Rising Security Concerns and Threats

The North America Drone Defense System Market is largely driven by escalating security concerns and the proliferation of drone-related threats. Incidents involving unauthorized drone flights over critical infrastructure, such as airports and military bases, have heightened awareness regarding the need for robust defense mechanisms. The Federal Aviation Administration (FAA) has reported a notable increase in drone sightings near sensitive areas, prompting a reevaluation of existing security protocols. Consequently, organizations are investing in drone defense systems to mitigate risks associated with potential attacks or surveillance. This growing emphasis on security is likely to propel the North America Drone Defense System Market, as stakeholders seek effective solutions to counteract emerging threats.

Growing Demand from Commercial Sectors

The North America Drone Defense System Market is experiencing a notable increase in demand from commercial sectors, including logistics, agriculture, and energy. As businesses increasingly adopt drone technology for operational efficiency, the need for protective measures against potential threats has become paramount. For instance, logistics companies are investing in drone defense systems to safeguard their delivery operations from malicious activities. The market is projected to witness a significant uptick, with commercial entities recognizing the importance of securing their drone operations. This trend not only enhances the overall market landscape but also encourages innovation within the North America Drone Defense System Market, as companies strive to develop tailored solutions for diverse applications.

Regulatory Framework and Policy Support

The North America Drone Defense System Market is influenced by a robust regulatory framework and supportive policies aimed at enhancing aerial security. Government agencies are actively developing regulations that govern drone operations, ensuring that safety and security measures are in place. For example, the FAA has implemented guidelines that require drone operators to adhere to specific safety protocols, which indirectly boosts the demand for drone defense systems. Additionally, state and local governments are establishing policies that promote the integration of drone defense technologies in public safety initiatives. This regulatory support is likely to foster growth within the North America Drone Defense System Market, as stakeholders align their strategies with evolving legal requirements.

Increased Government Investment in Defense

The North America Drone Defense System Market is witnessing a surge in government investment aimed at bolstering national security. Governments are allocating substantial budgets to develop and procure advanced drone defense systems, recognizing the growing threat posed by unauthorized drones. For example, the U.S. Department of Defense has earmarked billions for research and development in drone defense technologies, reflecting a strategic priority to enhance aerial security. This increased funding not only supports the development of innovative solutions but also stimulates economic growth within the defense sector. As a result, the North America Drone Defense System Market is expected to expand significantly, with government contracts playing a pivotal role in shaping market dynamics.

Technological Advancements in Drone Defense Systems

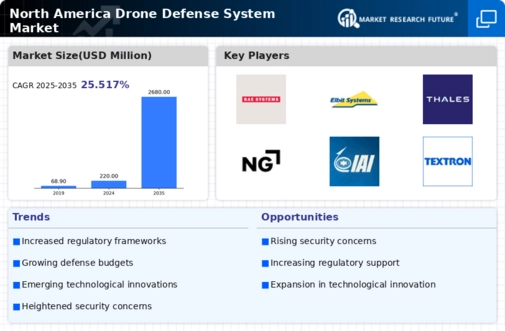

The North America Drone Defense System Market is experiencing rapid technological advancements that enhance the effectiveness of defense systems. Innovations such as artificial intelligence, machine learning, and advanced sensors are being integrated into drone defense systems, allowing for improved detection and neutralization of threats. For instance, the implementation of AI algorithms enables real-time data analysis, which significantly reduces response times. According to recent data, the market for drone defense systems in North America is projected to grow at a compound annual growth rate of over 15% through 2028, driven by these technological enhancements. As defense contractors and technology firms collaborate, the capabilities of drone defense systems are expected to expand, addressing emerging threats more effectively.