Non Alcoholic Beer Market Summary

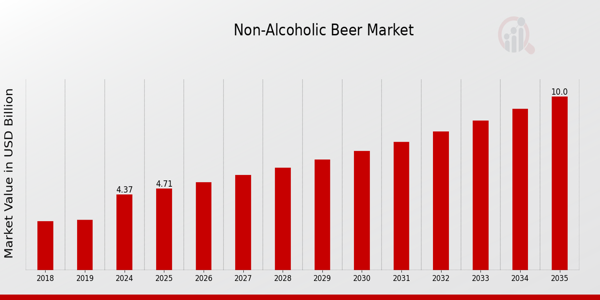

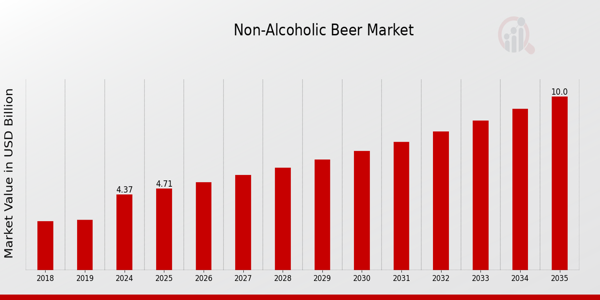

As per MRFR Analysis, the Global Non-Alcoholic Beer Market was valued at 4.05 USD Billion in 2023 and is projected to reach 10 USD Billion by 2035, growing at a CAGR of 7.82% from 2025 to 2035. The market is driven by rising health consciousness among consumers, increasing demand for non-alcoholic beverages, and the expansion of distribution channels. Key players are innovating to meet the evolving preferences of health-conscious consumers, leading to a diverse range of product offerings.

Key Market Trends & Highlights

The non-alcoholic beer market is witnessing significant trends driven by consumer preferences and health awareness.

- 36% of individuals aged 18-34 are actively seeking healthier beverage alternatives over the past five years.

- 25% of adults in the European Union are reducing their alcohol intake or abstaining entirely.

- 40% increase in shelf space for non-alcoholic options in grocery and convenience stores worldwide over the last three years.

- New product launches in the non-alcoholic segment have increased by over 50% in the past two years.

Market Size & Forecast

2023 Market Size: USD 4.05 Billion

2024 Market Size: USD 4.37 Billion

2035 Market Size: USD 10.0 Billion

CAGR (2025-2035): 7.82%

Largest Regional Market Share in 2024: Europe.

Major Players

Key companies include Carlsberg, AnheuserBusch InBev, Boston Beer Company, Ambev, Molson Coors Beverage Company, Fallen Brewing Co, Thornbridge Brewery, Kirin Brewery Company, Asahi Group Holdings, Diageo, Deschutes Brewery, Heineken, and BrewDog.

Key Non-Alcoholic Beer Market Trends Highlighted

The Non-Alcoholic Beer Market is experiencing significant growth driven by a shift in consumer preferences toward healthier lifestyles. The increasing awareness of health benefits associated with moderate drinking or abstaining from alcohol altogether is a primary market driver.

As more consumers opt for low or zero-alcohol beverages, non-alcoholic beer is seen as a favorable alternative that offers the taste of traditional beer without the effects of alcohol, making it particularly appealing among millennials and health-conscious individuals.

Opportunities to be explored include the expansion of product lines to cater to diverse flavor preferences, enhancing the appeal of non-alcoholic options in various cultural contexts.

Craft breweries are starting to come up with new flavors and brewing methods, which is helping to make non-alcoholic drinks more popular around the world. Recent trends show that non-alcoholic beer is becoming more common in social settings.

Bars and restaurants are adding it to their menus, giving people who want to enjoy the social aspect of drinking without drinking alcohol more options.

There is also a clear rise in the online sale of non-alcoholic beers. This shows that people are becoming more comfortable buying drinks online, especially as e-commerce continues to grow around the world.

The market is also seeing an uptick in promotional activities and marketing campaigns aimed at raising awareness of the benefits of non-alcoholic beer, contributing to its acceptance and popularity worldwide.

Finally, regulatory frameworks in various regions are becoming more supportive of innovative beverage options, providing a conducive environment for market growth and product development on a global scale.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Non-Alcoholic Beer Market Drivers

Increase in Health Consciousness Among Consumers

The Non-Alcoholic Beer Market is experiencing substantial growth driven by an overall increase in health awareness among global consumers.

