Growth in the Construction Sector

The Nonwovens Market is significantly influenced by the expansion of the construction sector, where nonwoven fabrics are increasingly employed for various applications. These materials are utilized in geotextiles, insulation, and roofing membranes, contributing to enhanced durability and performance. The construction industry is anticipated to grow at a compound annual growth rate of around 5% over the next few years, which will likely bolster the demand for nonwoven products. As sustainability becomes a priority, nonwovens are favored for their lightweight and eco-friendly properties, making them an attractive choice for builders and contractors. This trend indicates a promising outlook for the Nonwovens Market in the context of construction.

Increasing Environmental Awareness

The Nonwovens Market is witnessing a shift towards sustainable practices, driven by increasing environmental awareness among consumers and manufacturers alike. There is a growing demand for biodegradable and recyclable nonwoven materials, as stakeholders seek to minimize their ecological footprint. This trend is reflected in the rising popularity of nonwoven products made from natural fibers and recycled materials. The market for sustainable nonwovens is projected to grow significantly, as companies adopt eco-friendly practices to align with consumer preferences. This shift not only enhances brand reputation but also opens new avenues for growth within the Nonwovens Market, as sustainability becomes a key differentiator.

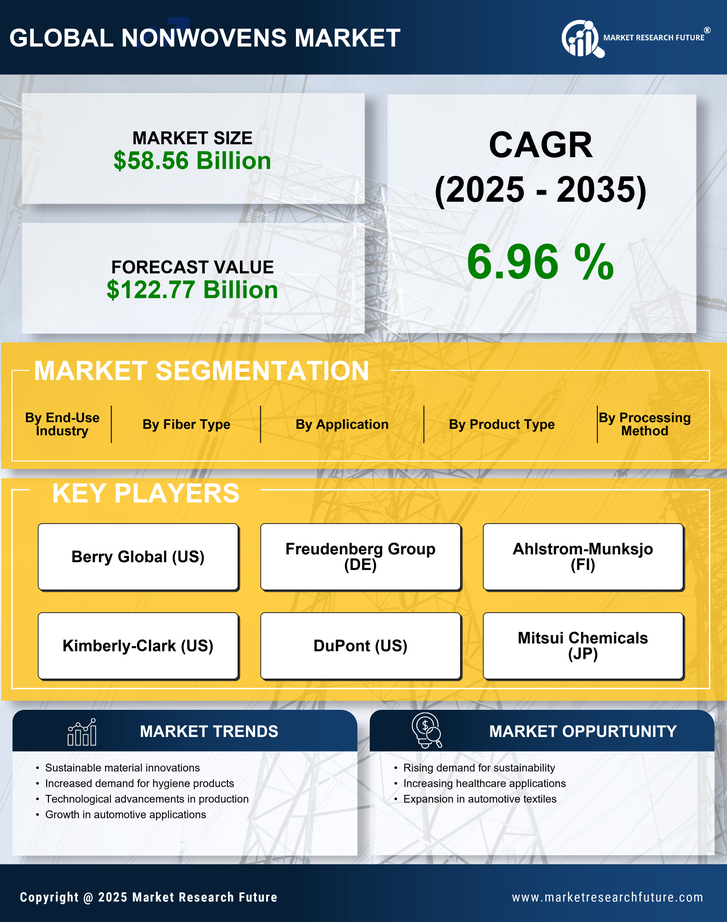

Rising Demand for Hygiene Products

The Nonwovens Market experiences a notable surge in demand for hygiene products, driven by increasing awareness of health and sanitation. Nonwoven materials are extensively utilized in the production of personal care items such as diapers, feminine hygiene products, and adult incontinence products. The market for these hygiene products is projected to reach approximately USD 60 billion by 2026, indicating a robust growth trajectory. This demand is further fueled by the growing population and changing consumer preferences towards disposable and convenient hygiene solutions. As a result, manufacturers in the Nonwovens Market are focusing on innovative materials and designs to cater to this expanding market segment.

Expanding Applications in Medical Sector

The Nonwovens Market is experiencing substantial growth due to the expanding applications of nonwoven materials in the medical sector. Nonwovens are widely used in surgical gowns, drapes, and wound care products, owing to their excellent barrier properties and comfort. The medical nonwovens market is expected to reach USD 10 billion by 2025, reflecting a strong demand driven by advancements in healthcare and an increasing focus on patient safety. As healthcare providers prioritize infection control and hygiene, the adoption of nonwoven materials is likely to rise. This trend underscores the critical role of the Nonwovens Market in supporting the evolving needs of the medical field.

Technological Innovations in Manufacturing

Technological advancements play a pivotal role in shaping the Nonwovens Market, as innovations in manufacturing processes enhance product quality and efficiency. Techniques such as spunbonding, meltblowing, and needle punching are being refined to produce nonwoven fabrics with superior characteristics. The introduction of automation and smart manufacturing technologies is expected to streamline production, reduce costs, and improve sustainability. As a result, manufacturers are likely to invest in research and development to create high-performance nonwoven materials that meet diverse consumer needs. This focus on innovation is anticipated to drive growth in the Nonwovens Market, positioning it favorably for future expansion.