Market Trends

Key Emerging Trends in the Odontogenic Tumor Market

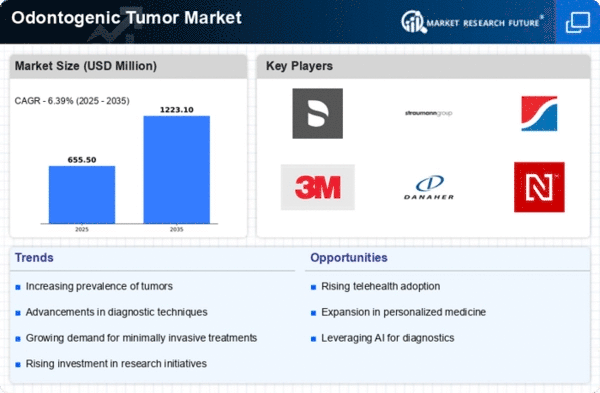

Market trends in the area of odontogenic tumors have been experiencing significant shifts, which are indicative of developments in diagnostic methods, treatment procedures and the increased focus on personalized healthcare. Odontogenic tumors, which come from tissues associated with tooth formation, have shown a huge increase in research and development. Notably, the market has witnessed increased uptake in advanced imaging technologies like cone-beam computed tomography (CBCT) and magnetic resonance imaging (MRI) for accurate and early identification of these tumors. This heightened diagnostic accuracy not only aids timely intervention but also enhances favorable patient outcomes.

Moreover,Versus this background is a noticeable drift towards minimally invasive treatment options for odontogenic tumors. Conventional surgical techniques are being replaced or supplemented by less invasive approaches such as endoscopic and laser assisted techniques. Besides reducing patient discomfort and recovery periods, this change conforms to general health care’s trend towards more patient-friendly interventions.

There is also an influx of targeted therapies being developed and adopted by the market into odontogenic tumors. With deepening knowledge of the molecular genetic basis of such diseases, pharmaceutical companies are investing in research geared towards identifying specific molecular pathways that can be targeted within these conditions. This is paving way for more effective treatments that can be tailored to suit individual patients’ needs, something that is particularly crucial given the heterogeneous nature of odontogenic tumors.

As well as technological advancements, improved awareness about comprehensive patient care is another major thrust in contemporary practice/ Therefore, today dentists as well as physicians work together closely to provide holistic management strategies against odontogenic tumor including considerations for both physical aspects as well as psychological effects on patients concerned. The market has embraced this new approach because healthcare providers are looking for integrated solutions that put an emphasis on overall welfare of victims suffering from odontogenic tumors.

Further still, there is globalization taking place within the market since there is increasing knowledge exchange among researchers internationally plus medical specialists globally. Through this international collaboration, a better understanding of odontogenic tumors is being developed, their prevalence and varied manifestations in different populations. Additionally, the standardization of diagnostic and treatment protocols is being influenced through such international involvement which has enhanced the quality of care given to all patients throughout various geographical areas.

The increasing prevalence of odontogenic tumors also calls for increased demand for supportive technologies and tools. These include software solutions for efficient data management, telemedicine platforms for remote consultations as well as patient education resources that enhance sensitization. The market has responded to these needs by seeing an array of digital health solutions tailored towards the unique requirements of odontogenic tumor patients and healthcare providers.

Due to rise in cases of odontogenic tumors, there is also a simultaneous demand for supportive technologies and tools. This includes software solutions for efficient data management, telemedicine platforms for remote consultations, and patient education resources to enhance awareness. In response to such demands on the market, there has been an explosion in the number of digital health offerings that are customized to cater exclusively to the distinct preferences of patients diagnosed with pulmonary fibrosis or other diseases affecting teeth including gum inflammation or swelling among others.

Leave a Comment