Technological Advancements in Mining

The Nickel Mining Market is experiencing a transformation due to technological advancements that enhance extraction and processing efficiency. Innovations such as automated mining equipment and advanced geological modeling are streamlining operations, reducing costs, and increasing yield. For instance, the adoption of real-time data analytics allows for better decision-making and resource management. As a result, companies are likely to improve their operational efficiency, which could lead to a more competitive market landscape. Furthermore, these technologies may also contribute to sustainability efforts by minimizing environmental impact, thus aligning with the growing demand for responsible mining practices.

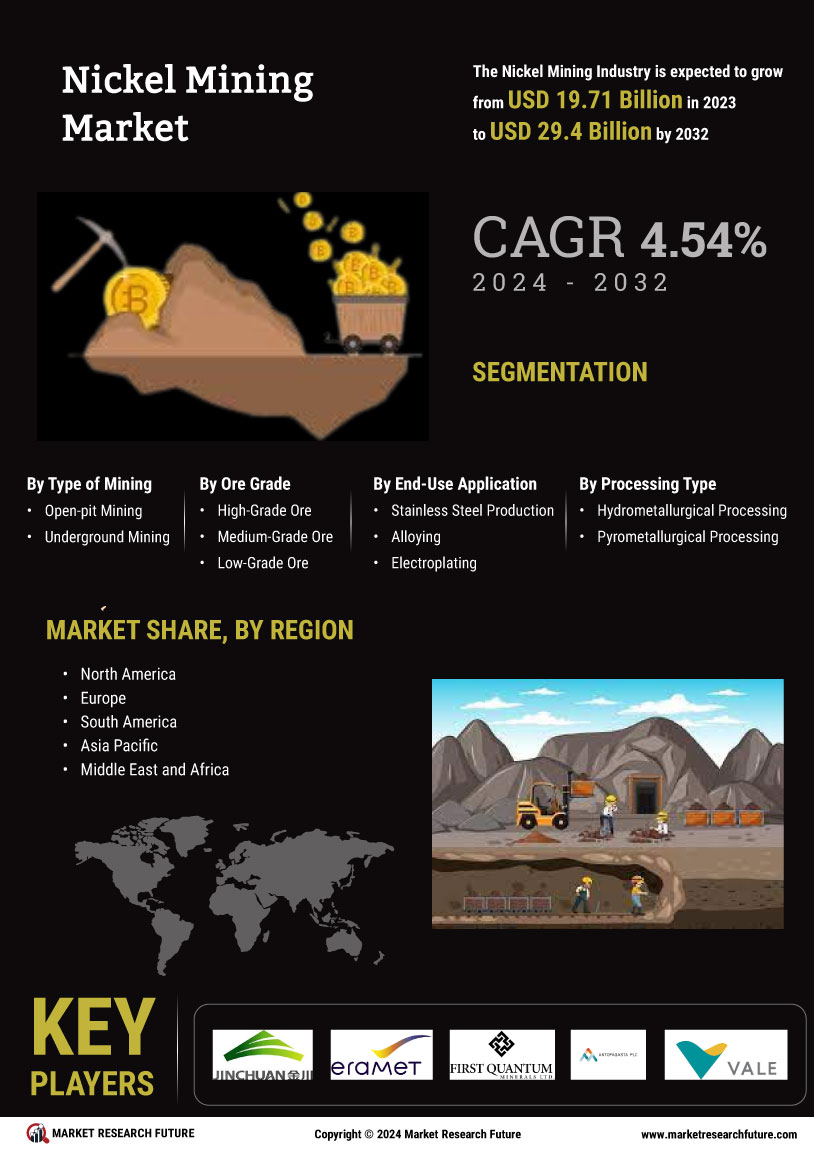

Investment in Exploration and Development

The Nickel Mining Market is witnessing a surge in investment focused on exploration and development of new nickel deposits. As demand for nickel continues to rise, mining companies are allocating resources to identify and develop untapped reserves. This trend is driven by the need to secure a stable supply of nickel for various applications, particularly in the battery and stainless steel industries. Increased investment in exploration not only enhances the potential for new discoveries but also stimulates economic growth in mining regions. As companies seek to expand their operations, the overall competitiveness of the nickel mining market is likely to improve.

Supply Chain Dynamics and Market Volatility

The Nickel Mining Market is affected by supply chain dynamics and market volatility, which can influence pricing and availability. Disruptions in supply chains, whether due to geopolitical tensions or natural disasters, can lead to fluctuations in nickel prices. For instance, a sudden increase in demand from the battery sector may strain existing supply chains, resulting in price surges. Conversely, oversupply can lead to price declines, impacting profitability for mining companies. Understanding these dynamics is crucial for stakeholders in the nickel mining sector, as they navigate the complexities of supply and demand in a rapidly changing market.

Regulatory Framework and Environmental Policies

The Nickel Mining Market is shaped by evolving regulatory frameworks and environmental policies that govern mining operations. Governments are increasingly implementing stringent regulations aimed at minimizing environmental degradation and promoting sustainable practices. Compliance with these regulations often requires significant investment in cleaner technologies and processes. While this may pose challenges for some mining companies, it also presents opportunities for those that can adapt and innovate. The emphasis on sustainability may lead to a more responsible mining sector, potentially enhancing the reputation of nickel mining operations and attracting investment from environmentally conscious stakeholders.

Increasing Demand for Nickel in Battery Production

The Nickel Mining Market is significantly influenced by the rising demand for nickel in battery production, particularly for electric vehicles and energy storage systems. Nickel is a critical component in lithium-ion batteries, which are essential for the transition to renewable energy sources. As the market for electric vehicles expands, the demand for nickel is projected to increase substantially. Reports indicate that the battery sector could account for over 60% of nickel consumption by 2025. This trend not only drives investment in nickel mining but also encourages exploration and development of new mining projects to meet future demand.