North America ATV and UTV Market Summary

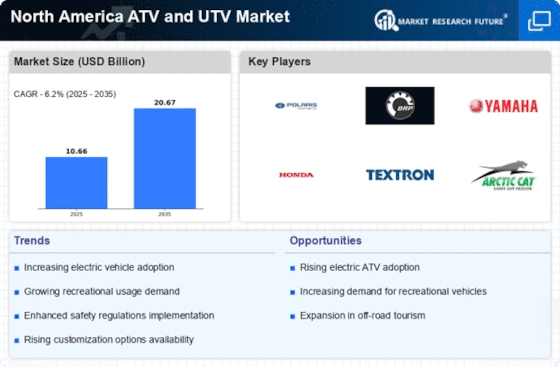

As per Market Research Future analysis, the North America ATV and UTV Market was valued at USD 7.45 Billion in 2024. The ATV and UTV Market industry is projected to grow from USD 7.96 Billion in 2025 to USD 14.84 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 8.1%during the forecast period (2025-2035).

Key Market Trends & Highlights

The North America ATV And UTV Market is a rapidly expanding sector driven by recreational demand, agricultural utility, and industrial applications:

- Rising interest in outdoor recreation like trail riding, hunting, and adventure tourism boosts demand, especially for sport ATVs. Utility in agriculture, construction, and forestry expands UTV adoption, while electric and hybrid advancements address environmental concerns.

- Electric and hybrid ATVs/UTVs are gaining traction due to environmental regulations and lower operating costs. Models like Polaris Ranger EV and Can-Am electric variants lead this shift, appealing to eco-conscious users in recreation and farming.

- Outdoor activities like off-roading, hunting, and adventure tourism fuel demand, especially in the U.S. with trails like Hatfield-McCoy and Moab. Younger demographics boost sport ATVs, while family-oriented UTVs support leisure growth; North America leads globally due to vast public lands.

- Advancements include safety enhancements (roll cages, stability control), autonomous navigation, and connected telematics for fleet management. Manufacturers like Honda and Yamaha integrate GPS and app controls, improving industrial use in forestry and military ops.

Market Size & Forecast

| 2024 Market Size | 7.45 (USD Billion) |

| 2035 Market Size | 7.96 (USD Billion) |

| CAGR (2025 - 2035) | 8.1% |

Major Players

Polaris Industries Inc (US), BRP Inc (CA), Yamaha Motor Corporation (JP), Honda Motor Co Ltd (JP), Kawasaki Motors Corp (JP), Textron Inc (US), Arctic Cat Inc (US), CFMOTO (CN), John Deere (US)