As people become more health-conscious, there is a considerable shift toward products perceived as healthier alternatives to traditional alcoholic beverages.

According to statistics from the World Health Organization, around 28% of individuals globally are actively trying to reduce their alcohol intake, which contributes to a rising demand for non-alcoholic options.

Organizations like the International Institute of Beverage Economics have noted a considerable uptick in the sales of non-alcoholic beverages, with some countries reporting sales growth of nearly 50% over the last five years.

This trend not only reflects consumer preference but also indicates a wider lifestyle change focusing on better health, enhancing the prospects of the Non-Alcoholic Beer Market.

Innovations and Product Diversification

The Non-Alcoholic Beer Market is witnessing significant advancements fueled by innovation and product diversification. Major beverage companies, including Anheuser-Busch InBev and Heineken, are investing heavily in Research and Development to cater to the evolving tastes of consumers.

Recent data from industry reports show that over 30% of new beer releases are focusing on non-alcoholic or low-alcohol variants, which showcases the accelerated pace of innovation.

Furthermore, products such as flavored non-alcoholic beers and craft versions have emerged, appealing to a broader demographic. This innovation trend positions the Non-Alcoholic Beer Market advantageously to tap into a fast-growing consumer segment that appreciates variety and quality.

Support from Regulatory Initiatives

Legislative changes and supportive governmental policies worldwide are positively impacting the Non-Alcoholic Beer Market. Governments in several regions have begun to promote non-alcoholic beverages as a safer drinking option.

For example, recent initiatives by health ministries and educational campaigns in various countries have led to increased visibility and acceptance of non-alcoholic options.

A public health policy report indicated that approximately 20% of adults in Europe are now consuming non-alcoholic beer as a responsible choice for social occasions, a clear sign of growing acceptance.

The proactive approach of institutions and their focus on reducing alcohol-related health risks is solidifying the position of non-alcoholic beer in global culture, fostering market growth further.

Non-Alcoholic Beer Market Segment Insights

Non-Alcoholic Beer Market Product Type Insights

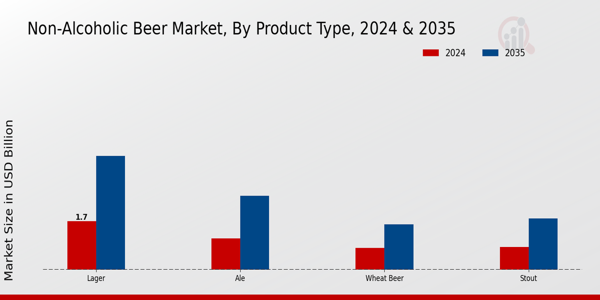

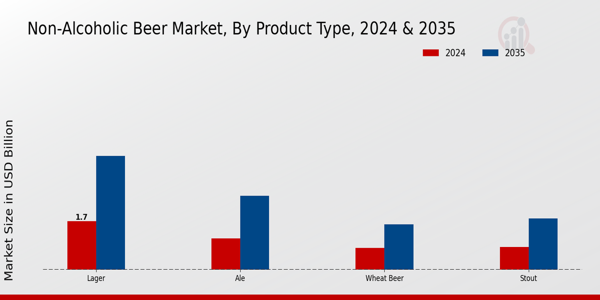

The Non-Alcoholic Beer Market demonstrates a notable diversification in its Product Type segment, revealing key segments such as Lager, Ale, Stout, and Wheat Beer.

In 2024, the Lager segment is projected to hold a substantial market value of 1.7 USD Billion, which is set to increase significantly to 4.0 USD billion by 2035, showcasing its majority holding within the overall market.

This segment's dominance can be attributed to its widespread appeal and traditional association with beer consumption.

Following closely, the Ale segment is expected to reach a market value of 1.1 USD Billion in 2024 and grow to 2.6 USD billion by 2035, benefiting from a growing interest in craft brewing and artisanal beverages, which have become increasingly popular among consumers seeking variety.

The Stout segment is anticipated to achieve a valuation of 0.8 USD Billion in 2024, rising to 1.8 USD Billion in 2035, reflecting the unique flavor profile that appeals to niche markets but still holds significant potential for growth.

Lastly, the Wheat Beer segment starts at a valuation of 0.77 USD billion in 2024 and is expected to reach 1.6 USD billion by 2035, driven by trends favoring refreshing beverages, particularly in warm climates and among health-conscious consumers.

