Rising Crime Rates

The increasing incidence of crime in urban areas across North America appears to be a primary driver for the physical security market. As communities face heightened concerns regarding theft, vandalism, and violent crime, there is a growing demand for advanced security solutions. In 2025, crime rates in major cities have shown a troubling upward trend, prompting businesses and homeowners to invest in security systems. This trend is reflected in the projected growth of the physical security market, which is expected to reach approximately 30.0 USD Billion by 2026. The urgency to protect assets and ensure safety is likely to propel investments in surveillance cameras, access control systems, and alarm systems, thereby driving the physical security market forward.

Technological Advancements

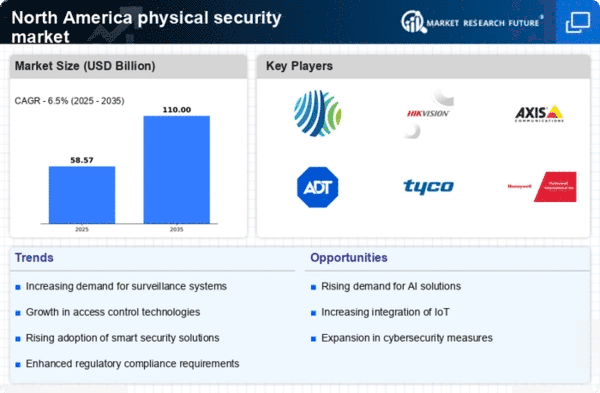

The rapid evolution of technology is significantly influencing the physical security market. Innovations such as artificial intelligence, machine learning, and the Internet of Things (IoT) are transforming traditional security measures into more sophisticated systems. In 2025, the integration of smart technologies is expected to enhance the effectiveness of surveillance and monitoring solutions. For instance, AI-driven analytics can provide real-time insights, enabling quicker responses to security breaches. The market for smart security solutions is projected to grow at a CAGR of 12% over the next five years, indicating a robust demand for technologically advanced security systems. This trend suggests that businesses are increasingly prioritizing the adoption of cutting-edge technologies to safeguard their premises.

Growing Awareness of Security Risks

There is a notable increase in awareness regarding security risks among businesses and individuals in North America. This heightened consciousness is driving the demand for physical security solutions as organizations seek to mitigate potential threats. In 2025, many companies are expected to conduct risk assessments and implement security protocols to protect their assets and personnel. The physical security market is likely to benefit from this trend, as businesses invest in comprehensive security strategies that include employee training, emergency response plans, and advanced security technologies. The market is projected to grow by approximately 10% annually, reflecting the increasing prioritization of security in corporate governance.

Regulatory Pressures and Compliance

The landscape of regulatory compliance is evolving, and businesses in North America are facing increasing pressure to adhere to security standards. In 2025, various industries, including finance, healthcare, and retail, are expected to implement stricter security measures to comply with regulations. This trend is likely to drive the physical security market as organizations invest in systems that meet compliance requirements. The financial sector, for instance, is projected to allocate over 5.0 USD Billion towards enhancing security infrastructure to comply with federal regulations. As companies strive to avoid penalties and protect sensitive data, the demand for compliant security solutions is expected to rise, further propelling the growth of the physical security market.

Increased Investment in Infrastructure

The ongoing investment in infrastructure development across North America is likely to bolster the physical security market. As cities expand and new facilities are constructed, the need for comprehensive security solutions becomes paramount. In 2025, government and private sector initiatives are expected to allocate substantial funds towards enhancing security measures in public spaces, transportation hubs, and commercial buildings. This influx of capital is anticipated to drive the demand for integrated security systems, including video surveillance, access control, and perimeter security solutions. The physical security market could see an increase in revenue, potentially exceeding 25.0 USD Billion by 2026, as stakeholders recognize the importance of securing infrastructure investments.