainability, diversify their offerings, and leverage data-driven insights are likely to navigate the shifting tides and carve out their own profitable voyages in the offshore support vessels market.

This analysis provides a snapshot of the competitive landscape in the OSV market. It is important to remember that the market is constantly evolving, and the strategies and trends discussed here may change over time. Staying informed about the latest developments and adapting accordingly is crucial for any company hoping to thrive in this challenging yet rewarding domain.

Industry Developments and Latest Updates:

SEACOR Marine (U.S.):

- Oct 17, 2023: SEACOR Marine reports Q3 2023 revenue increase of 68%. Source: SEACOR Marine Investor Relations

Tidewater (U.S.):

- Aug 31, 2023: Tidewater Marine reports Q3 2023 net loss of $32.6 million. Source: Tidewater Marine Investor Relations

GulfMark Offshore Inc. (U.S.):

- Jul 05, 2023: GulfMark Offshore reports Q2 2023 revenue increase of 38%. Source: GulfMark Offshore Investor Relations

Havila Shipping (Norway):

- Aug 30, 2023: Havila Shipping signs long-term contract with Ørsted for offshore wind farm support. Source: Havila Shipping Press Releases