Emphasis on Enhanced User Experience

The application server market is increasingly emphasizing enhanced user experience as a critical driver of growth. Organizations are recognizing that a seamless and intuitive user experience can significantly influence customer satisfaction and loyalty. As a result, application servers are being designed with user-centric features that prioritize performance, accessibility, and responsiveness. Recent market analysis indicates that companies investing in user experience improvements can see a return on investment of up to 300%. This focus on user experience is prompting application server vendors to innovate continuously, ensuring that their solutions not only meet functional requirements but also provide an engaging and efficient user interface. This trend is likely to shape the future landscape of the application server market.

Rising Demand for Scalable Solutions

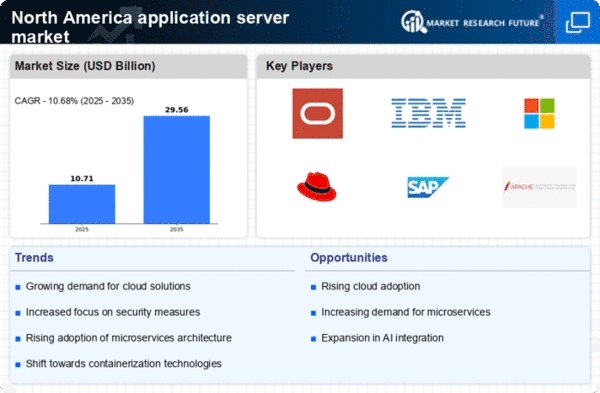

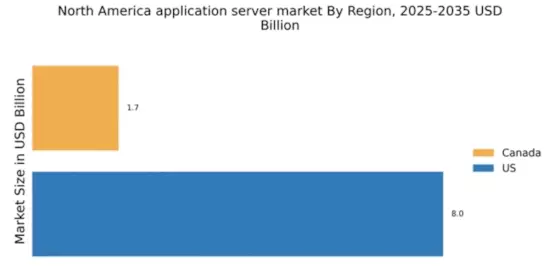

The application server market in North America experiences a notable surge in demand for scalable solutions. As businesses increasingly seek to enhance their operational efficiency, the need for application servers that can seamlessly scale with growing workloads becomes paramount. This trend is particularly evident in sectors such as e-commerce and finance, where transaction volumes can fluctuate significantly. According to recent data, the market for scalable application servers is projected to grow at a CAGR of 12% over the next five years. This growth is driven by the necessity for organizations to maintain performance levels during peak usage times, thereby ensuring customer satisfaction and retention. Consequently, the application server market is adapting to meet these evolving requirements, leading to innovations in server architecture and deployment strategies.

Adoption of Microservices Architecture

The application server market is experiencing a notable shift towards the adoption of microservices architecture. This architectural approach allows organizations to develop and deploy applications as a collection of loosely coupled services, enhancing flexibility and scalability. As businesses strive for agility in their operations, microservices are becoming increasingly attractive. Recent data suggests that the adoption rate of microservices in North America is expected to reach 70% by 2027. This trend is driven by the need for faster deployment cycles and improved fault isolation. Consequently, application server vendors are adapting their solutions to support microservices, thereby positioning themselves favorably within the competitive landscape of the application server market.

Increased Focus on Hybrid Cloud Solutions

The application server market in North America is witnessing a marked shift towards hybrid cloud solutions. Organizations are increasingly adopting hybrid models to leverage the benefits of both on-premises and cloud environments. This approach allows for greater flexibility, cost efficiency, and enhanced data security. Recent statistics indicate that approximately 60% of enterprises in North America are expected to implement hybrid cloud strategies by 2026. This trend is driven by the need for businesses to optimize their IT infrastructure while ensuring compliance with regulatory standards. As a result, application server vendors are innovating to provide solutions that facilitate seamless integration between on-premises and cloud-based applications, thereby enhancing the overall functionality and appeal of their offerings in the application server market.

Growing Importance of Real-Time Data Processing

In the application server market, the growing importance of real-time data processing is becoming increasingly evident. Organizations are recognizing the need to process and analyze data in real-time to make informed decisions swiftly. This trend is particularly pronounced in sectors such as healthcare and finance, where timely data can significantly impact outcomes. Recent studies suggest that the demand for real-time processing capabilities is expected to increase by 25% over the next few years. Consequently, application server solutions that support real-time data processing are gaining traction, as they enable businesses to respond promptly to market changes and customer needs. This shift is prompting vendors to enhance their offerings, ensuring that they can meet the evolving demands of the application server market.