Market Trends

Key Emerging Trends in the North America Transmission Infrastructure Market

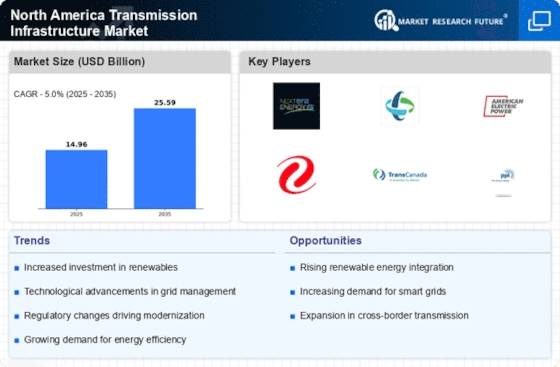

The North America transmission infrastructure market is experiencing notable trends, driven by various factors shaping the energy landscape of the region. One significant trend is the increasing focus on grid modernization and expansion to accommodate the growing demand for electricity, driven by population growth, urbanization, and industrial development. This has led to a surge in investments in transmission infrastructure projects aimed at enhancing reliability, efficiency, and resilience of the grid.

Another prominent trend is the transition towards renewable energy sources such as wind and solar power. With the declining costs of renewable energy technologies and the increasing awareness of environmental sustainability, there has been a significant shift towards integrating more renewables into the energy mix. This transition necessitates upgrades and expansion of transmission infrastructure to connect remote renewable energy resources to population centers and load centers.

Furthermore, there is a growing emphasis on enhancing grid flexibility and enabling the integration of distributed energy resources (DERs) such as rooftop solar panels, energy storage systems, and electric vehicles. These DERs are transforming the traditional one-way flow of electricity into a dynamic, decentralized system, requiring upgrades in transmission infrastructure to accommodate bidirectional power flows and optimize grid operations.

In addition to technological advancements, regulatory policies and market dynamics play a crucial role in shaping the transmission infrastructure market trends in North America. Regulatory reforms aimed at promoting competition, incentivizing investment in infrastructure upgrades, and facilitating the integration of renewables are driving market growth. Moreover, market liberalization and the emergence of competitive wholesale electricity markets are fostering greater private sector participation and innovation in transmission infrastructure development.

The increasing frequency and severity of extreme weather events, such as hurricanes, wildfires, and ice storms, are also influencing market trends in the transmission infrastructure sector. These events pose significant risks to the reliability and resilience of the grid, necessitating investments in grid hardening, resilience measures, and advanced technologies to mitigate potential disruptions and ensure uninterrupted power supply.

Moreover, the advent of digitalization, data analytics, and advanced grid technologies is revolutionizing the way transmission infrastructure is planned, operated, and maintained. Smart grid technologies, including advanced sensors, automation, and predictive analytics, are enabling utilities to optimize asset performance, improve grid reliability, and enhance situational awareness.

Furthermore, the electrification of transportation and the growing adoption of electric vehicles (EVs) are driving the need for expanded transmission infrastructure to support increased electricity demand from charging stations and EV fleets. This trend presents both challenges and opportunities for grid operators and infrastructure developers to plan and invest in resilient and scalable transmission solutions to support the electrification of transportation.

Overall, the North America transmission infrastructure market is undergoing significant transformation driven by technological innovation, regulatory reforms, market dynamics, and evolving energy needs. As the region continues to transition towards a cleaner, more sustainable energy future, investments in transmission infrastructure will play a critical role in ensuring the reliability, efficiency, and resilience of the grid while facilitating the integration of renewable energy resources and enabling the electrification of transportation.

Leave a Comment