The Non-Alcoholic Beer Market revenue showcases strong growth across these segments as shifting consumer preferences towards health-focused lifestyles and a decrease in alcohol consumption are driving demand.

Overall, the public perception of non-alcoholic beers is evolving, fueled by rising health awareness, resulting in an attractive landscape for expansion across these diverse product types.

As the market potentially evolves, the resilience of traditional styles like Lager alongside innovative segments such as Wheat Beer illustrates the dynamic nature of the Non-Alcoholic Beer Market.

The expansion of this market segment translates into a promising realm of opportunities for producers and marketers alike, prompting exploration into new flavors, branding strategies, and consumer education to capture the interest of an increasingly discerning audience.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Non-Alcoholic Beer Market Distribution Channel Insights

The Non-Alcoholic Beer Market exhibits significant growth across various Distribution Channels, contributing to a revenue of 4.37 USD billion in 2024.

This sector encompasses multiple distribution avenues like Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores, each playing a vital role in market dynamics.

Supermarkets and Hypermarkets dominate the landscape as they offer a vast selection and convenience, facilitating easy access for consumers.

Convenience Stores are also crucial as they provide quick access to products, catering to consumer needs for on-the-go purchases.

The rise of Online Retail is noteworthy, driven by changing consumer preferences toward e-commerce, allowing for a broader reach and increasing market penetration.

Moreover, Specialty Stores cater to niche markets, often emphasizing unique flavors and artisanal qualities, enhancing consumer choices.

Overall, the Non-Alcoholic Beer Market's segmentation highlights a diverse landscape that responds effectively to varying consumer demands and preferences, bolstered by shifting purchasing behaviors in the Global market environment.

These trends and dynamics create numerous opportunities for growth while presenting challenges in adapting to rapidly evolving consumer habits.

Non-Alcoholic Beer Market Packaging Type Insights

The Non-Alcoholic Beer Market has shown significant growth, with the value expected to reach 4.37 USD Billion in 2024. In this market, the Packaging Type segment plays a pivotal role in consumer preferences and market dynamics.

Among the various packaging types, cans, bottles, and kegs are prominent choices, each catering to different consumer needs and occasions.

Cans are widely recognized for their convenience and lightweight nature, making them suitable for outdoor activities and on-the-go consumption.

Bottles, on the other hand, are perceived as more traditional and premium, often chosen for social gatherings or special occasions due to their aesthetic appeal.

Kegs are essential for the bar and restaurant sector, providing a cost-effective solution for serving non-alcoholic beer in larger volumes.

The ongoing trends towards sustainability and eco-friendly packaging options further influence these segments, as consumers increasingly seek brands that align with their environmental values.

As a result, the Non-Alcoholic Beer Market segmentation highlights strong demand for all three packaging types, each contributing uniquely to the overall market growth, which is characterized by evolving consumer preferences and lifestyle changes across the globe.

Non-Alcoholic Beer Market Flavor Profile Insights

The Non-Alcoholic Beer Market is experiencing notable growth, driven by an increasing consumer preference for healthier beverage options. By 2024, the market is projected to reach a value of 4.37 billion USD, highlighting the expanding acceptance of non-alcoholic beer.

Within this market, the Flavor Profile segment encompasses a variety of tastes, which are essential for appealing to diverse consumer preferences. Traditional flavors remain significant, offering familiar taste profiles that attract a broad audience.

Fruity options are captivating younger consumers looking for refreshing and innovative beverages, while Spicy and Herbal flavors are gaining traction among niche markets that value unique and sophisticated tasting experiences.

These diverse offerings support the growing trend towards personalization in beverage choices, presenting opportunities for brands to differentiate themselves.

The Non-Alcoholic Beer Market segmentation reflects this shift, with each flavor profile playing a crucial role in catering to different segments of the population, influenced by cultural trends and changing lifestyles.

As a result, the market dynamics are gearing towards a richness in flavor options, enabling producers to better meet consumer demands and drive market growth.

