Growth in Automotive Sector

The Nickel Coated Fibers Market is poised to benefit from the automotive sector's increasing focus on lightweight materials and enhanced performance. Nickel-coated fibers are being integrated into automotive components to improve electrical conductivity and reduce weight, which is crucial for fuel efficiency. The automotive industry is projected to witness a significant shift towards electric vehicles (EVs), with estimates suggesting that EV sales could reach 30% of total vehicle sales by 2030. This transition is likely to drive the demand for nickel-coated fibers, as they are essential in the manufacturing of components such as battery packs and wiring harnesses. Consequently, the growth of the automotive sector, particularly in the context of EVs, is expected to be a key driver for the Nickel Coated Fibers Market.

Rising Demand in Electronics

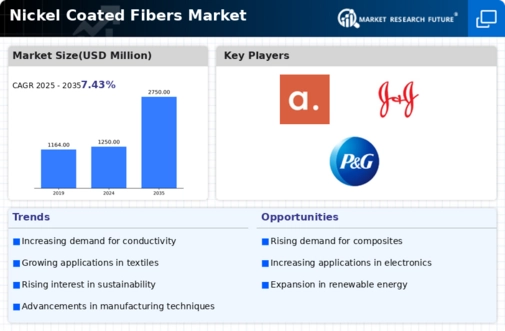

The Nickel Coated Fibers Market is experiencing a surge in demand driven by the increasing use of nickel-coated fibers in electronic applications. These fibers are integral in the production of conductive textiles, which are utilized in wearable technology, smart clothing, and electronic devices. The market for conductive textiles is projected to grow at a compound annual growth rate (CAGR) of approximately 25% over the next five years, indicating a robust expansion in this sector. As industries seek to enhance the functionality of textiles, the incorporation of nickel-coated fibers is becoming more prevalent, thereby propelling the market forward. This trend suggests that manufacturers are likely to invest more in research and development to innovate and improve the performance of nickel-coated fibers, further solidifying their position in the electronics market.

Increased Focus on Sustainability

The Nickel Coated Fibers Market is also being shaped by a growing emphasis on sustainability within various sectors. As industries strive to reduce their environmental impact, the demand for sustainable materials is on the rise. Nickel-coated fibers, known for their durability and recyclability, are becoming a preferred choice for manufacturers looking to meet sustainability goals. The textile industry, in particular, is under pressure to adopt eco-friendly practices, and the use of nickel-coated fibers can contribute to this effort. Reports indicate that sustainable textiles could account for over 30% of the market by 2027, suggesting a significant shift towards environmentally responsible materials. This trend is likely to bolster the Nickel Coated Fibers Market as companies seek to align with consumer preferences for sustainable products.

Advancements in Textile Technology

The Nickel Coated Fibers Market is significantly influenced by advancements in textile technology, which are enabling the development of innovative products. The integration of nickel-coated fibers into textiles enhances their properties, such as conductivity, durability, and resistance to corrosion. This is particularly relevant in sectors like healthcare, where smart textiles are being developed for monitoring patient health. The market for smart textiles is anticipated to grow at a CAGR of around 20% in the coming years, indicating a strong potential for nickel-coated fibers. As manufacturers continue to explore new applications and improve production techniques, the demand for nickel-coated fibers is likely to increase, thereby driving the overall market forward.

Expanding Applications in Healthcare

The Nickel Coated Fibers Market is witnessing an expansion in applications within the healthcare sector, driven by the increasing demand for advanced medical textiles. Nickel-coated fibers are being utilized in the development of smart bandages, wearable health monitors, and other medical devices that require conductivity and flexibility. The global market for medical textiles is projected to grow at a CAGR of approximately 15% over the next few years, indicating a robust opportunity for nickel-coated fibers. As healthcare providers seek innovative solutions to improve patient care and monitoring, the integration of nickel-coated fibers into medical applications is likely to become more prevalent. This trend suggests that the Nickel Coated Fibers Market will continue to evolve, driven by the need for advanced healthcare solutions.