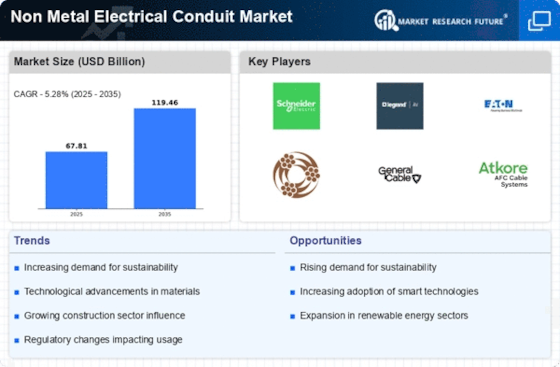

Growth in Construction Activities

The ongoing expansion of construction activities across various sectors, including residential, commercial, and industrial, is likely to bolster the Non Metal Electrical Conduit Market. As urbanization accelerates, the need for robust electrical infrastructure becomes increasingly critical. Non-metal conduits are favored for their ease of installation and durability, which aligns with the fast-paced nature of modern construction projects. Recent statistics suggest that the construction sector is expected to grow by approximately 5% annually, creating a substantial demand for non-metal conduits. This growth is indicative of a broader trend towards innovative building solutions that prioritize safety and efficiency, thereby enhancing the market landscape for non-metal electrical conduits.

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency in construction and electrical installations appears to be a primary driver for the Non Metal Electrical Conduit Market. As energy costs continue to rise, builders and contractors are seeking materials that not only meet safety standards but also contribute to energy savings. Non-metal conduits, such as PVC and fiberglass, are lightweight and resistant to corrosion, making them ideal for energy-efficient designs. According to recent data, the demand for energy-efficient electrical systems is projected to grow at a rate of 8% annually, further propelling the Non Metal Electrical Conduit Market. This trend indicates a shift towards sustainable building practices, where non-metal conduits play a crucial role in reducing energy consumption and enhancing overall system performance.

Environmental Sustainability Initiatives

The growing focus on environmental sustainability initiatives is emerging as a key driver for the Non Metal Electrical Conduit Market. As industries and governments strive to reduce their carbon footprints, the demand for eco-friendly materials is on the rise. Non-metal conduits, particularly those made from recycled materials, align with these sustainability goals. The market for sustainable building materials is projected to grow at a rate of 7% annually, indicating a strong potential for non-metal conduits. This trend reflects a broader societal shift towards environmentally responsible practices, where the Non Metal Electrical Conduit Market is likely to play a pivotal role in promoting sustainable construction and electrical solutions.

Regulatory Compliance and Safety Standards

The stringent regulatory compliance and safety standards imposed on electrical installations are a significant driver for the Non Metal Electrical Conduit Market. Governments and regulatory bodies are increasingly mandating the use of non-metal conduits in specific applications due to their non-conductive properties and resistance to corrosion. This regulatory push is expected to enhance the market for non-metal conduits, as compliance becomes a critical factor for contractors and builders. Recent regulations have indicated a shift towards safer electrical installations, which could lead to a market growth rate of approximately 6% in the coming years. The emphasis on safety and compliance is likely to solidify the position of non-metal conduits as a preferred choice in various electrical applications.

Technological Innovations in Electrical Systems

Technological advancements in electrical systems are significantly influencing the Non Metal Electrical Conduit Market. Innovations such as smart wiring and advanced insulation materials are driving the adoption of non-metal conduits, which are compatible with modern electrical technologies. These conduits offer enhanced protection against environmental factors and are easier to integrate with smart home systems. The market for smart electrical systems is projected to expand at a compound annual growth rate of 10%, suggesting a robust future for non-metal conduits. As technology continues to evolve, the demand for conduits that can support these advancements will likely increase, positioning the Non Metal Electrical Conduit Market favorably in the coming years.