Non-Alcoholic Beer Market Regional Insights

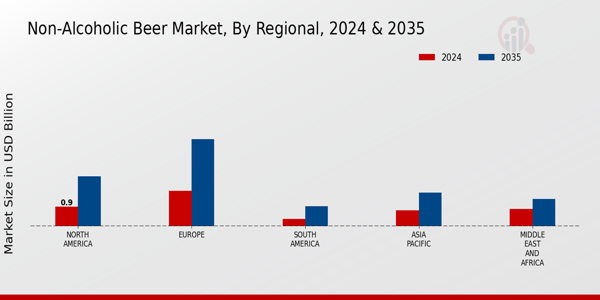

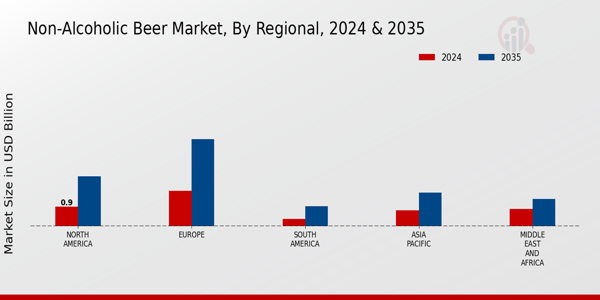

The Non-Alcoholic Beer Market is expanding across various regions, with significant valuations set for 2024.

North America is expected to achieve a valuation of 0.895 USD Billion, growing to 2.292 USD billion by 2035, showcasing its majority holding in the market, driven by a growing health-conscious consumer base.

Europe follows closely with a value of 1.628 USD Billion in 2024, and an anticipated rise to 4.0 USD Billion by 2035, making it a key player due to its well-established beer culture and rising demand for low-alcohol alternatives.

South America, while smaller with 0.326 USD Billion expected in 2024, is projected to grow to 0.917 USD Billion by 2035, indicating emerging opportunities as consumer preferences shift towards healthier choices.

The Asia Pacific region is also notable with its valuation of 0.732 USD Billion in 2024, aiming for 1.542 USD Billion by 2035, reflecting increasing urbanization and demand for diverse beverage options.

Lastly, the Middle East and Africa are expected to reach a value of 0.789 USD billion in 2024, growing to 1.25 USD billion by 2035, as these regions embrace non-alcoholic options amid changing social norms.

This diversification within the Non-Alcoholic Beer Market segmentation highlights both growth opportunities and consumer trends that favor healthier beverages.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Non-Alcoholic Beer Market Key Players and Competitive Insights

The Non-Alcoholic Beer Market is characterized by a rapidly evolving competitive landscape where numerous players strive to capture market share in a growing segment that caters to health-conscious consumers and those seeking alternatives to traditional alcoholic beverages.

The shift in consumer preferences toward non-alcoholic options, driven by an increasing awareness of health and wellness benefits, is creating opportunities for both established brands and emerging entrants.

Companies within this market are focusing on innovation, product diversification, and strategic marketing efforts to enhance brand visibility and foster consumer loyalty.

The competition is not just about flavor profiles but also about the unique selling propositions that resonate with targeted demographics, further intensifying the race among competitors to differentiate their offerings and make a lasting impact on the market.

Beer 52 is carving a niche for itself in the Non-Alcoholic Beer Market through its distinctive offerings and customer-centric approach.

The company's strength lies in its subscription model, which allows consumers to discover a variety of non-alcoholic beer brands from around the world.

This model not only enhances customer engagement but also positions Beer 52 as a primary source for craft non-alcoholic beers.

The company emphasizes curating quality products, often sourced from local or artisanal breweries, which appeals to the discerning tastes of its customer base.

Additionally, its successful marketing strategies and commitment to sustainability further bolster its reputation and market presence, ultimately contributing to a growing community of enthusiasts who appreciate innovative and flavorful non-alcoholic options.

In the context of the Non-Alcoholic Beer Market, Carlsberg Group distinguishes itself with a robust portfolio of key products that include several popular non-alcoholic beer variants.

The company's strategic market presence is characterized by its strong distribution channels and established brand recognition that resonates globally.

One of Carlsberg Group's main strengths lies in its dedication to quality and innovation, allowing it to remain competitive amidst a crowded marketplace.

The company actively invests in research and development to enhance its product offerings, thus ensuring it stays aligned with consumer trends.

Carlsberg Group has also pursued strategic mergers and acquisitions to expand its reach and capability within this growing sector, reinforcing its commitment to the non-alcoholic beverage segment.

By leveraging its extensive resources and expertise, Carlsberg continues to solidify its position as a key player in the global non-alcoholic beer landscape.

