Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the spatial computing market in North America. Various federal and state programs are designed to promote research and development in emerging technologies, including spatial computing. For instance, funding opportunities are available for startups and established companies focusing on AR and VR applications. These initiatives not only provide financial support but also foster collaboration between public and private sectors, enhancing innovation. The U.S. government has allocated millions of dollars to support technology development, which is expected to stimulate growth in the spatial computing market. As a result, the industry may experience accelerated advancements and increased competitiveness, positioning North America as a leader in spatial computing.

Rise of Remote Work and Collaboration Tools

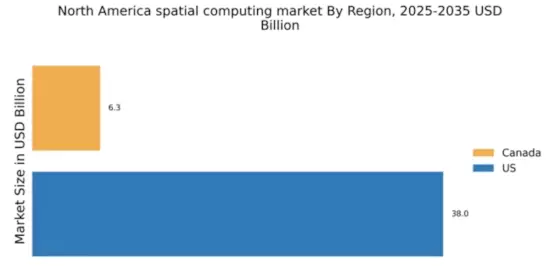

The rise of remote work has significantly influenced the spatial computing market in North America. As organizations adapt to new work environments, there is an increasing demand for collaboration tools that leverage spatial computing technologies. These tools facilitate virtual meetings and interactive workspaces, enhancing productivity and engagement among remote teams. Companies are investing in spatial computing solutions to create immersive environments that replicate in-person interactions. This shift is reflected in market data, indicating that the demand for spatial computing applications in the workplace is expected to grow by over 25% annually. Consequently, the spatial computing market is likely to expand as businesses seek innovative ways to enhance remote collaboration and maintain team cohesion.

Advancements in Hardware and Software Technologies

Advancements in hardware and software technologies are driving the spatial computing market in North America. The development of more powerful processors, high-resolution displays, and improved sensors has enabled the creation of sophisticated AR and VR applications. These technological improvements enhance user experiences and broaden the range of potential applications across industries such as healthcare, manufacturing, and entertainment. Furthermore, software platforms that support spatial computing are becoming more accessible, allowing developers to create innovative solutions with greater ease. As a result, the spatial computing market is expected to witness substantial growth, with projections indicating a market size of approximately $80 billion by 2025. This trend suggests that ongoing technological advancements will continue to fuel the expansion of the spatial computing market.

Surge in Consumer Demand for Immersive Experiences

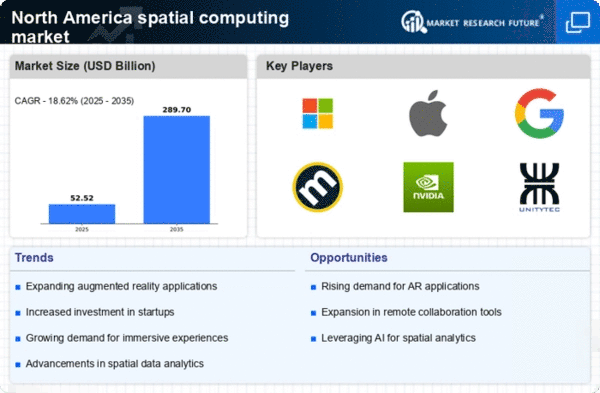

The North America spatial computing market is witnessing a notable surge in consumer demand for immersive experiences. This trend is driven by advancements in augmented reality (AR) and virtual reality (VR) technologies, which are increasingly being adopted across various sectors, including entertainment, retail, and real estate. As consumers seek more engaging and interactive experiences, businesses are compelled to invest in spatial computing solutions. According to recent estimates, the market is projected to reach approximately $100 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 30%. This growing consumer appetite is likely to propel innovation and development within the spatial computing market, as companies strive to meet evolving expectations and enhance user engagement.

Increased Focus on Training and Simulation Applications

The increased focus on training and simulation applications is a significant driver of the spatial computing market in North America. Industries such as healthcare, aviation, and military are increasingly utilizing AR and VR technologies for training purposes. These applications provide immersive learning experiences that enhance skill acquisition and retention. For instance, medical professionals can practice surgical procedures in a risk-free environment, while pilots can undergo flight simulations that replicate real-world scenarios. The effectiveness of these training methods is leading to a growing adoption of spatial computing solutions. Market analysis suggests that the training and simulation segment could account for over 40% of the spatial computing market by 2026, indicating a robust demand for innovative training solutions.