Growing Environmental Awareness

There is a marked increase in environmental awareness among consumers and businesses, which is impacting the Off-highway Hybrid Vehicle Market. As stakeholders become more conscious of their carbon footprints, there is a growing preference for vehicles that contribute to sustainability. Hybrid vehicles, which emit fewer greenhouse gases compared to conventional machines, are becoming more attractive. This shift in consumer behavior is prompting manufacturers to prioritize the development of eco-friendly solutions. Furthermore, industries such as agriculture and construction are under pressure to adopt greener practices, further driving the demand for hybrid technology. This evolving landscape is likely to enhance the Off-highway Hybrid Vehicle Market.

Integration of Smart Technologies

The integration of smart technologies is transforming the Off-highway Hybrid Vehicle Market. Advanced telematics, automation, and connectivity features are being incorporated into hybrid vehicles, enhancing their operational efficiency and safety. These technologies allow for real-time monitoring of vehicle performance, enabling operators to optimize fuel usage and reduce emissions. Additionally, the use of artificial intelligence in fleet management can lead to more efficient scheduling and maintenance practices. As these smart technologies become more prevalent, they are likely to attract a wider range of users to hybrid vehicles, thereby stimulating growth in the Off-highway Hybrid Vehicle Market.

Rising Demand for Fuel Efficiency

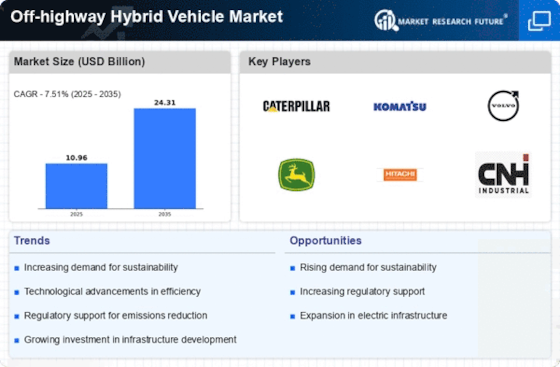

The Off-highway Hybrid Vehicle Market is experiencing a notable surge in demand for fuel-efficient vehicles. As fuel prices continue to fluctuate, operators in sectors such as construction and agriculture are increasingly seeking solutions that minimize fuel consumption. Hybrid vehicles, which combine traditional engines with electric power, offer a compelling alternative. According to recent data, hybrid vehicles can reduce fuel consumption by up to 30% compared to their conventional counterparts. This shift towards fuel efficiency not only lowers operational costs but also aligns with broader sustainability goals. Consequently, manufacturers are investing in hybrid technology to meet this growing demand, thereby driving the Off-highway Hybrid Vehicle Market forward.

Advancements in Battery Technology

Innovations in battery technology are playing a pivotal role in shaping the Off-highway Hybrid Vehicle Market. Enhanced battery performance, including increased energy density and reduced charging times, is making hybrid vehicles more viable for off-highway applications. Recent advancements have led to batteries that can last longer and withstand harsher conditions, which is crucial for industries such as mining and forestry. The introduction of lithium-ion and solid-state batteries has the potential to revolutionize the market, providing vehicles with greater range and efficiency. As these technologies continue to evolve, they are likely to attract more operators to hybrid solutions, thereby propelling the Off-highway Hybrid Vehicle Market.

Government Incentives and Subsidies

Government incentives and subsidies are significantly influencing the Off-highway Hybrid Vehicle Market. Many governments are implementing policies aimed at reducing carbon emissions and promoting cleaner technologies. These initiatives often include financial incentives for companies that invest in hybrid vehicles, making them more accessible to a broader range of operators. For instance, tax credits and grants can offset the initial investment costs associated with hybrid technology. As a result, the adoption of hybrid vehicles is likely to increase, as operators are encouraged to transition from traditional machinery to more sustainable options. This trend is expected to bolster the Off-highway Hybrid Vehicle Market in the coming years.