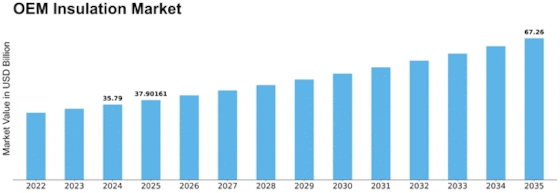

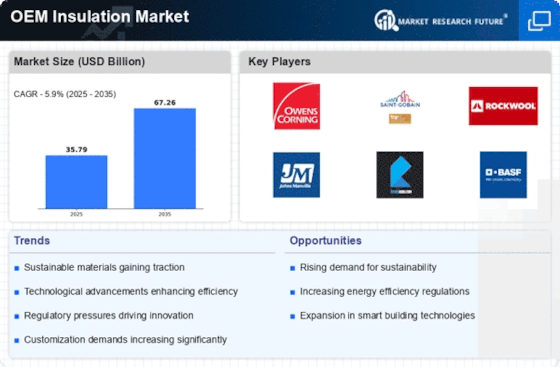

Oem Insulation Size

OEM Insulation Market Growth Projections and Opportunities

Multiple variables shape the OEM Insulation Market. OEM insulation is used in appliances, automobile parts, industrial machinery, and electronics during manufacture. Industry energy efficiency is a major driver of the OEM Insulation Market. OEM insulation materials are in demand to improve thermal efficiency and fulfill strict energy efficiency regulations as governments and industries worldwide focus on decreasing energy consumption and enhancing sustainability.

The OEM Insulation industry is expected to increase from USD 33.8 Billion in 2023 to USD 53.4 Billion in 2032, a 5.90% CAGR.

Insulation material and manufacturing technology greatly affect the OEM Insulation Market. Research and development aim to provide high-performance, lightweight, and cost-effective insulating solutions for OEM applications. Innovative materials including enhanced foams, aerogels, and composite structures boost insulation performance and adaptability, shaping the industry.

Industry norms and government restrictions shape the OEM Insulation Market. Energy efficiency, environmental, and building rules encourage OEM insulating material usage. OEM manufacturers choose insulating materials to fulfill these criteria and maintain product efficiency.

The OEM Insulation Market is heavily influenced by the construction sector, notably in building materials and appliances. As development increases and building rules tighten energy efficiency, OEM insulation becomes essential in HVAC systems, appliances, and building components. The construction industry's focus on sustainable building practices drives OEM demand for eco-friendly and effective insulating solutions.

Industrial output, consumer expenditure, and building affect the OEM Insulation Market. OEM insulating material demand rises with economic expansion and production. As manufacturing sectors respond to economic downturns, production objectives may change, affecting the market.

Market dynamics are shaped by insulation competition. Research and development help companies develop new insulating solutions, boost production efficiency, and fulfill OEM demands. Gaining market share and influencing industry trends requires strong OEM connections, understanding insulating needs, and offering unique solutions.

Supply chain and global commerce affect the OEM Insulation Market. International trade policies, shipping costs, and insulation demand affect the availability and price of raw materials including fiberglass, foam, and reflective materials. Import and export patterns boost market competitiveness and stability.

The OEM Insulation Market is growing environmentally conscious. The industry investigates eco-friendly manufacturing, recycling, and sustainable insulating materials. OEM manufacturers and insulation suppliers minimize their products' carbon footprint as environmental awareness rises, adding to the market's sustainability.

Consumer knowledge of energy efficiency and sustainability boosts markets. OEM insulating materials may become more popular as consumers learn about energy-efficient goods and green production. Educational programs, energy efficiency labels, and communication help consumers trust OEM insulating solutions.

Leave a Comment