Expansion of 5G Technology

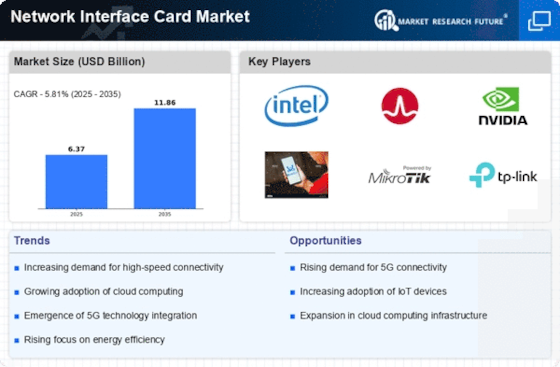

The rollout of 5G technology is poised to be a transformative force for the Network Interface Card Market. With its promise of ultra-fast data speeds and low latency, 5G is expected to revolutionize various sectors, including telecommunications, healthcare, and transportation. The demand for network interface cards that can support 5G infrastructure is likely to increase as service providers upgrade their networks. Recent projections suggest that the 5G market could reach a valuation of 700 billion dollars by 2025, which will inherently drive the need for advanced network interface cards capable of handling the increased data traffic. This expansion presents a significant opportunity for manufacturers within the Network Interface Card Market to innovate and meet the evolving demands of 5G connectivity.

Growing Cybersecurity Concerns

As cybersecurity threats become increasingly sophisticated, the Network Interface Card Market is witnessing a heightened focus on security features within network interface cards. Organizations are prioritizing the protection of their data and networks, leading to a demand for NICs that incorporate advanced security protocols. This trend is particularly relevant as data breaches and cyberattacks continue to rise, prompting businesses to invest in secure networking solutions. The market for cybersecurity solutions is projected to grow significantly, which will likely influence the Network Interface Card Market as manufacturers respond to the need for enhanced security features in their products. This shift may lead to the development of NICs with integrated security capabilities, thereby addressing the evolving landscape of cybersecurity.

Rising Adoption of Cloud Computing

The increasing adoption of cloud computing services is a pivotal driver for the Network Interface Card Market. As businesses migrate their operations to the cloud, the demand for high-performance network interface cards escalates. These cards are essential for ensuring seamless connectivity and data transfer between local systems and cloud servers. According to recent data, the cloud computing market is projected to reach a valuation of over 800 billion dollars by 2025, which inherently boosts the need for robust network infrastructure. Consequently, the Network Interface Card Market is likely to experience substantial growth as organizations seek to enhance their network capabilities to support cloud-based applications and services.

Surge in Internet of Things (IoT) Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the Network Interface Card Market. With billions of devices expected to be connected to the internet, the demand for efficient and reliable network interface cards is surging. These cards facilitate communication between IoT devices and networks, ensuring data is transmitted effectively. Market analysis indicates that the number of connected IoT devices could exceed 30 billion by 2025, creating a substantial opportunity for the Network Interface Card Market. This trend necessitates the development of specialized network interface cards that can handle the unique requirements of IoT applications, thereby driving innovation and growth in the sector.

Increased Focus on Data Center Optimization

The ongoing emphasis on data center optimization is a crucial driver for the Network Interface Card Market. As organizations strive to enhance the efficiency and performance of their data centers, the demand for high-quality network interface cards is rising. These cards play a vital role in ensuring optimal data flow and connectivity within data center environments. Market data indicates that the data center market is expected to grow substantially, with investments in infrastructure and technology reaching new heights. This growth necessitates the deployment of advanced network interface cards that can support high bandwidth and low latency requirements, thereby propelling the Network Interface Card Market forward. The focus on optimization is likely to drive innovation and competition among manufacturers, leading to the development of cutting-edge NIC solutions.