Support from Scientific Research

The medicinal mushroom market is experiencing a boost from increasing scientific research that validates the health benefits of various mushroom species. Numerous studies have explored the pharmacological properties of mushrooms, leading to a growing body of evidence supporting their use in health and wellness. This scientific backing is crucial for consumer confidence and is likely to enhance market growth. In North America, funding for research on medicinal mushrooms has seen a rise, with government and private institutions investing in studies that explore their therapeutic potential. This trend suggests that as more research emerges, the medicinal mushroom market will likely benefit from heightened credibility and consumer interest, potentially leading to increased sales and market expansion.

Increased Availability of Products

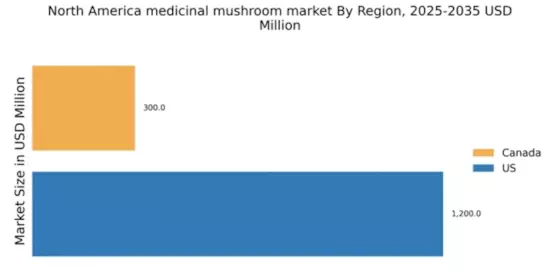

The medicinal mushroom market is benefiting from an increase in the availability of products across various retail channels. With the rise of e-commerce and health food stores, consumers now have greater access to a diverse range of medicinal mushroom products, including powders, capsules, and extracts. This enhanced accessibility is likely to stimulate market growth, as consumers are more inclined to purchase products that are readily available. In North America, the online sales of health supplements, including medicinal mushrooms, are expected to account for over 30% of total sales by 2025. This trend indicates that as product availability expands, the medicinal mushroom market will likely attract a broader consumer base, further driving demand and sales.

Shift Towards Preventive Healthcare

The medicinal mushroom market is benefiting from a broader shift towards preventive healthcare among consumers in North America. As healthcare costs rise, individuals are increasingly seeking proactive measures to maintain their health and prevent illness. Medicinal mushrooms, known for their adaptogenic properties, are perceived as effective tools for enhancing resilience against stress and disease. This trend aligns with the growing emphasis on holistic health approaches, which prioritize natural remedies over conventional treatments. The market for preventive health products, including medicinal mushrooms, is expected to grow significantly, with estimates suggesting a potential increase of 10% annually. This shift indicates a promising future for the medicinal mushroom market, as consumers prioritize wellness and seek out products that support long-term health.

Growing Awareness of Health Benefits

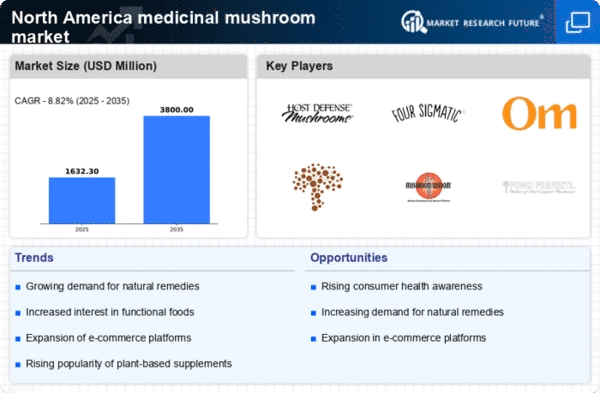

The medicinal mushroom market is experiencing a surge in consumer awareness regarding the health benefits associated with various mushroom species. Research indicates that mushrooms such as Reishi, Lion's Mane, and Chaga possess properties that may enhance immune function, cognitive health, and overall well-being. This growing awareness is likely to drive demand, as consumers increasingly seek natural alternatives to pharmaceuticals. In North America, the market for functional foods, including medicinal mushrooms, is projected to reach approximately $20 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 8%. This trend suggests that as more individuals become informed about the potential health advantages of medicinal mushrooms, the market will continue to expand, attracting both new consumers and investors alike.

Rising Popularity of Plant-Based Diets

The medicinal mushroom market is witnessing a notable increase in demand due to the rising popularity of plant-based diets. As more consumers adopt vegetarian and vegan lifestyles, the search for nutrient-dense, plant-derived supplements has intensified. Medicinal mushrooms offer a rich source of vitamins, minerals, and antioxidants, making them an attractive addition to plant-based diets. In North America, the plant-based food market is projected to reach $74 billion by 2027, with a significant portion of this growth attributed to the incorporation of functional ingredients like medicinal mushrooms. This trend suggests that as plant-based diets continue to gain traction, the medicinal mushroom market will likely experience substantial growth, driven by health-conscious consumers seeking natural and effective dietary supplements.

Leave a Comment