Regulatory Support for Organic Products

The North America Organic Baby Food Market benefits from robust regulatory frameworks that support organic farming and food production. The USDA's National Organic Program sets stringent standards for organic labeling, which helps to build consumer trust in organic baby food products. This regulatory environment not only ensures the integrity of organic claims but also encourages more producers to enter the market. As of 2025, the organic food sector in the United States has seen a growth rate of over 10% annually, indicating a favorable climate for organic baby food. This regulatory support is likely to continue fostering growth and innovation within the industry.

Sustainability and Environmental Concerns

The North America Organic Baby Food Market is also being propelled by growing concerns regarding sustainability and environmental impact. Parents are increasingly aware of the ecological footprint of their purchasing decisions, leading them to favor organic products that are produced using sustainable farming practices. Research suggests that organic farming methods can reduce environmental degradation and promote biodiversity. As a result, many consumers view organic baby food as not only a healthier choice for their children but also a more responsible option for the planet. This alignment of consumer values with product offerings is likely to enhance market growth in the organic baby food sector.

Growing Health Consciousness Among Parents

The North America Organic Baby Food Market is experiencing a notable surge in demand driven by the increasing health consciousness among parents. As more caregivers prioritize nutrition and wellness, they are gravitating towards organic options that are perceived as healthier for their infants. According to recent surveys, approximately 70% of parents express a preference for organic baby food, believing it to be free from harmful chemicals and additives. This trend is further supported by the growing body of research linking organic diets to better health outcomes in children. Consequently, manufacturers are responding by expanding their organic product lines, which is likely to enhance market growth in the coming years.

Increased Availability of Organic Products

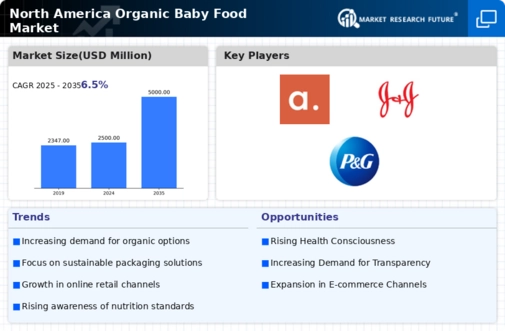

The North America Organic Baby Food Market is witnessing an expansion in the availability of organic baby food products across various retail channels. Major grocery chains and online platforms are increasingly stocking organic options, making them more accessible to consumers. Data indicates that organic baby food sales in North America reached approximately $1.5 billion in 2025, reflecting a growing trend towards convenience and variety. This increased availability is likely to attract a broader customer base, including those who may not have previously considered organic options. As retailers continue to prioritize organic offerings, the market is expected to experience sustained growth.

Influence of Social Media and Digital Marketing

The North America Organic Baby Food Market is significantly influenced by social media and digital marketing strategies. Parents are increasingly turning to online platforms for information and recommendations regarding baby food options. Influencers and parenting blogs play a crucial role in shaping consumer perceptions and preferences, often promoting organic products as the best choice for infants. This digital engagement has led to a rise in brand awareness and loyalty among consumers. As of 2025, it is estimated that over 60% of parents rely on social media for product recommendations, indicating a shift in how purchasing decisions are made. This trend is likely to continue driving growth in the organic baby food sector.