Key Companies in the Non-Alcoholic Beer Market Include

- Beer 52

- Carlsberg Group

- Molson Coors Beverage Company

- Athletic Brewing Company

- Diageo

- Anheuser-Busch InBev

- Heineken

- Pabst Brewing Company

- Koninklijke Grolsch

- Lagunitas Brewing Company

- Mikkeller

- Krombacher Brewery

- Brooklyn Brewery

- BrewDog

- Asahi Group Holdings

Non-Alcoholic Beer Market Developments

In recent years, the Non-Alcoholic Beer Market has grown a lot because more people are choosing healthier lifestyles and drinking less alcohol. Anheuser-Busch InBev said in October 2023 that it would expand its line of non-alcoholic drinks.

This includes promoting brands like Budweiser Zero and Corona Cero around the world. This is in line with the company's goal of making no- and low-alcohol options 20% of its global beer volume by 2025. Athletic Brewing Company, a top maker of non-alcoholic craft beer, released new seasonal beers in North America in August 2023.

This helped the company become a leader in the premium NA beer market. BrewDog also added to its line of alcohol-free beers with the release of "Hazy AF" in September 2023. This was in response to the growing demand for full-flavored, low-calorie options.

In early 2024, Carlsberg Group worked on both sustainability and portfolio diversification by adding non-alcoholic lines like Carlsberg 0.0, Moussy, and Fayrouz.

They focused on markets in Europe and the Middle East. Meanwhile, Molson Coors Beverage Company said that its business did well in the fourth quarter of 2023.

It said that part of its growth was due to more sales of Coors Edge and other non-alcoholic products, which is in line with the trend of people drinking less and being more mindful of their drinking.

The rise in demand for craft-style non-alcoholic beer has also led to new products from companies like Brooklyn Brewery, which is still expanding its Special Effects line, and Lagunitas Brewing Company, which is known for its IPNA. Both companies are focusing on flavor-forward options that appeal to traditional craft beer fans.

Non-Alcoholic Beer Market Segmentation Insights

-

Non-Alcoholic Beer Market Product Type Outlook

- Lager

- Ale

- Stout

- Wheat Beer

-

Non-Alcoholic Beer Market Distribution Channel Outlook

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

-

Non-Alcoholic Beer Market Packaging Type Outlook

-

Non-Alcoholic Beer Market Flavor Profile Outlook

- Traditional

- Fruity

- Spicy

- Herbal

-

Non-Alcoholic Beer Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

4.05 (USD Billion)

|

|

Market Size 2024

|

4.37 (USD Billion)

|

|

Market Size 2035

|

10.0 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

7.82% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Beer 52, Carlsberg Group, Molson Coors Beverage Company, Athletic Brewing Company, Diageo, Anheuser-Busch InBev, Heineken, Pabst Brewing Company, Koninklijke Grolsch, Lagunitas Brewing Company, Mikkeller, Krombacher Brewery, Brooklyn Brewery, BrewDog, Asahi Group Holdings

|

|

Segments Covered

|

Product Type, Distribution Channel, Packaging Type, Flavor Profile, Regional

|

|

Key Market Opportunities

|

Health-conscious consumer demand, Innovative flavor profiles, Expansion in online sales, Growth in emerging markets, Rising popularity among millennials

|

|

Key Market Dynamics

|

Health consciousness, changing consumer preferences, product innovation, expansion of distribution channels, and rising demand for low-alcohol options

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Non Alcoholic Beer Market Highlights:

Frequently Asked Questions (FAQ) :

The Non-Alcoholic Beer Market is expected to reach a valuation of 10.0 billion USD by 2035.

The market is expected to grow at a CAGR of 7.82% from 2025 to 2035.

By 2035, Europe is projected to dominate the market with a valuation of 4.0 billion USD.

In 2024, the North America market is valued at 0.895 billion USD.

By 2035, Lager is expected to have the highest market value at 4.0 billion USD.

Key players include Anheuser-Busch InBev, Heineken, and Molson Coors Beverage Company, among others.

The Wheat Beer segment is valued at 0.77 billion USD in 2024.

The Asia Pacific region is expected to reach a market valuation of 1.542 billion USD by 2035.

The Stout segment is expected to grow from 0.8 billion USD in 2024 to 1.8 billion USD by 2035.

The Middle East and Africa region shows significant growth potential, with a projected market value increase to 1.25 billion USD by 2035.