Growing Aging Population

The Global Non-Invasive Monitoring Device Market Industry is also propelled by the growing aging population, which is more susceptible to various health issues. As individuals age, the need for regular health monitoring becomes paramount. Non-invasive devices offer a practical solution, allowing elderly patients to manage their health without invasive procedures. This demographic shift is expected to drive market growth as healthcare systems adapt to cater to the needs of older adults. The increasing demand for user-friendly and effective monitoring solutions aligns with the projected CAGR of 8.39% from 2025 to 2035, indicating robust market potential.

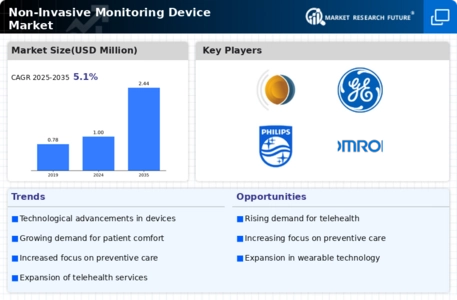

Market Growth Projections

The Global Non-Invasive Monitoring Device Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 1.0 USD Billion in 2024 and 2.44 USD Billion by 2035, the industry is on a promising trajectory. The anticipated CAGR of 8.39% from 2025 to 2035 indicates a robust expansion phase, driven by various factors including technological advancements and increasing healthcare demands. This growth reflects the industry's potential to innovate and adapt to changing healthcare landscapes, ensuring that non-invasive monitoring devices remain integral to patient care.

Technological Advancements

The Global Non-Invasive Monitoring Device Market Industry is experiencing rapid technological advancements, which enhance the accuracy and efficiency of monitoring devices. Innovations such as wearable sensors and advanced imaging techniques are becoming increasingly prevalent. For instance, devices that utilize photoplethysmography for heart rate monitoring are gaining traction. These advancements not only improve patient outcomes but also facilitate remote monitoring, which is crucial in today's healthcare landscape. As a result, the market is projected to reach 1.0 USD Billion in 2024, reflecting a growing demand for sophisticated non-invasive monitoring solutions.

Shift Towards Home Healthcare

The Global Non-Invasive Monitoring Device Market Industry is witnessing a notable shift towards home healthcare, driven by patient preferences for convenience and comfort. Non-invasive monitoring devices enable patients to manage their health from home, reducing the need for frequent hospital visits. This trend is particularly relevant in the context of chronic disease management, where continuous monitoring is essential. The rise of telehealth services further supports this shift, as healthcare providers increasingly utilize remote monitoring tools. Consequently, the market is poised for growth, with a projected increase in demand for home-based monitoring solutions.

Rising Chronic Disease Prevalence

The Global Non-Invasive Monitoring Device Market Industry is significantly influenced by the rising prevalence of chronic diseases such as diabetes and cardiovascular disorders. These conditions necessitate continuous monitoring, thereby driving demand for non-invasive solutions. According to health statistics, millions of individuals globally are affected by these diseases, leading to an increased focus on preventive healthcare measures. The market is expected to expand as healthcare providers seek efficient monitoring tools that minimize patient discomfort. This trend is anticipated to contribute to the market's growth, with projections indicating a value of 2.44 USD Billion by 2035.

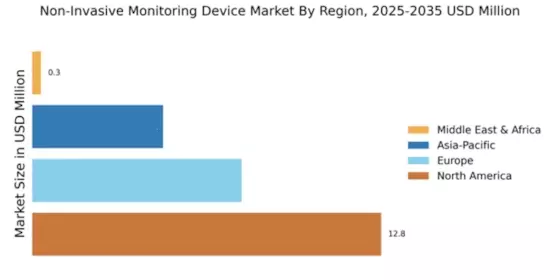

Increased Investment in Healthcare Infrastructure

The Global Non-Invasive Monitoring Device Market Industry benefits from increased investment in healthcare infrastructure, particularly in developing regions. Governments and private entities are recognizing the importance of modernizing healthcare facilities and integrating advanced monitoring technologies. This investment is crucial for improving patient care and outcomes, as non-invasive devices play a vital role in effective health monitoring. Enhanced infrastructure facilitates the adoption of these technologies, thereby expanding market reach. As healthcare systems evolve, the demand for innovative non-invasive monitoring solutions is expected to rise, contributing to overall market growth.